Customer relationship management tools are meant to manage, track and analyze customer interactions and data. For providers to do this successfully, they use a combination of core and advanced technologies and features that are all housed within the singular platform. These key features work to optimize and automate existing sales processes.

While some industries might require niche features, there are still core features that the top CRM software all provide that are considered must-haves. The top features to expect when looking for a CRM provider should cover each stage of your business’ sales process, from lead generation and lead nurturing, to deal closing and ongoing customer support. This includes marketing tools, lead scoring and sales forecasting, to name a few.

Featured Partners

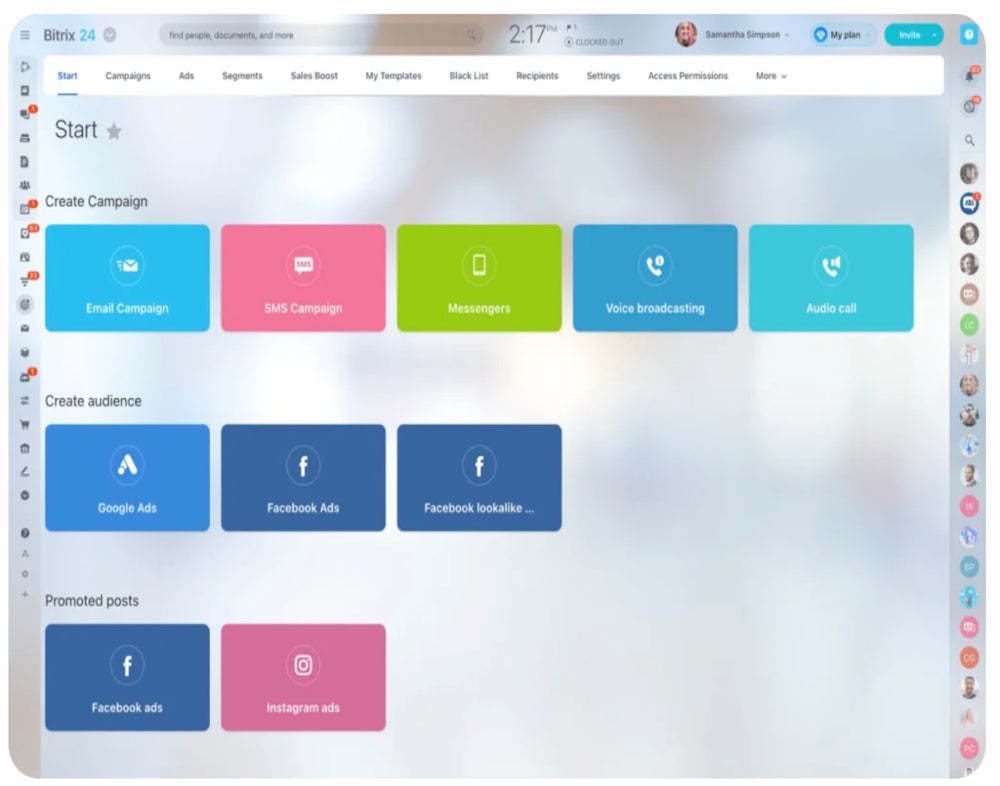

1. Marketing tools

CRM software helps organizations manage their marketing campaigns. This can include live events, marketing material and social media campaigns. With the growing popularity of social media, CRM marketing software allows users to connect their Google or Facebook account and launch campaigns right from the tool. Beyond just creating content from templates, this feature can segment audiences, manage ad spend and produce analytics of campaign performance. This way, users can advertise their products with promoted posts while creating an entire channel for new lead generation.

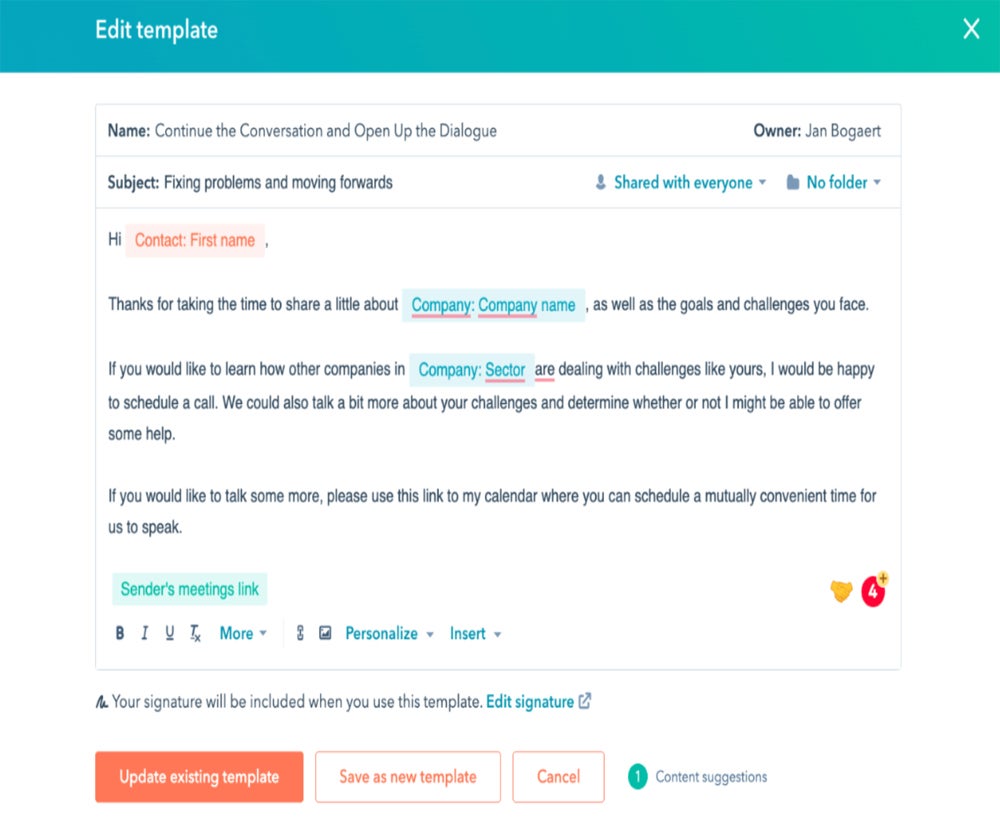

2. Email management

Email management is a critical part of digital selling. This feature encompasses a variety of functionality, including building templates, workflows and even tracking emails with detailed reporting. With the help of email integrations through Outlook, Office 365 or Gmail, users can gain valuable insights into their email drip campaigns by viewing open rates, times and locations, as well as click-throughs on links and attachments.

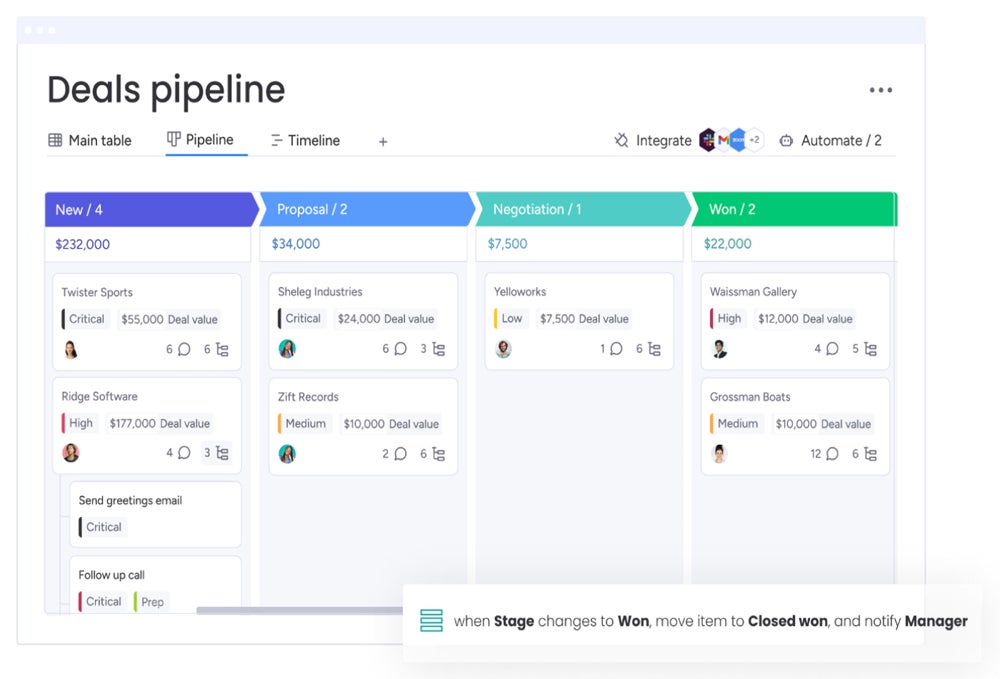

3. Pipeline management

Pipeline management is a way to visually track where deals, or even individual leads, are in your sales process. This allows users to track high-value leads and nurture them to become active customers. Businesses can customize their pipeline, drag-and-drop deals between stages, automate manual work and easily track all contact interactions. This way, users can anticipate small problems before they become big problems that impact revenue.

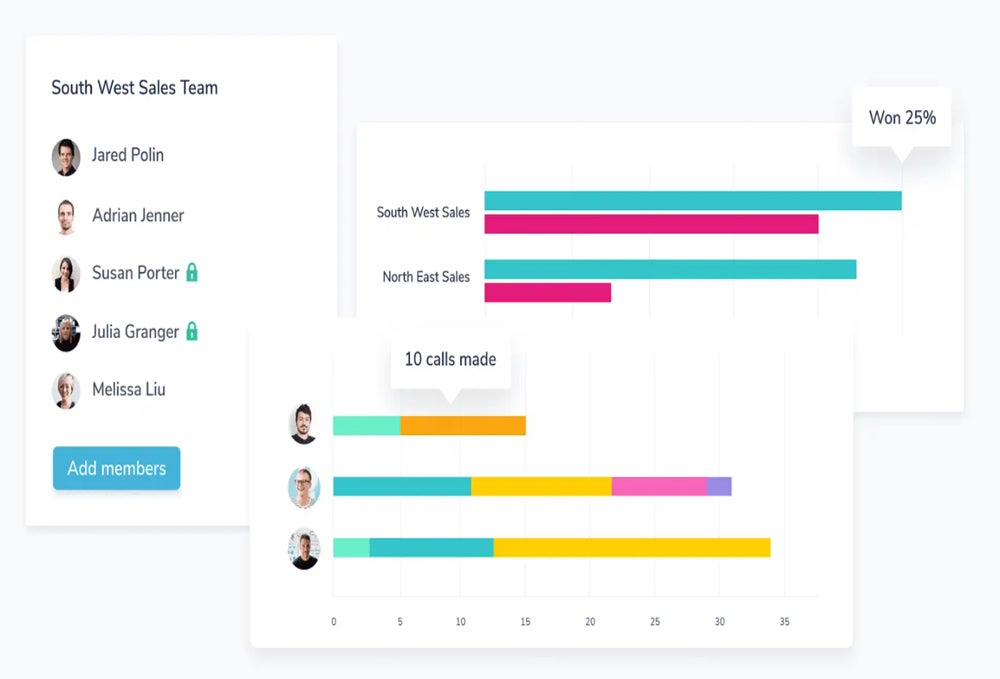

4. Activity tracking

Activity tracking manages all sales activities that have been completed, when they were completed and by who. This feature allows users to have a centralized record of what communication has occurred between the business and their customers. Managers can track the performance of their sales team as well as what engagements are most effective with their clientele. With this information, teams can make a more informed decision about how to approach prospects and customers with personalized customer service.

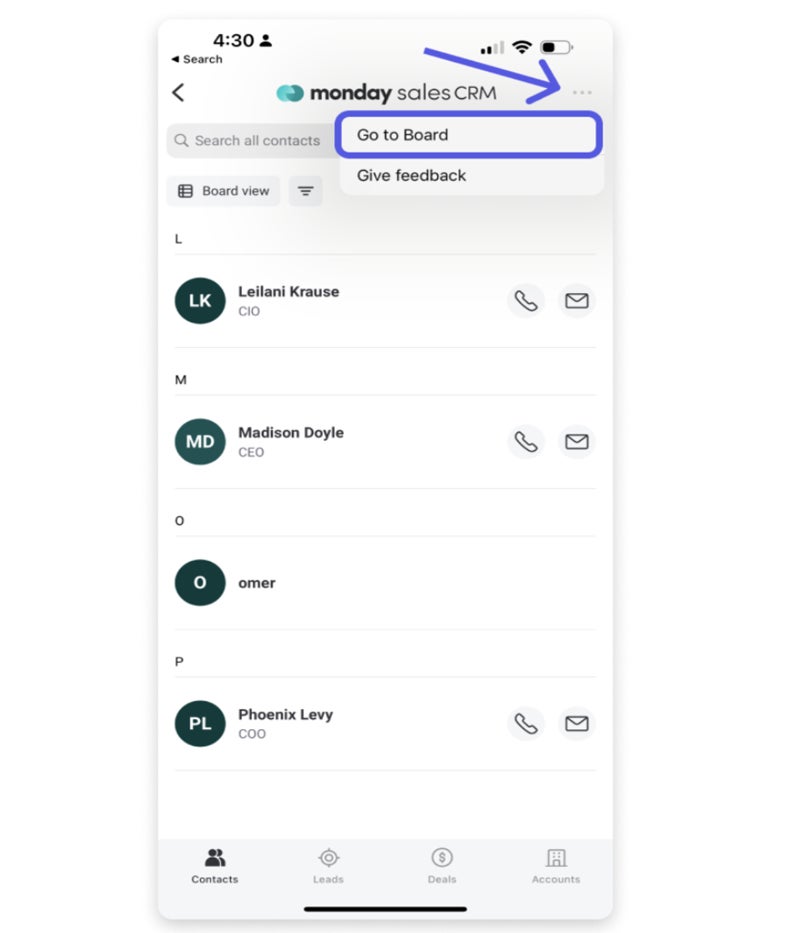

5. Mobile apps

Most CRMs offer a mobile version of their platform for both iOS and Android users. It’s not meant to replace the web experience of the product but rather to enhance the web experience by making the most important aspects of the CRM available on the go. This includes access to

leads, deals, accounts and contacts boards. This feature is great for small businesses looking for a CRM tool and who have reps out in the field canvassing for leads.

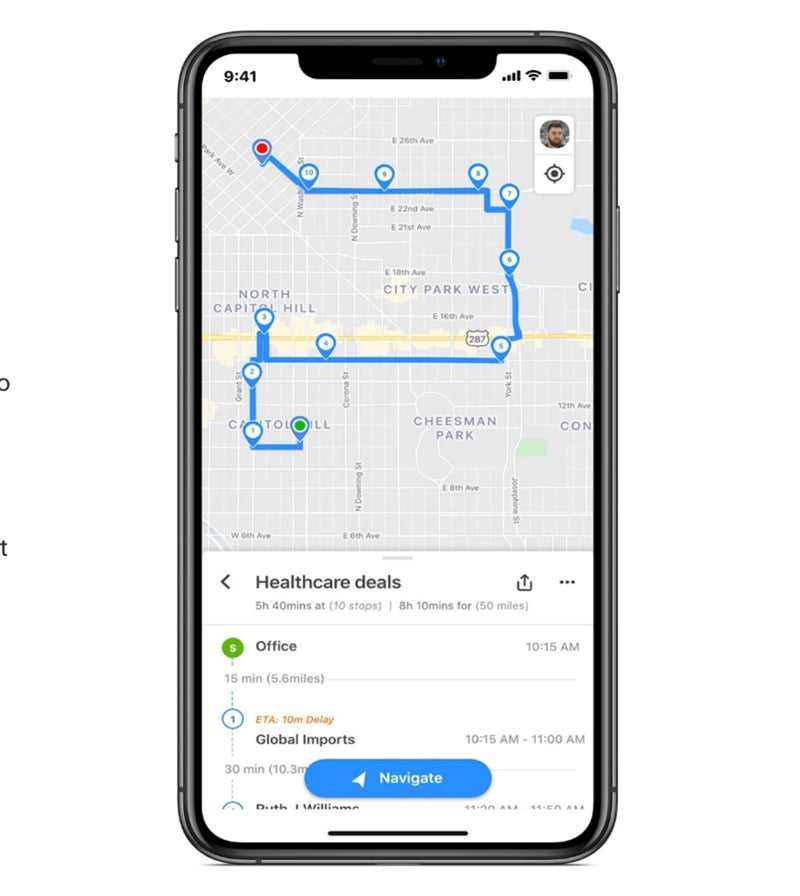

6. Territory management

Territory management allows users to segment accounts, contacts and deals into territories.

Businesses can build a territory hierarchy by creating territories and sub-territories with defined criteria. Using that information, sales reps plan the best route to meet their leads, taking distance, appointments and drop-ins into account. This helps businesses that sell door to door, commercial or residential, visualize their CRM data on an interactive map and filter for the leads they want to meet.

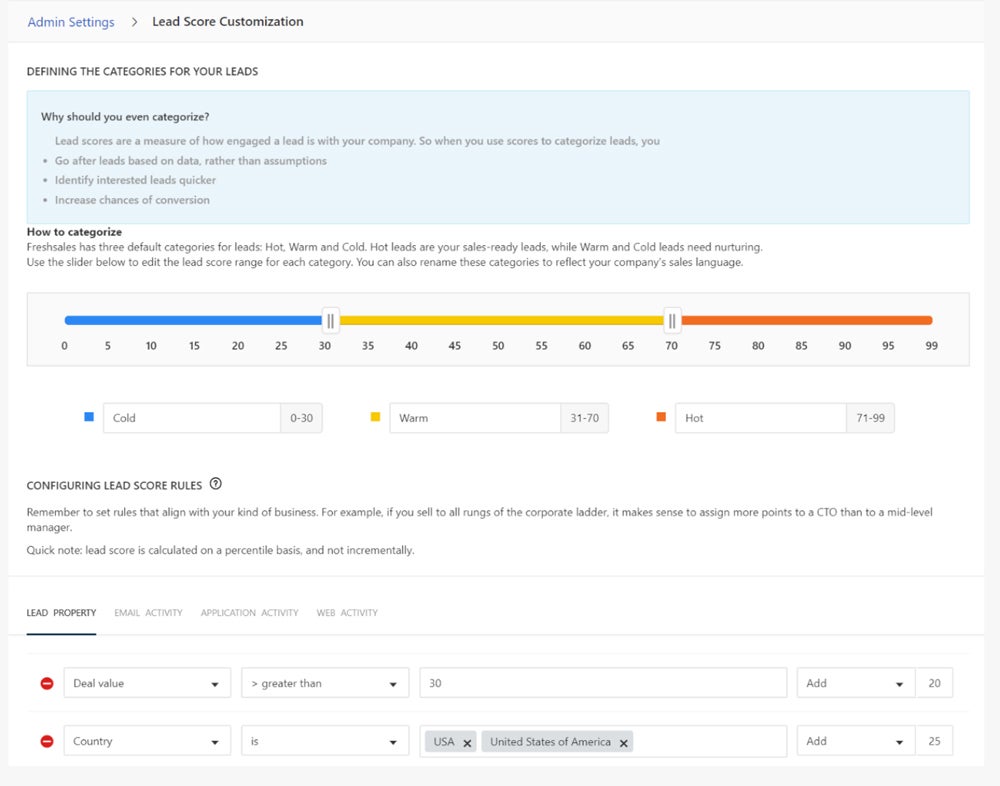

7. Lead scoring

Lead scoring ranks incoming leads based on their engagement with a business. By assigning scores to leads, users are able to easily differentiate qualified and unqualified leads as hot, warm or cold. This allows reps to invest their valuable time in pursuing the right sales leads. The tool typically tracks week-on-week increases and decreases in lead score, and provides insights into factors that contributed to the score. Use this information to align your follow-up to the lead’s activity.

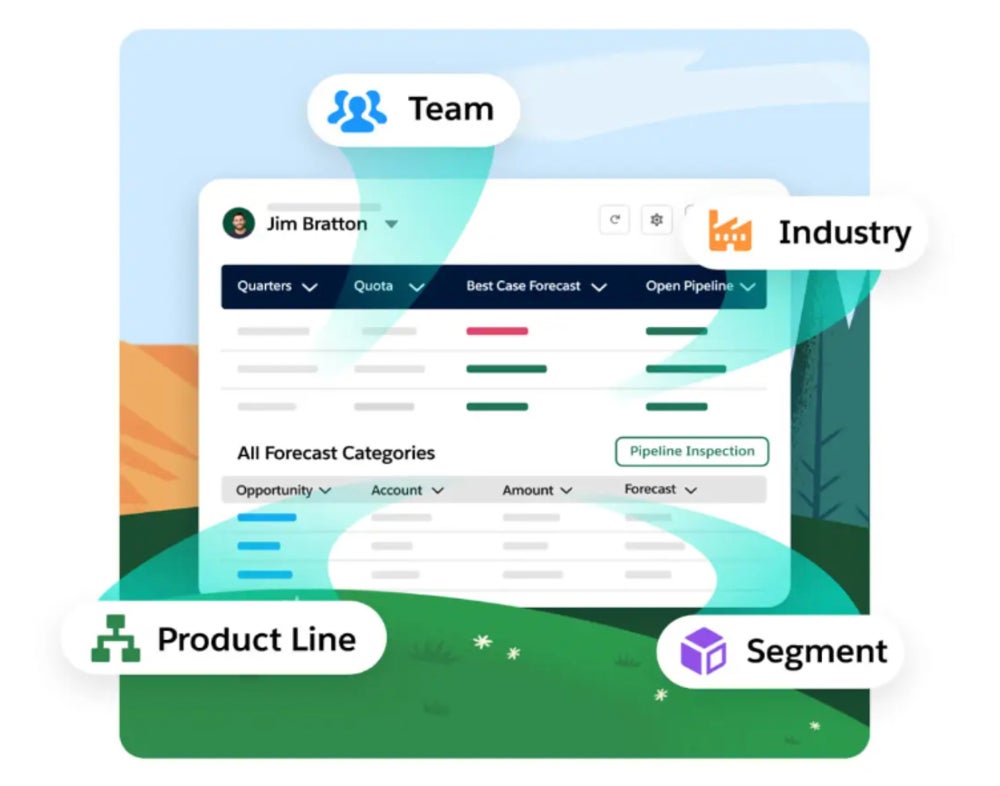

8. Sales forecasting

With the help of sales analytics built directly into the CRM tool, reps can sell smarter by anticipating customer actions. Strategize using contextual data and relevant insights from internal and external sources. Forecasting can be filtered by teams, territories, opportunity splits and custom measures. Sales managers can easily assess opportunities by designing page layouts for their unique sales processes.

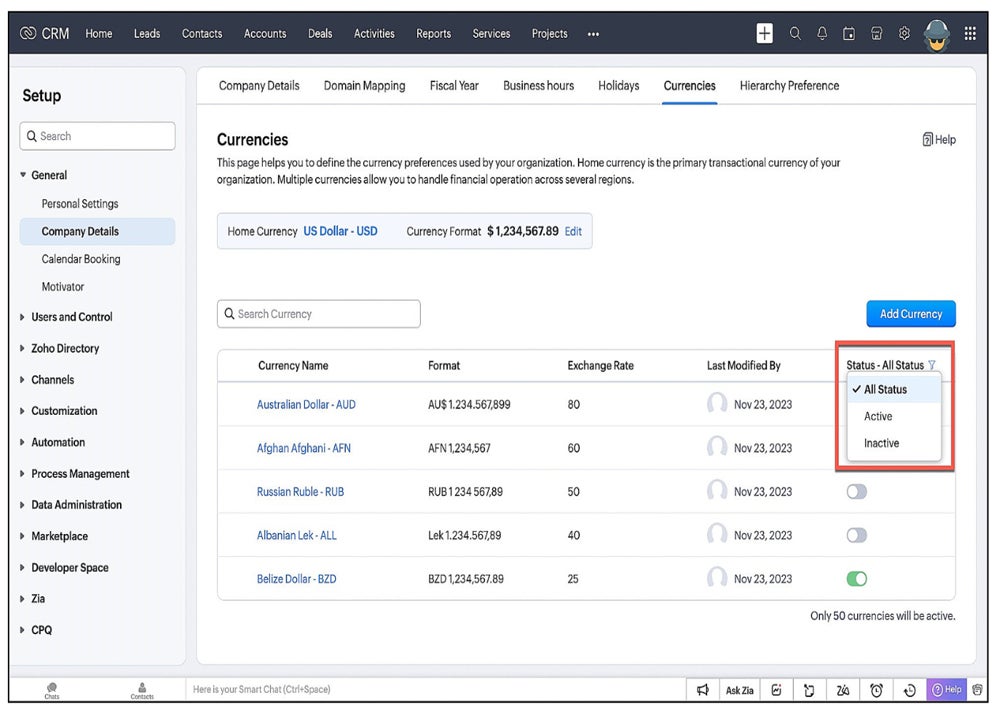

9. Multi-currency and multi-language

For organizations that sell to customers in different languages or currencies, most providers offer a unique multi-currency or language feature. After choosing a “home currency,” users with permission to access the currencies tab can add other currencies that their company uses for business. This feature helps users scale the platform to grow with them as they expand business internationally.

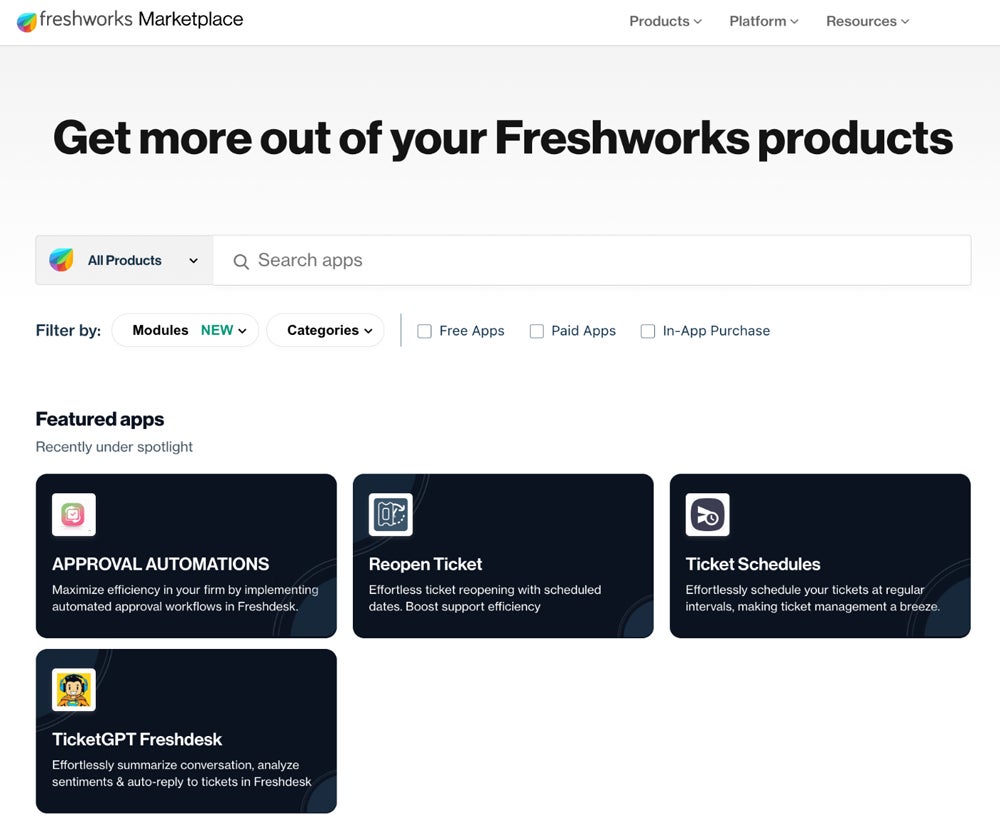

10. Integration marketplace

CRM software is meant to exist in tandem with other products in your tech stack through integrations. Popular integrations include Slack, Google Workspace, Microsoft 365, LinkedIn and other social media. CRM providers typically offer a marketplace where users can see all possible integrations, including native solutions, third-party applications and free downloads.

Some CRM tools are open-source software, meaning there’s additional capability for customization to the tool or its integrations through public source code.

Final thoughts

A major benefit to CRM software is how customizable and scalable they can be, and choosing the right CRM tool for your business can really make a difference. Depending on your business’ needs and industry, there are industry-specific features that help niche businesses build out their sales process. But before you get to those niche offerings, the core features of a CRM are key to getting any business started.

When deciding between providers, consider the features we’ve highlighted above. Prioritize the core features based on how often, or if at all, you’d plan on using them. It’s also important to understand if the feature is included in the free CRM version or is only available through a premium subscription to the software.