Jira and Confluence are two popular project management software created by the same company, Atlassian. While they are both designed to help businesses and individuals plan and track projects, they are very different tools.

Confluence is better suited to knowledge base management and team collaboration, while Jira is designed for bug and issue tracking.

In this article, we compare the pricing plans and features for Jira vs Confluence and list out the pros and cons for each software to help you decide which one is the best choice for your business.

Featured Partners

Confluence vs Jira: Comparison table

| Features | ||

|---|---|---|

| Our rating (out of 5) | ||

| Starting price (billed annually) | ||

| Forever free account | ||

| Kanban boards | ||

| Agile reporting | ||

| Issue tracking | ||

| Team collaboration | ||

| Knowledge base management |

Confluence vs Jira: Pricing

Both Jira and Confluence have very similar pricing structures, which makes sense since they are both Atlassian products. Both platforms offer a forever free plan for teams of up to 10 people and also offer 14-day free trials for their Standard and Premium plans.

Each platform also offers volume discounts, so the per-person costs decrease as you add more users. Both Confluence and Jira also offer Enterprise plans that are only available to companies with more than 800 users, as well as both cloud-based software and on-premise software options.

Jira pricing

- Free: $0 for up to 10 users.

- Standard: $8.15 per user per month billed monthly and $850 annually for one to 10 users.

- Premium: $16 per user per month billed monthly and $1,600 annually for one to 10 users.

- Enterprise: Starts at $141,000 a year for 800+ users. Only available for companies with more than 800 employees. Annual billing only.

For more information, see this full Jira review.

Confluence pricing

- Free: $0 for up to 10 users.

- Standard: $6.05 per user per month billed monthly or $600 annually for one to 10 users.

- Premium: $11.55 per user per month billed monthly or $1,150 annually for one to 10 users.

- Enterprise: Starts at $107,500 a year for 800+ users. Only available for companies with more than 800 employees. Annual billing only.

For more information, see this full Confluence review.

Confluence vs Jira: Feature comparison

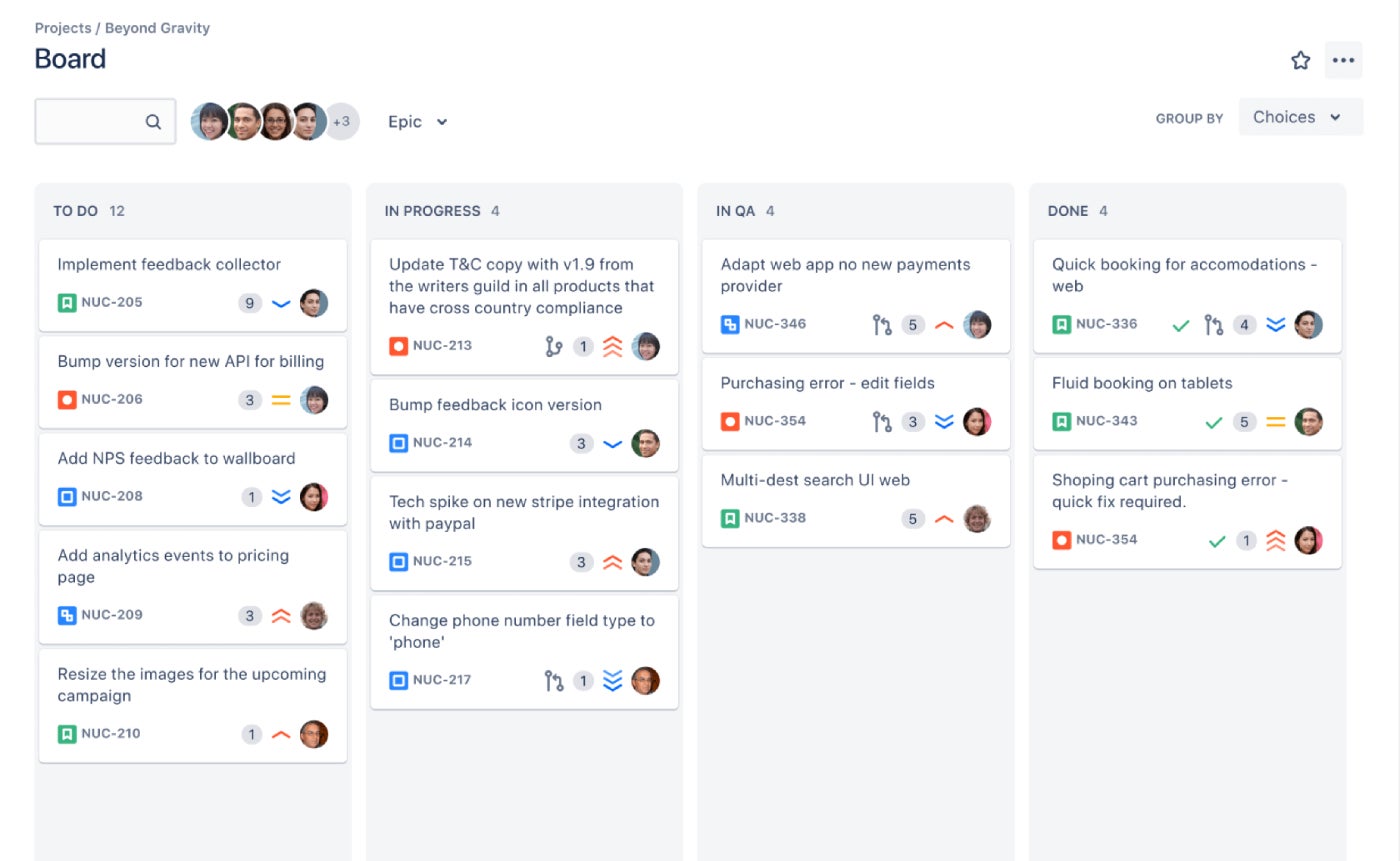

Kanban boards

Winner: Jira

In keeping with its agile project management approach, Jira offers a kanban board view so teams can easily visualize work in progress and identify bottlenecks quickly. I found these kanban boards easy to customize to my specific requirements.

Unfortunately, Confluence does not offer native kanban boards, so you’ll have to use a third-party integration if you want that function in Confluence. Since Confluence isn’t primarily designed for complex project management, other project views are limited as well.

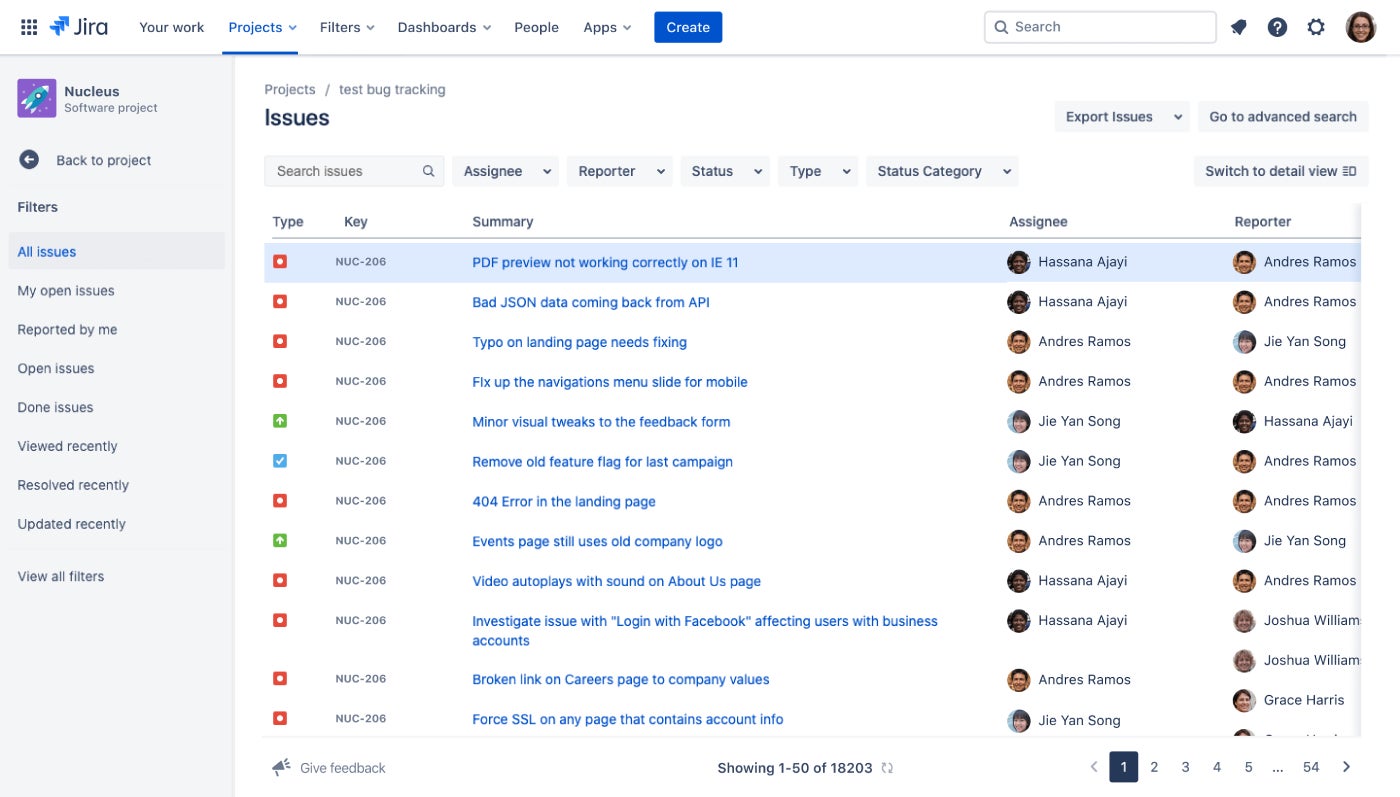

Issue tracking

Winner: Jira

Jira was originally designed for software development teams, and nowhere is that more apparent than its excellent issue tracking feature. Jira’s bug tracking software can also be modified to fit the workflows of other teams outside of software development, though I personally found the learning curve to be a bit higher for this compared to more general project management software. Confluence does not offer a dedicated issue tracking feature, so if your team needs this, then Jira is the clear choice.

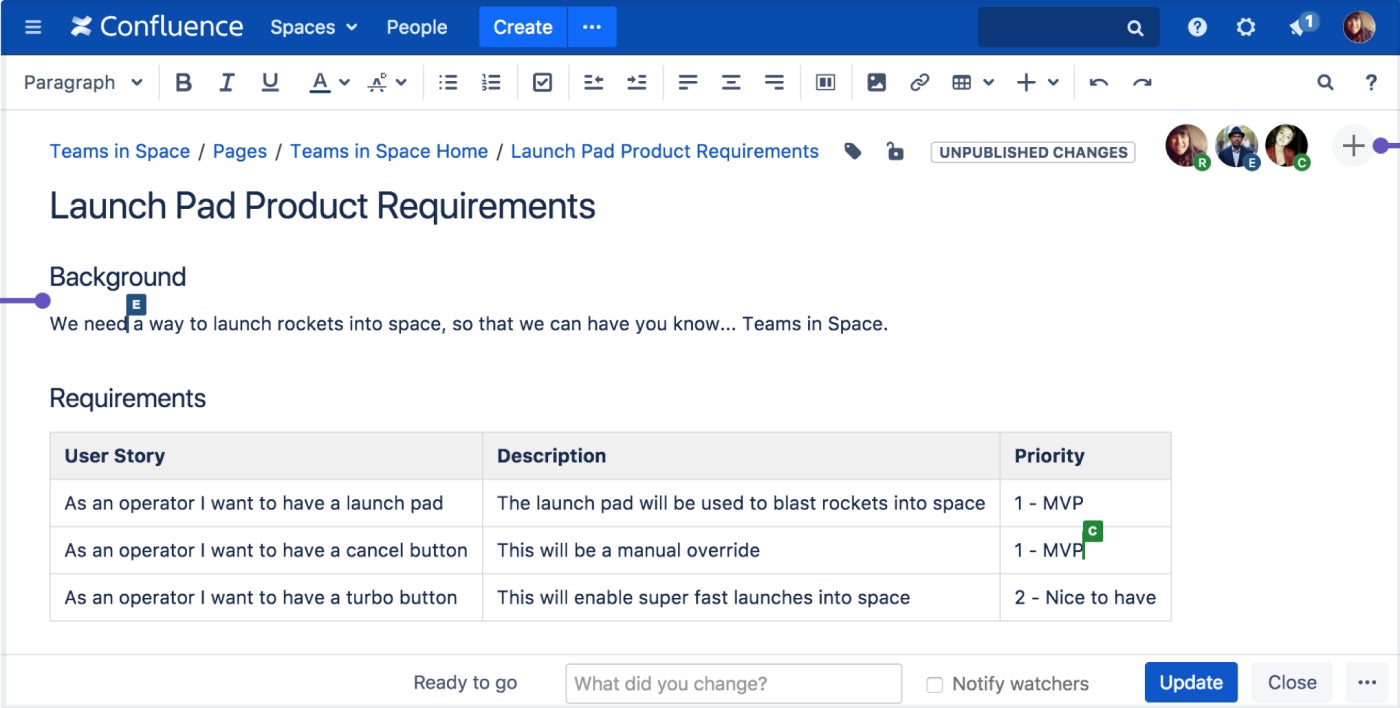

Team collaboration

Winner: Confluence

While Jira has more tracking features, it’s not the best choice for teams that need a lot of communication and collaboration tools. I was able to assign tasks and comment on them, but features beyond that are limited.

In contrast, Confluence offers multiple tools for collaboration, including real-time editing, shared spaces, and control access permission. It’s an especially good choice if you need to collaborate on editing content with your team.

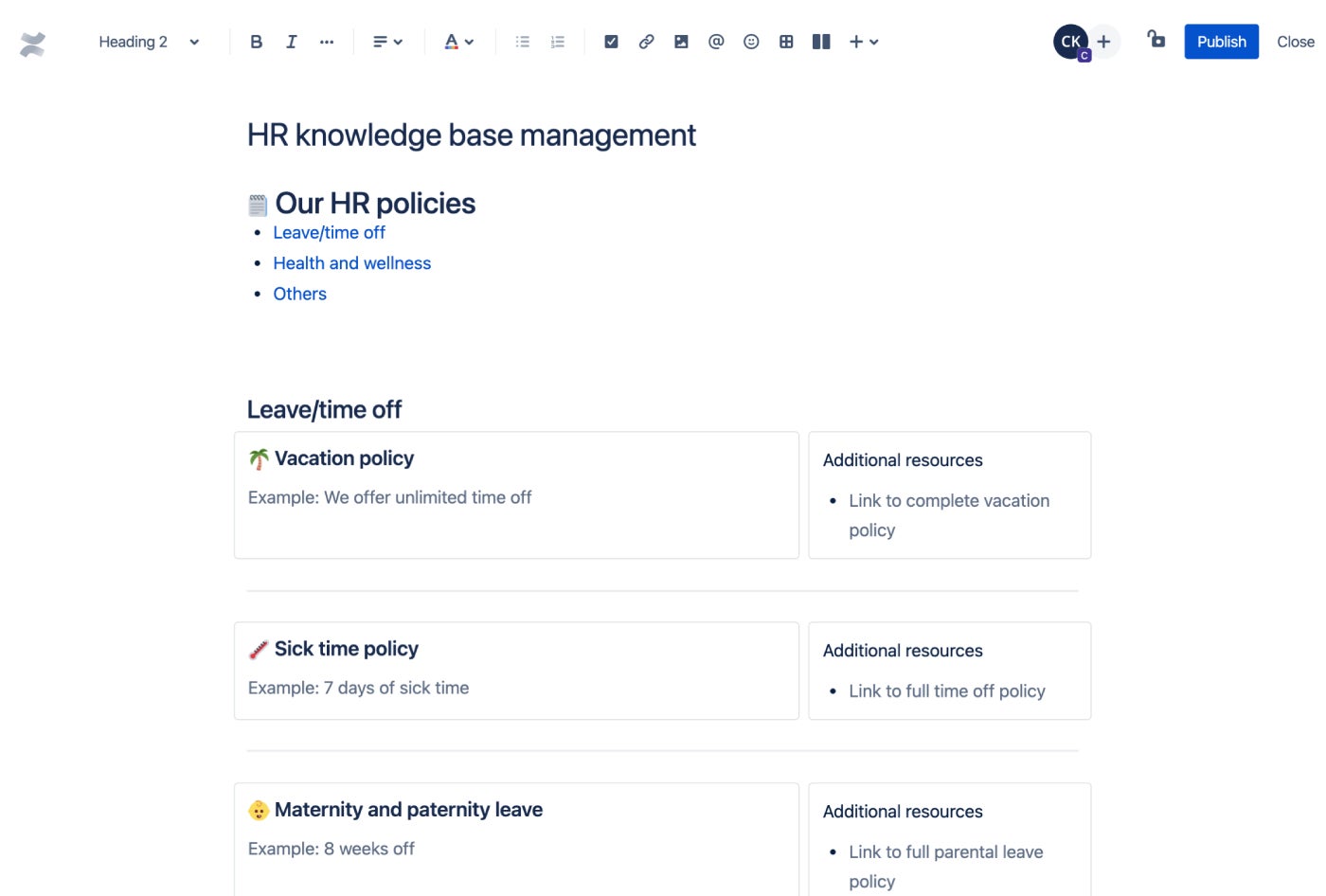

Knowledge base management

Winner: Confluence

Knowledge bases are critical for centralizing documentation and information, which is why it’s unfortunate that Jira doesn’t offer this feature. Since Confluence was designed specifically for knowledge base management, it’s a much better choice for this particular need.

This is why Confluence ranks as the best pick for project documentation when it comes to startup project management software. Keep in mind that you can also integrate Jira and Confluence together so that you don’t have to choose between Jira’s project management and Confluence’s knowledge base management.

Jira pros and cons

Pros of Jira

- Highly scalable.

- Outstanding issue tracking tools.

- Robust agile reporting tools.

- Variety of add-ons are available.

Cons of Jira

- Steep learning curve.

- Limited project views.

- Limited collaboration and communication tools.

Confluence pros and cons

Pros of Confluence

- Knowledge base creation and management.

- Excellent collaboration tools.

- Extensive range of templates.

- User-friendly interface.

Cons of Confluence

- Limited scalability.

- Limited document management capabilities.

Should your organization use Confluence or Jira?

Choose Jira if . . .

- You need issue tracking capabilities.

- You want more extensive project management features.

- You are looking for native time tracking.

- You need kanban boards.

- You value agile reporting.

Choose Confluence if . . .

- You are looking to create and manage knowledge bases.

- You need more team collaboration and communication tools.

- You want a large template library to choose from.

- You value advanced search functions.

- You want software that is easier to learn.

Alternatives to Jira and Confluence

If neither Jira or Confluence sounds like the right fit for your needs and/or budget, there are plenty of other options to check out. I’ve assembled a list of the best alternatives for both platforms to help further your search.

The best Jira alternatives are:

- Best for comprehensive project management: monday work management

- Best for agencies and remote teams: Teamwork

- Best for flexibility and customization: ClickUp

- Best for documentation and knowledge management: Confluence

- Best for ease of use: Trello

- Best for workflow management: Asana

- Best all-in-one workspace solution: Notion

The best Confluence alternatives are:

- Best for existing Microsoft product users: Microsoft SharePoint

- Best wiki for internal knowledge base: Nuclino

- Best for technical documentation: Document360

- Best for affordability and customization: ClickUp

- Best for Google Docs users: You need a wiki (YNAW)

- Best for communication and collaboration: Google Workspace

- Best for combination of task and document management: Notion

- Best for ease of use: Trello

- Best for workflow and task management: Asana

- Best for sales teams: Quip

FAQ

What is the main difference between Jira and Confluence?

Jira offers bug tracking and issue tracking software as well as additional project management tools like kanban boards and time tracking. Confluence is a team collaboration platform that is especially designed for knowledge base creation and management.

What is Confluence used for in Jira?

Confluence is used to add knowledge base management and team collaboration features to Jira. Confluence offers some features that Jira does not, such as real-time editing and a library of content templates to choose from.

Are Jira and Confluence separate?

Jira and Confluence are two separate software products, although they are both owned by the same parent company, Atlassian. You do not need one software in order to use the other, although you can choose to integrate them together (which is true of all Atlassian products).

Do you need Confluence for Jira?

No, you do not need to sign up for Confluence in order to use Jira. They are two separate software products that can be used independently of one another — although there is an optional integration available, so you can connect Confluence and Jira if you have both tools.

Review methodology

To compare Confluence vs Jira, I signed up for free trials of both software and tested them out myself. I also consulted the ratings rubrics compiled by our expert software reviewers. I considered features such as agile project management, kanban boards, issue tracking, time tracking, team collaboration, and knowledge base creation. I also weighed other factors like pricing, customer support, learning curve, and ease of use.