Global Smartphone AP (Application Processor) Shipments Market Share: Q1 2022 to Q2 2023

Published Date: September 7, 2023

A repository of quarterly data for the global smartphone AP market based on smartphone AP/SoC shipment numbers.

This data is based on the smartphone AP/SoC shipments

This data is based on the smartphone AP/SoC shipments

Note: Totals may not add up due to rounding

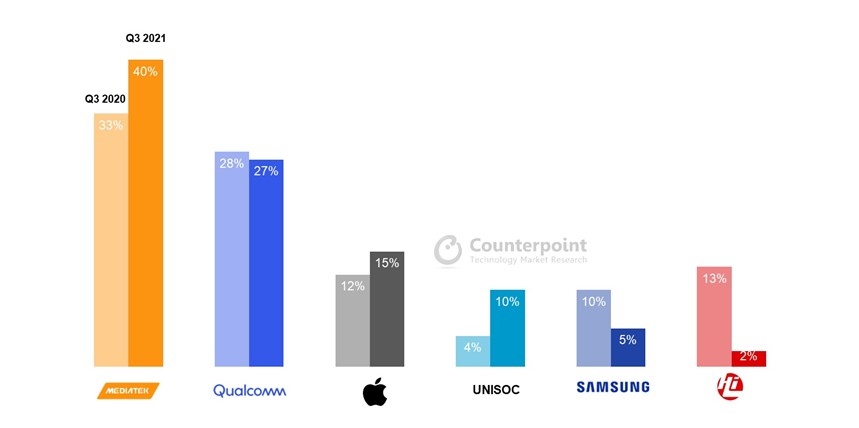

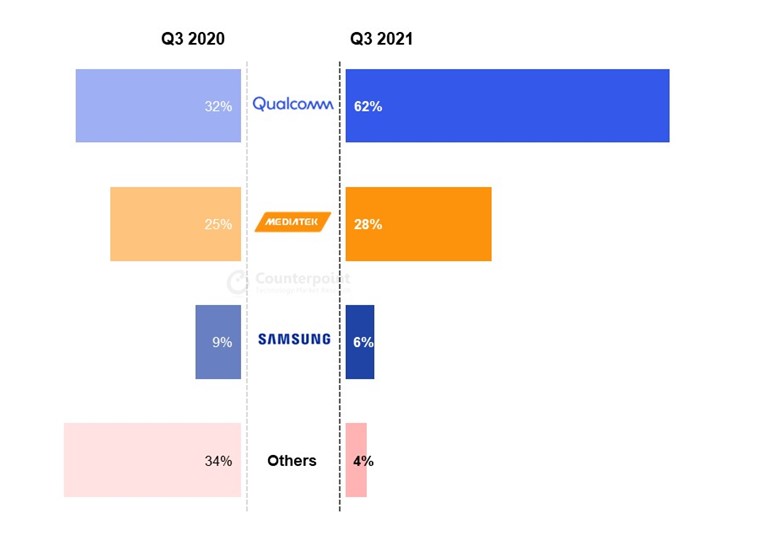

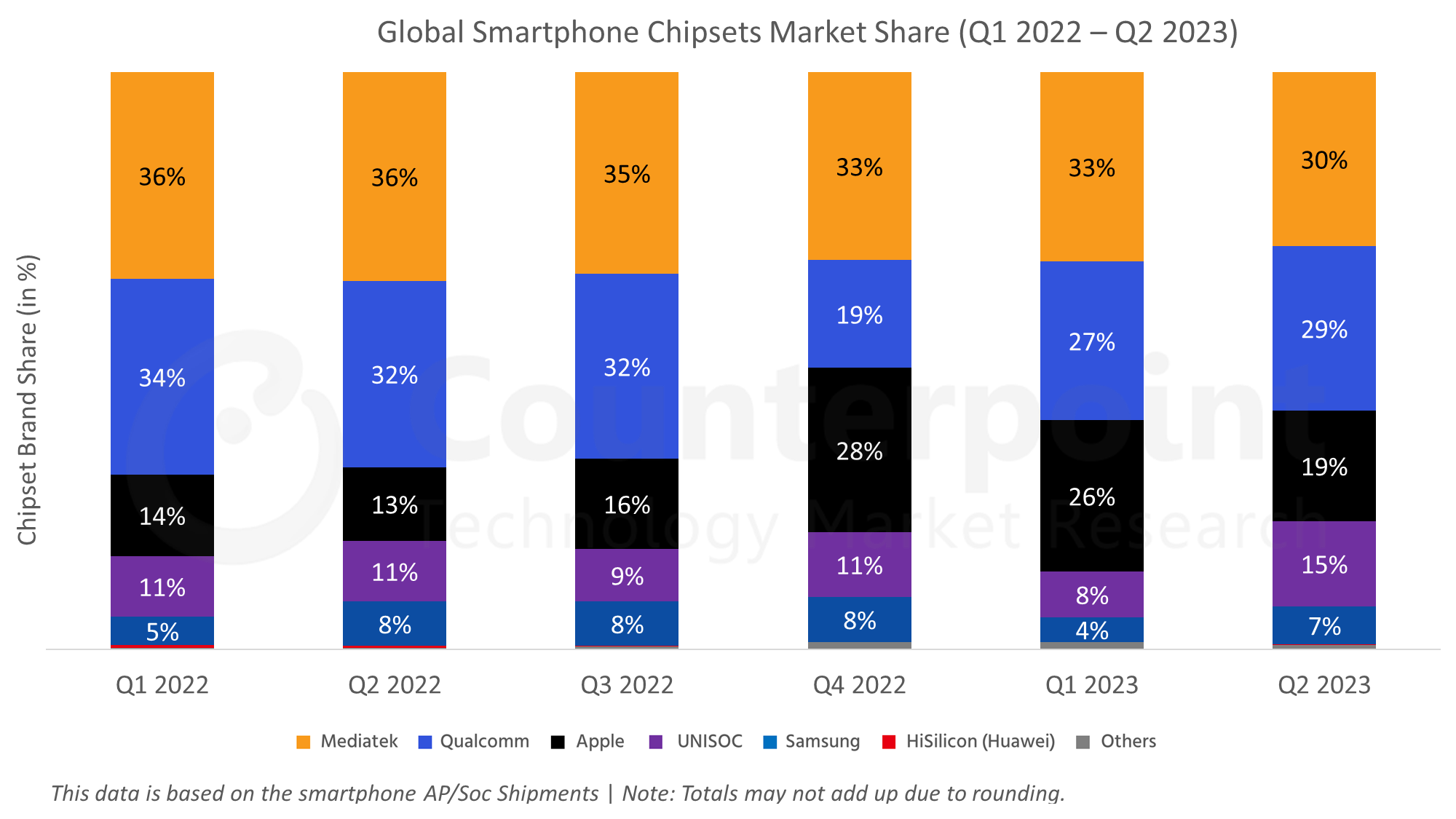

| Global Smartphone Chipset Market Share (Q1 2022 – Q2 2023) | ||||||

| Brands | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 |

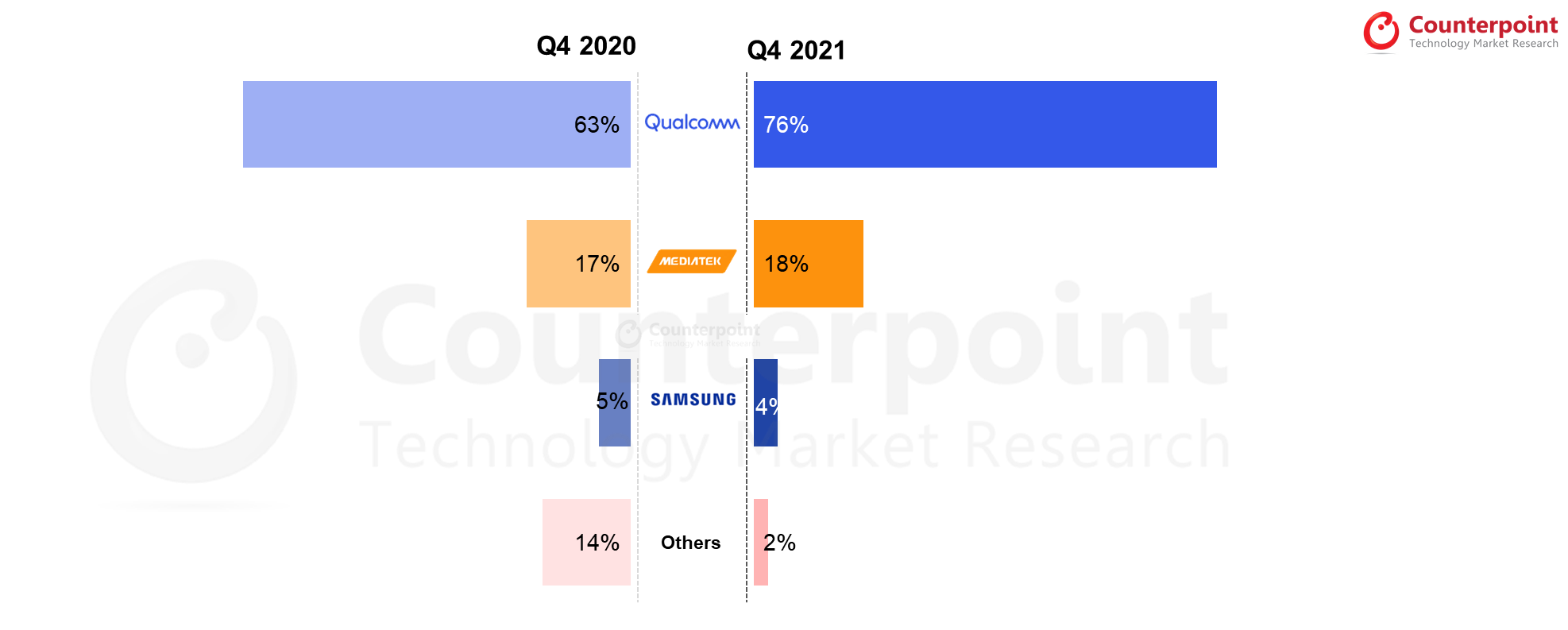

| Mediatek | 36% | 36% | 35% | 33% | 33% | 30% |

| Qualcomm | 34% | 32% | 32% | 19% | 27% | 29% |

| Apple | 14% | 13% | 16% | 28% | 26% | 19% |

| UNISOC | 11% | 11% | 9% | 11% | 8% | 15% |

| Samsung | 5% | 8% | 8% | 8% | 4% | 7% |

| HiSilicon (Huawei) |

1% | 0% | 0% | 0% | 0% | 0% |

| Others | 0% | 0% | 1% | 1% | 1% | 1% |

Source: Global Smartphone AP-SoC Shipments & Forecast Tracker by Model – Q2 2023

DOWNLOAD:

(Use the buttons below to download the complete chart)

![]()

![]()

Highlights:

Apple’s sales declined in Q2 2023 due to seasonality. Its Pro series did better.

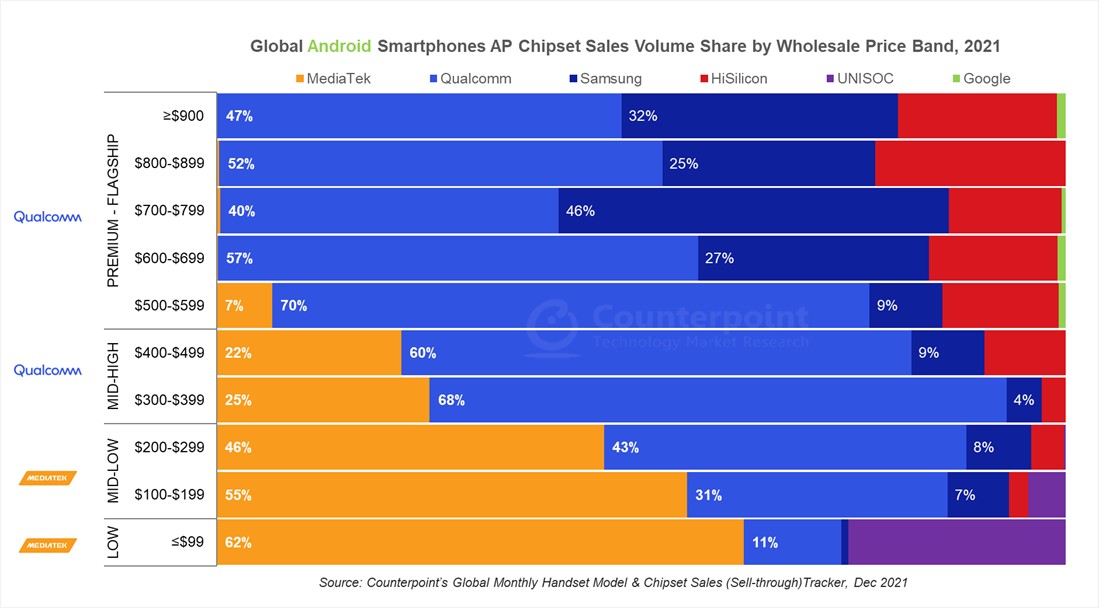

MediaTek’s shipments increased slightly in Q2 2023 with reduced inventory levels and growing competition in the entry-level 5G smartphone market. New smartphone launches in the low-to-mid-end segments increased the shipments of Dimensity 6000 and Dimensity 7000 series. The Dimensity 9200 Plus was added to the premium tier.

Qualcomm’s shipments increased in Q2 2023 due to the Snapdragon 8 Gen 2’s adoption in Samsung’s flagship smartphones and by Chinese OEMs. The launch of Samsung’s Flip and Fold series also contributed to this growth. Qualcomm refreshed the Snapdragon 7 Gen 1, Snapdragon 6 Gen 1 and Snapdragon 4 Gen 1 series to gain some share back. However, the premium segment’s growth remained in focus.

Samsung’s shipments increased in Q2 2023. The Exynos 1330 and 1380’s launch added volumes to the low and mid-high segments.

UNISOC’s shipments grew in Q2 2023 after a weak Q1. It gained some share in the $100-$150 LTE segment. In H2 2023, as entry-level 5G smartphones pick up in regions like LATAM, SEA, MEA and Europe, UNISOC will gain some share.

For a more detailed smartphone AP-SoC shipments & forecast tracker, click below:

Global Smartphone AP-SOC Shipment & Forecast Tracker by Model – Q2 2023

This report tracks the smartphone AP/SoC Shipments by Model for all the vendors. The scope of this report is from the AP/SoC shipments from all the key vendors like Apple, Qualcomm, MediaTek, Huawei, Samsung, UNISOC and JLQ. We have covered all the main models starting from Q1 2020 to Q2 2023. We have also included a one-quarter forecast for Q3E 2023. This report will help you to understand the AP/SoC Market from the shipment perspective. Furthermore, we have also covered key specs for these AP/SoC covering market view by:

- Network (4G/5G AP/SoC)

- Foundry Details (like TSMC, Samsung. etc.)

- Process node (5nm, 6nm, 8nm, etc.)

- Manufacturing Process (FinFET, N7, N5, etc.)

- CPU Cores Architecture and CPU Cores Count

- Modem (External/Internal)

- Modem Name

- Secure Element Presence

- Security Chip

- AI Accelerator

For detailed insights on the data, please reach out to us at sales(at)counterpointresearch.com. If you are a member of the press, please contact us at press(at)counterpointresearch.com for any media enquiries.

Related Posts: