- Best overall CRM with project management: HubSpot

- Best for activity and performance tracking: monday CRM

- Best for project templates: Pipedrive

- Best for portfolio management: ClickUp

- Best for team collaboration: Bitrix24

When a CRM solution is described as having project management functionality, that means the software can monitor all ongoing communication, campaigns, client-based operations, and task assignments—in addition to client relationship management and data collection. These CRM manage both client and project management features in order to help foster collaboration and transparency between sales, marketing, and operational departments.

Featured Partners

Top CRM with project management comparison

The best CRM providers can host a multitude of tracking and management features for marketing campaigns, sales analytics, and projects. The top CRM for project management typically offer activity tracking, task management, and robust reporting capabilities. Below we show you how our top five CRM for project management, including HubSpot, monday CRM, and others, compare at a glance.

| Star rating (out of 5) | Starting price* | Activity tracking | Task management | Real time reporting | |

|---|---|---|---|---|---|

| HubSpot | 4 | Free | Yes | Yes | High |

| monday CRM | 3.6 | $14 per user, per month | Yes | Yes | High |

| Pipedrive | 4.3 | $12 per user per month | Yes | Yes | Medium |

| ClickUp | 4.1 | Free | Yes | Yes | High |

| Bitrix24 | 4.1 | Free | Yes | Yes | Medium |

| *Price when billed annually, not including tax. | |||||

HubSpot: Best overall CRM with project management

HubSpot can support global clients with lead generation and engagement, deal management, and automations—all available to use for overall project management initiatives. Users have access to a library of project management tools like task queues, deal pipelines, meeting scheduler, and detailed reporting capabilities that track marketing and sales projects. This helps businesses monitor their entire project management lifecycle from initiation and planning to execution, monitoring and evaluation, and finally closing.

SEE: What is project management?

Why I chose HubSpot

HubSpot is a customer platform that can connect marketing, sales, service, operations, and data teams within one AI-powered hub. As an extremely scalable solution, it can cater to the needs of larger businesses with multiple locations or teams. Its free CRM is also extremely feature-rich with advanced tools available even in the more basic version of the tool.

HubSpot’s higher paid tiers can be expensive. If you’re seeking an alternative to HubSpot that has similar marketing and ongoing project management capabilities, I suggest ClickUp or Bitrix24.

For more details, read my HubSpot review.

Pricing

- Free CRM: Free for five users with contact management, quotes, live chat and more.

- Sales Hub Starter: $15 per seat per month, billed annually, or $20 when billed monthly.

- Sales Hub Professional: $90 per seat per month, billed annually, or $100 when billed monthly, plus a one-time $1,500 onboarding fee.

- Sales Hub Enterprise: $150 per seat per month, with an annual commitment and one-time $3,500 onboarding fee.

Features

- Dashboard and reporting: Customize reports for all marketing, sales, and service data and keep private data secure with advanced permissions .

- Sales automation: Create and use workflows that automate lead distributions, create and assign tasks and streamline sales sequences.

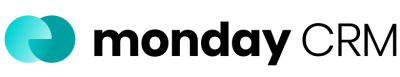

- Document management: Share, track, and manage all documents within permission-based libraries for constant visibility and collaboration.

Pros and cons

| Pros | Cons |

|---|---|

| Can integrate with over 1,500 applications. | Limited A/B split testing on lower tier plans. |

| Offers 24/7 customer support. | Higher paid tiers can be pricey, especially for small to midsize businesses. |

| Offers a detailed free demo of the software. | Requires an onboarding fee for Professional and Enterprise tiers. |

monday CRM: Best for activity and performance tracking

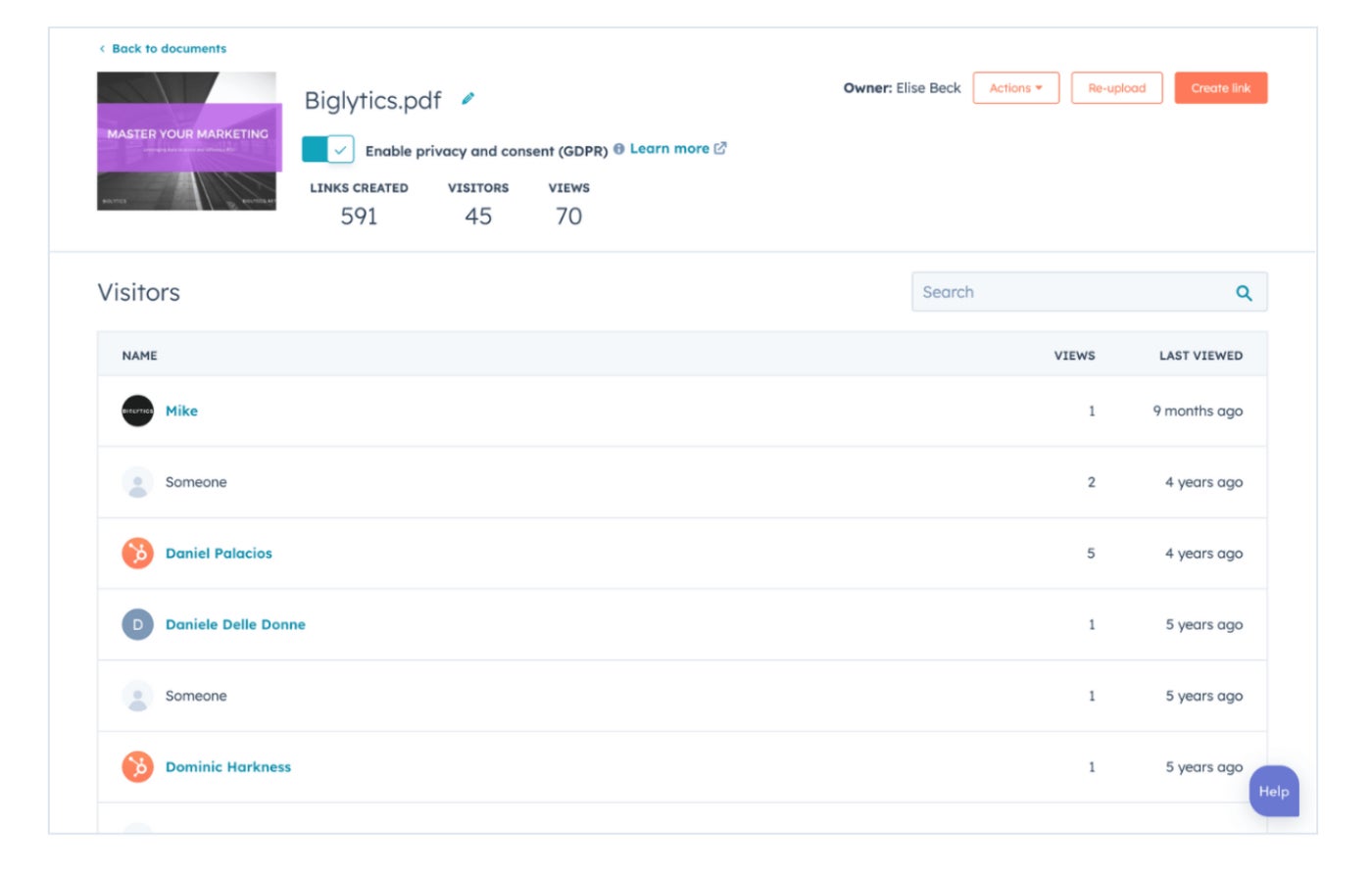

With monday CRM, users can monitor all pipelines, targets, and team performance from custom dashboards. Managers can access all their team’s activities, like calls and meetings scheduled or completed. This helps track performance, understand individual or team capacity, and test new strategies. Individual users can also log all contact-related activity like calls, meetings, and notes from the desktop or mobile version.

Why I chose monday CRM

Monday CRM also offers monday work management which is another tool in the monday.com suite. Monday CRM is a very customizable platform with automations, workflows, and dashboards. Users can build out project views that can be shared, viewed, and updated by different teams all at once.

Monday CRM only offers a free version of its tool in specific cases, and use of the free version requires an extensive approval process. If your business wants to try a CRM with project management through a basic free tier before fully committing a paid subscription, I recommend HubSpot, ClickUp, or Bitrix24.

Head over to my monday CRM review for more information.

Pricing

- Free version: Basic CRM offerings are only available for students and nonprofit organizations after submitting an application.

- Basic CRM: $12 per user per month when billed annually, or $15 when billed monthly.

- Standard CRM: $17 per user per month when billed annually, or $20 when billed monthly.

- Pro CRM: $28 per user per month when billed annually, or $33 when billed monthly.

- Enterprise CRM: Contact monday.com for a quote.

Features

- Sales forecasting: Generate reports that track forecasted sales vs. actual sales by month, sales rep, or project.

- Team goals: Manage team quota progress and attainment with win trackers.

- Custom dashboards: Gain visibility into all project statuses, progress, sales figures, and performance with custom dashboards.

Pros and cons

| Pros | Cons |

|---|---|

| 14-day free trial. | Tailored onboarding only available in the Enterprise plan. |

| Offers unlimited contacts. | Free CRM only available for qualified users. |

| Users praise accessibility of mobile apps on iOS and Android phones. | Limited integrations compared to others on this list. |

Pipedrive: Best for project templates

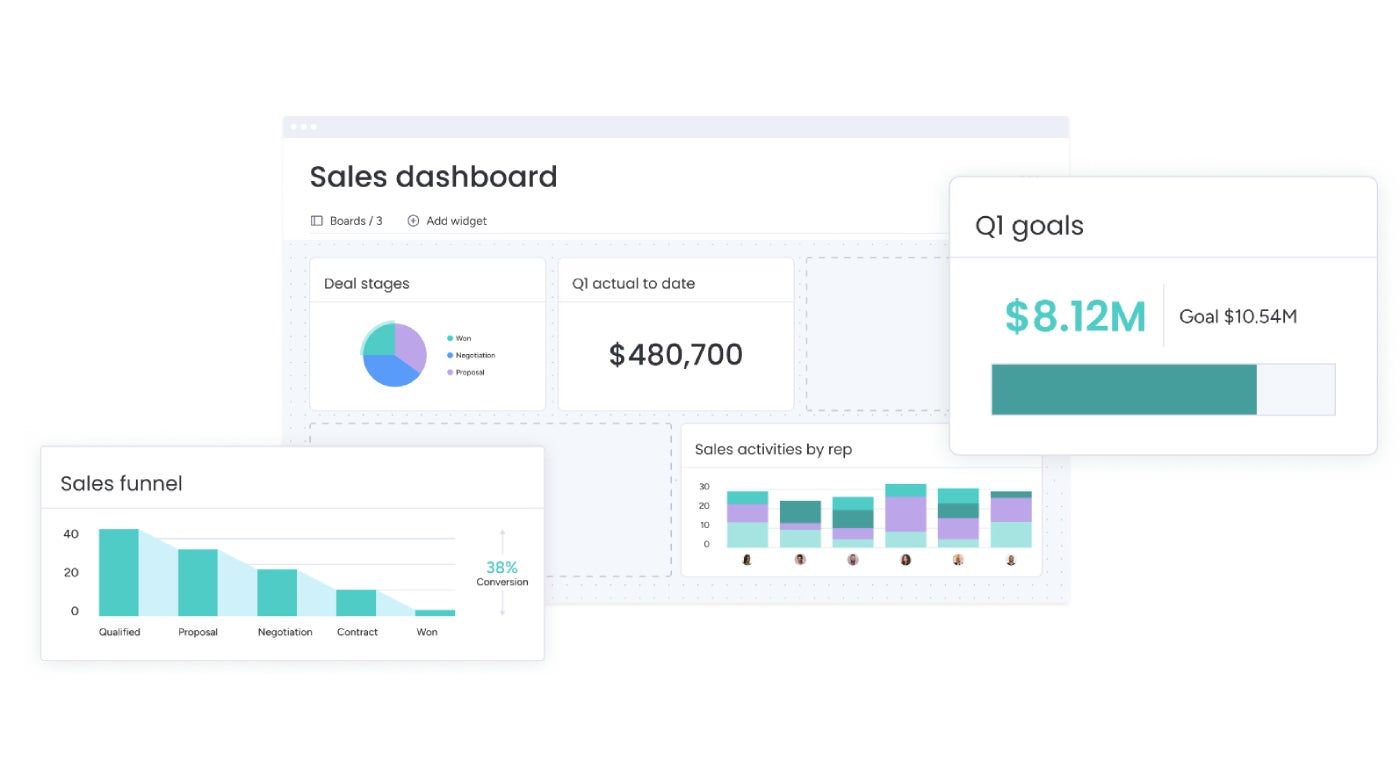

Pipedrive makes it easy for businesses to start new projects by offering project templates. These ready-made or customizable templates can be applied to any project or use case. They can include a variety of fields such as linking users or customer accounts to the project, projected spend and profit, tasks, subtasks and much more. This will make it easy to create new projects, and organize existing ones with activities, tasks and subtasks already planned out for each step.

Why I chose Pipedrive

Pipedrive is an operational CRM that helps businesses manage clients and projects through a series of pipelines and automations. Projects is Pipedrive’s all-in-one project management software solution that offers a suite of tools for collaboration, file sharing, project sharing, and robust customization. Pipedrive is also a very scalable tool that can be adapted into business workflows by startups, small and midsize businesses, and enterprises.

Similar to monday CRM, Pipedrive doesn’t have a free for life tier. Even though its paid tiers are affordable compared to industry standards, I understand that some businesses might want to start with a free tool first. If that’s the case, I recommend HubSpot or Bitrix24 as free alternatives to Pipedrive.

To learn more, check out the full Pipedrive review.

Pricing

- Essential: $14 per user per month, billed annually, or $24 per user when billed monthly.

- Advanced: $29 per user per month, billed annually, or $39 per user when billed monthly.

- Professional: $49 per user per month, billed annually, or $64 per user when billed monthly.

- Power: $64 per user per month, billed annually, or $79 per user when billed monthly.

- Enterprise: $99 per user per month, billed annually, or $129 per user when billed monthly.

Features

- Built-in task manager: Create and organize custom workflows that will define project phases and progress maps.

- Project scheduling functionality: Schedule and automate activities for specific phases in the project.

- Project templates: Use pre-made project templates that help you quickly define criteria such as project names, deliverables, scope states, start date, and task owners.

Pros and cons

| Pros | Cons |

|---|---|

| 14-day free trial. | Doesn’t provide a free version of the tool like some others on this list. |

| Users praise the simple onboarding process. | Users say there is limited reporting. |

| Offers 24/7 customer support. | Unlimited open deals and custom fields are only available in the Enterprise tier. |

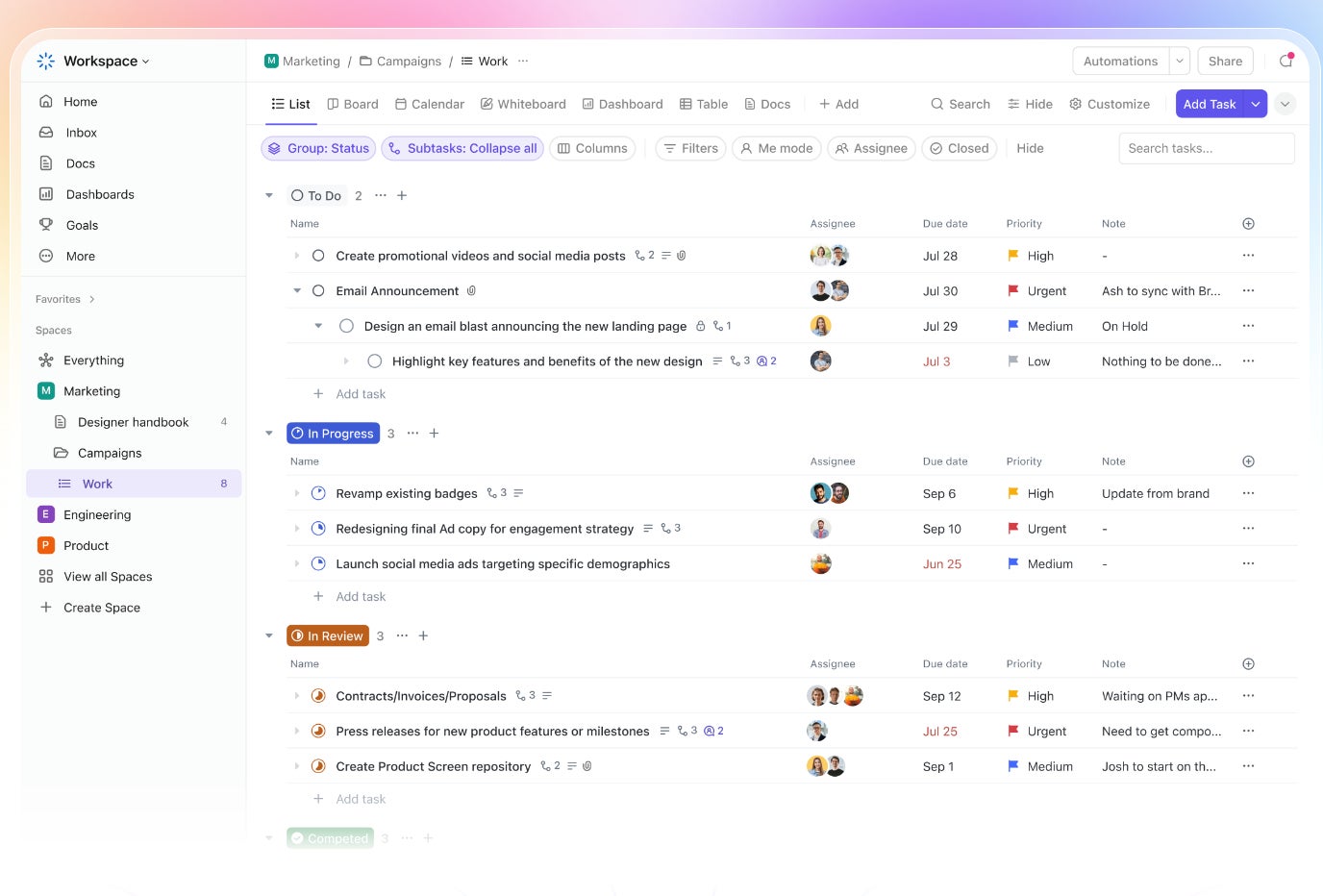

ClickUp: Best for portfolio management

ClickUp’s project management capabilities include task management, portfolio creation, board views, and Gantt charts, among others. The portfolio management functionality specifically helps monitor all business initiatives in one place, including strategy, development, and execution. These custom portfolios organize projects based on product releases, marketing campaigns, company objectives, or even store openings.

Why I chose ClickUp

ClickUp is another all-in-one CRM tool that also includes project management, product development, knowledge and resource management, collaboration, and custom workflows. Its affordable pricing structure, forever free plan, and long list of features make it a great option for businesses that work in sprints.

While ClickUp does have a user-friendly interface, its suite of tools and feature-rich software can make it an overpowered solution for smaller businesses who might not need all these extra bells and whistles. If you want similarly-priced software with more straightforward functionality, I recommend Pipedrive.

Pricing

- Forever Free: Free for unlimited users, allowing up to 100MB of storage, collaborative docs, real-time chat, and more.

- Unlimited: $7 per user, per month when billed annually or $10 when billed monthly.

- Business: $12 per user, per month when billed annually or $19 when billed monthly.

- Enterprise: Contact ClickUp directly for a quote.

Features

- Whiteboard: Collaborate with team members in real time within an agile project with a whiteboard.

- Time tracking: Track time, set estimates, add notes, and view reports on time-based projects from anywhere.

- Project dashboards: View the ongoing status of every project and filter them based on progress, task owner, next steps, and more.

Pros and cons

| Pros | Cons |

|---|---|

| 14-day free trial. | Users report delayed system notifications. |

| Offers white label functionality. | Users report a slight system learning curve. |

| Users praise flexibility with task management. | Some features, dashboard views, and filters aren’t available on the mobile app. |

Bitrix24: Best for team collaboration

Bitrix24 hosts a wide variety of communication and collaboration tools that businesses within any market can use to establish productive team collaboration. This includes online workspaces for team members, online meetings, shared calendars, workgroups, and online documents and file storage. This way users can schedule events and organize meetings in team calendars with or without external guests, create and co-edit documents, and share files in a secure cloud storage within Bitrix24. Users of Bitrix24 can do all of this at home, in the office, or on the go with the mobile app.

Why I chose Bitrix24

Bitrix24 markets itself as an ultimate workspace, and for good reason. In addition to the CRM product it sells, it hosts a multitude of task and project management, collaboration, and HR automation tools. Bitrix24 offers an AI-powered assistant, CoPilot, that can help strategize marketing campaigns, track team performance, and even generate content and summaries. Bitrix24 can also offer advanced site and ecommerce support, best for businesses in retail, storage, or travel.

If you’re seeking a similar tool that can both host collaboration between teams, and even offer white-label functionality, ClickUp and Pipedrive are great alternatives to Bitrix24.

For more info, read my Bitrix24 review.

Pricing

- Free: Free for unlimited users but only supports up to 5GB of storage space and limited communication features.

- Basic: $49 per organization for five users when billed annually, or $61 for five users when billed monthly.

- Standard: $99 per organization for 50 users when billed annually, or $124 for 50 users when billed monthly.

- Professional: $199 per organization for 100 users when billed annually, or $249 for 100 users when billed monthly.

- Enterprise: Billing starts at $399 per organization for 250 users when billed annually, or $499 for 250 users when billed monthly.

Features

- Mobile app: Access Bitrix24 and its complete list of features with a mobile phone or tablet.

- CoPilot: Generate AI-powered task descriptions from task assignments or checklists for teams or individuals to work on.

- Video calls and web conferences: Schedule meetings for up to 48 participants with HD video and audio, secure connections, and the ability to invite external users.

Pros and cons

| Pros | Cons |

|---|---|

| 15-day free trial. | Real users report limited outbound call volume. |

| Offers REST API for native integrations. | Real users report a software learning curve. |

| Free version supports unlimited users. | Advanced customer support is only available in the Enterprise tier. |

CRM software vs project management software

The main difference between CRM software and PM software is that CRMs are meant to manage customer relationships and act as a lead generating and sales outreach tool and PM software manages business projects.

Project management software is a tool that helps businesses track and manage all activity, progress, and documents within a project, campaign, or objective. While CRM and PM software can be two different solutions, CRM software can also provide generalized project management functionality.

Benefits of project management software include the real time goal tracking and seamless communication. Some drawbacks are that it requires training and documentation, plus could be costly. Most project management software providers can provide time tracking and some sort of reporting capability, plus individual use case examples to help guide your decision.

SEE: Comprehensive guide to the top project management software.

Why use a CRM with project management?

Having a CRM solution with distinct project management features can bring many benefits to a business. Combining the functionality in one platform may improve efficiency, minimize errors, and help improve the overall client experience and thus retention. A CRM with project management also acts as an all-in-one solution for different teams, allowing for more transparency across departments.

How do I choose the best CRM for project management?

Implementing CRM software with PM functionality can be a big investment. It is always best practice to research the software and understand its most ideal use case to learn if it can provide real solutions for your organization. I recommend looking into any of the providers on our list above and consider signing up for their free trials or demos.

Here are some questions to ask when choosing a CRM solution:

- Does this CRM tool integrate with my existing tech stack, such as Outlook for email?

- Does this CRM tool offer the marketing tools that my business needs?

- Does this CRM offer a free version that comes with all the features I need?

- Can the core sales features offered by this software streamline my sales process?

- Do we want an open-source CRM to maximize developer-friendly customizations?

- How quick is the onboarding process to get started using this tool?

- Can the CRM software scale up to adapt to my growing business?

- Does this CRM tool have any in-market specialization in my industry?

Methodology

While most generalized CRM solutions offer project management functionality, we used an in-house rubric to find the top 5 for you. With outlined criteria and subcategories for expected industry standards, each provider was scored and assigned an ideal use case. I referenced each CRM software’s own online resources, user feedback, and forums.

Here’s the breakdown of my scoring criteria:

- Cost: Weighted 25% of the total score.

- Core features: Weighted 25% of the total score.

- Customizations: Weighted 15% of the total score.

- Integrations: Weighted 15% of the total score.

- Ease of use: Weighted 10% of the total score.

- Customer support: Weighted 10% of the total score.

Frequently asked questions (FAQs)

What is CRM in project management?

Project management in the scope of CRM software refers to a collection of features that help businesses manage operations and projects around customers. This is achieved through creating marketing campaigns for lead generation, or deploying new selling strategies to try and shorten deal length.

Which CRM is best for project management?

I found the best CRM for project management are HubSpot, monday CRM, Pipedrive, ClickUp, and Bitrix24. The best of these solutions for your own business might depend on your budget, exact business and departmental needs, and existing tech stack. But any of these CRM providers can manage leads and ongoing operational or sales-based projects within a single CRM interface.

Do I need a CRM and a project management software?

If your business process includes extensive project management at a large scale, and if your technology budget can accommodate more software investments, having both a CRM and project management software can be beneficial. This is especially true since CRMs can typically integrate seamlessly with most project management software. But if you’re looking for a more all-encompassing tool that can monitor the operations of your client-based projects, a CRM solution with project management functionality might be enough.