eSIM has been a revolutionary technology driving the digital transformation of acquiring, accessing and consuming connectivity. OEMs are offering eSIM capability at the device level, while eSIM management solution vendors are offering software and services to mobile operators to connect these eSIM-capable devices to eSIM platforms securely.

The benefits of eSIM technology lie in enabling secure and seamless connectivity from chip to cloud, leading to an array of new business models for a broad range of stakeholders. This includes transforming mobile operators, making connected enterprises “fully digital”, thereby reducing overheads, customer acquisition costs and complexities, boosting customer experience, and driving newer business models connecting people and things at scale.

Demand for eSIM management solutions growing across different stakeholders

eSIM adoption is growing swiftly across different device categories and stakeholders. Mobile operators, enterprises, service providers and even platform players are sourcing innovative eSIM solutions to go digital, expand their service offering, maintain redundancy, plan hybrid deployments to comply with local regulations, or address specific subscriber or device segments. For example, players such as Uber are climbing on the eSIM bandwagon to drive newer business models and remove customer pain points by offering uninterrupted connectivity. Private networks are adopting eSIM to offer dedicated connectivity to their employees and remotely manage the connected IoT assets within the enterprise premises.

Different flavors of eSIM management solutions

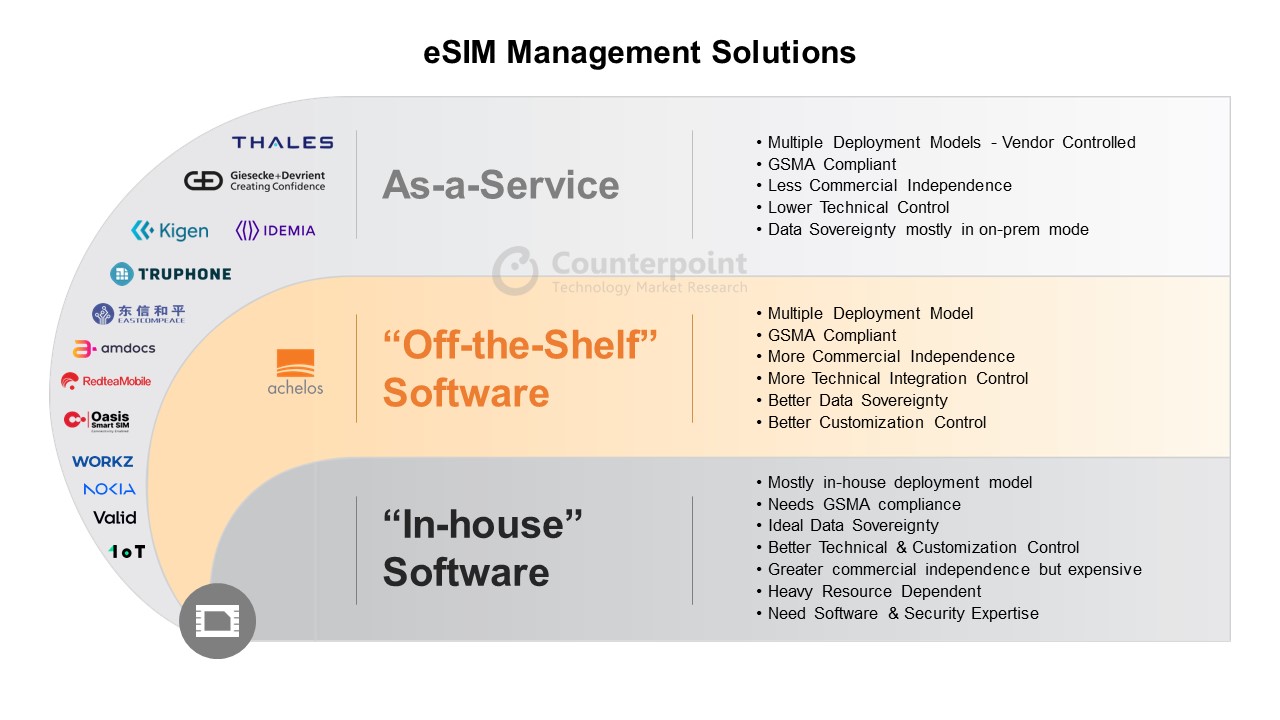

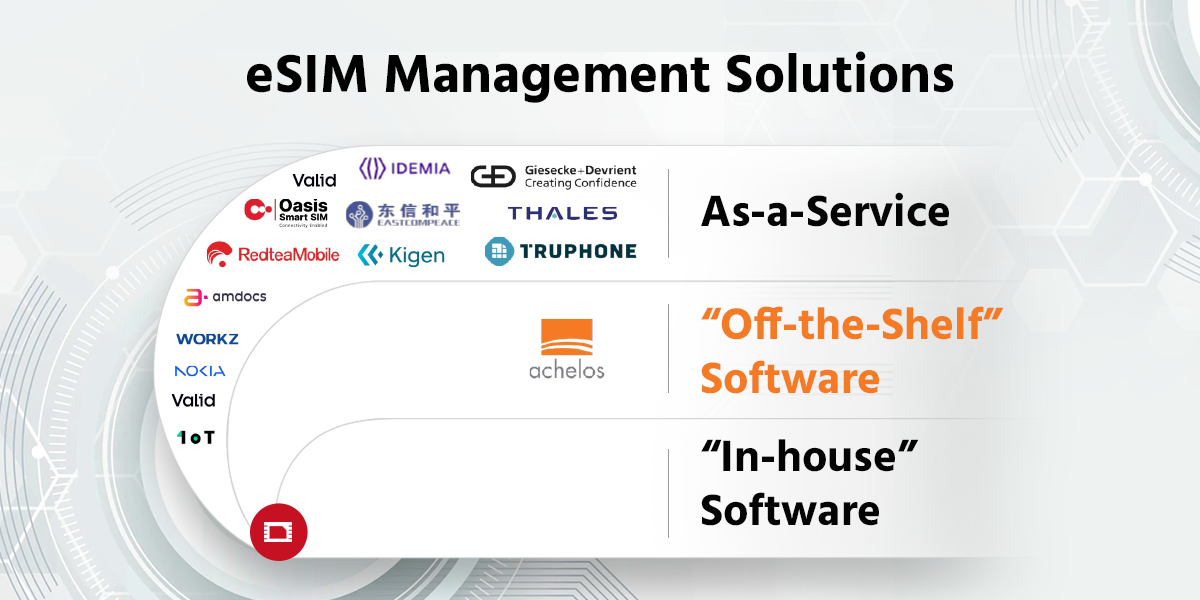

The incumbent SIM vendors have been delivering eSIM management solutions in the form of ‘eSIM-Management-as-a-Service’ as an extension of their existing SIM business model, with the storage and processing of the subscriber data usually managed by the vendors at their own sites or now in collaboration with third-party cloud platforms such as Azure, AWS and Google Cloud. However, in such traditional deployments, the customers, especially other Service and Solution Providers have very limited commercial and technical control over the eSIM-based subscription management and customer data.

While this has been the established method of eSIM management solution delivery during the early years, which saw very limited eSIM usage, the competitive, geopolitical and regulatory landscape is changing. As eSIM technology has matured with a clear path ahead to replace the SIM card, operators as well as service and solution providers are increasingly either considering developing their own eSIM management software or licensing it “off the shelf” and building a service on top of it.

Developing software and service “in-house” demands significant resources and domain knowledge, from software to standards to security. This makes the exercise incrementally expensive amid changing technologies and regulations. Therefore, using an off-the-shelf eSIM management software is emerging as a popular solution, offering the best of both worlds, i.e. in-house and as-a-service eSIM management solutions.

achelos GmbH, an important player in the eSIM value chain, is positioned to satisfy the abovementioned needs. The company offers a suite of off-the-shelf GSMA-compliant eSIM RSP software solutions with bespoke features and extensions that perfectly align with the different requirements of a broad range of players, whether MNO, private network operator, service provider or system integrator. They fill a gap in the booming eSIM RSP market, helping democratize the technology by offering eSIM solutions to potential stakeholders looking for eSIM provisioning capabilities integrated directly into their existing platforms or infrastructure at the software level rather than the traditional as-a-service solution.

In our discussions with multiple operators and stakeholders, the key needs and challenges mentioned are related to having more control, independence over costs, technology, integration, and data to manage the number of connected devices and connectivity on their networks. This is where off-the-shelf eSIM management software solutions are looking to help eliminate the significant cost, risks, resource requirements and compliance requirements. However, with the growing trend of sourcing multiple eSIM management and orchestration solutions, we believe the off-the-shelf software is a nice complement to the traditional as-a-service eSIM solutions, allowing these key stakeholders to strike the right balance between control and flexibility.

Firms such as achelos started as niche players, with a highly focussed “software-only” approach offering flexible, customizable off-the-shelf GSMA SAS-SM-compliant eSIM remote SIM provisioning and orchestration software solutions. These complement or offer an alternative to traditional as-a-service solutions by promising proof points across the following key criteria:

- Reliable: Redundancy, up-time, backup, recovery, security, resilience, etc.

- Scalable: With growing traffic across locations, device types, features, etc.

- Compliant: GSMA standards, specs, interoperability, etc.

- Comprehensive: Support different implementations – SM-DP, DP+, DS, etc.

- Efficient: Costs, resources, implementation, time-to-market, etc.

- Seamless: Architecture, orchestration, openness, cloud, BSS/OSS integrations

- Customizable: Features, services, deployments, UI, analytics to help differentiate

Furthermore, having access to an end-to-end suite of eSIM RSP and orchestration software and capabilities helps potential stakeholders co-develop distinctive features and services on top of the standards efficiently, with full control over security, scalability, and costs.

The key to success with this approach is in having a software partner which embraces open, lightweight, and advanced tools, frameworks and processes. This makes it seamless for the stakeholder’s IT team to co-create unique solutions built on industry standard-compliant and interoperable foundations.

Wrapping up

As the eSIM adoption rises across key stakeholders beyond mobile operators, there are significant opportunities for the vendors providing eSIM solutions in different forms. Different stakeholders have different needs, influenced by their digital transformation journeys, regulations, and need for redundancy or control over the solution and services attached to it.

As a result, we are seeing growing need for off-the-shelf eSIM solutions where some stakeholders want greater control, commercial independence, and sovereignty of the platform alongside the traditional ‘eSIM-Management-as-a-Service’ solutions. Players such as achelos are well positioned to complement and expand the eSIM solution provider ecosystem for the different key stakeholders in their eSIM transformation journey.

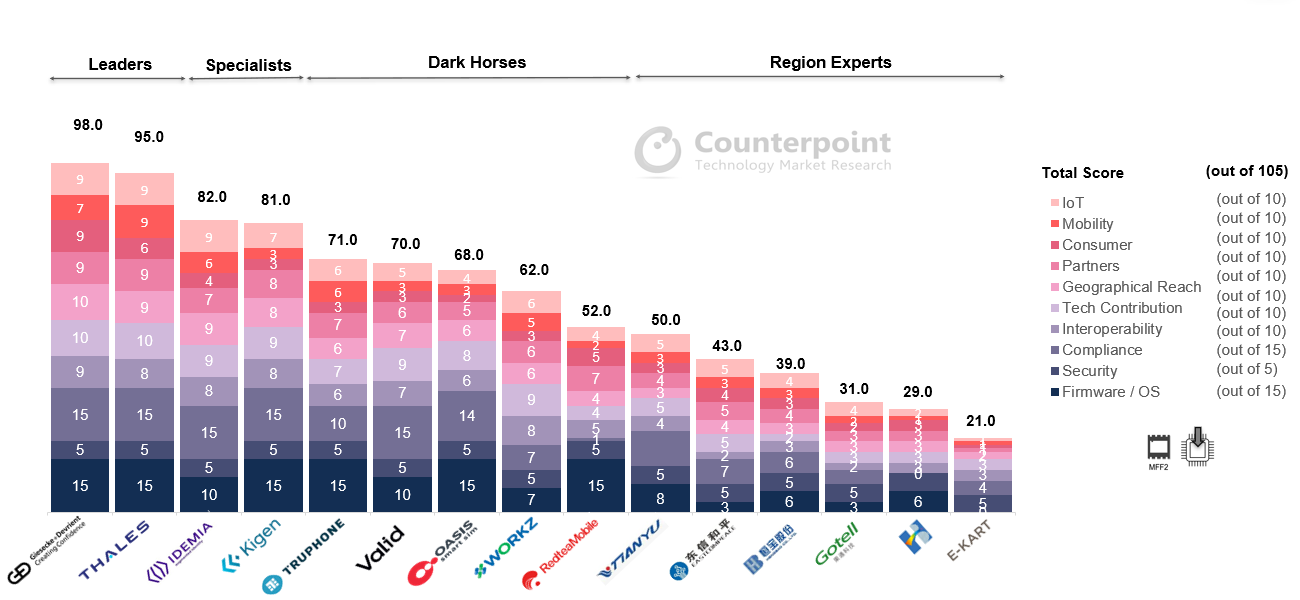

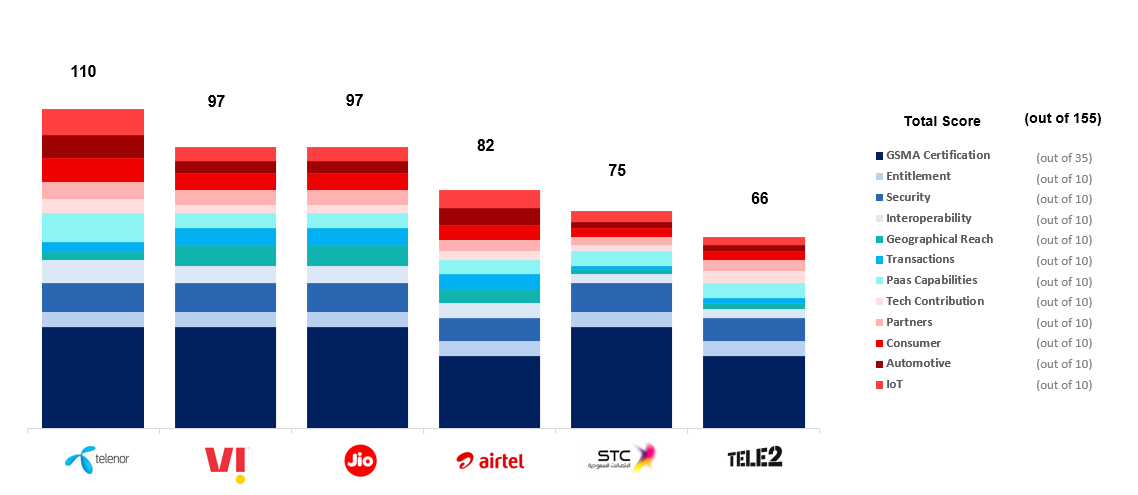

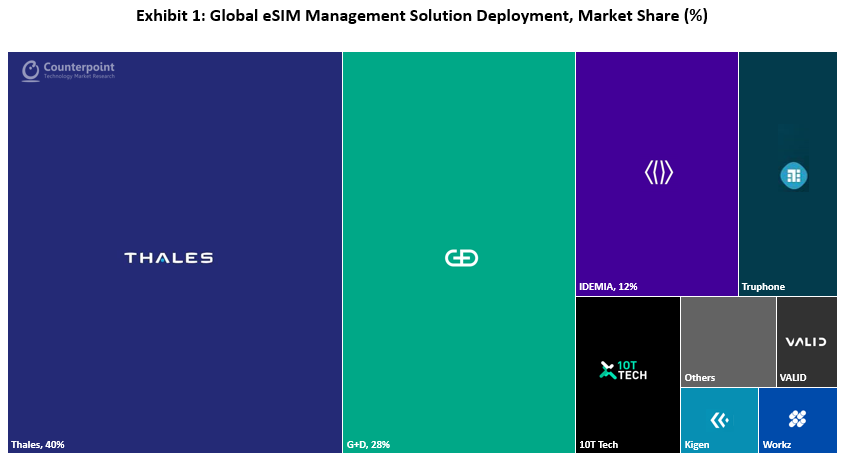

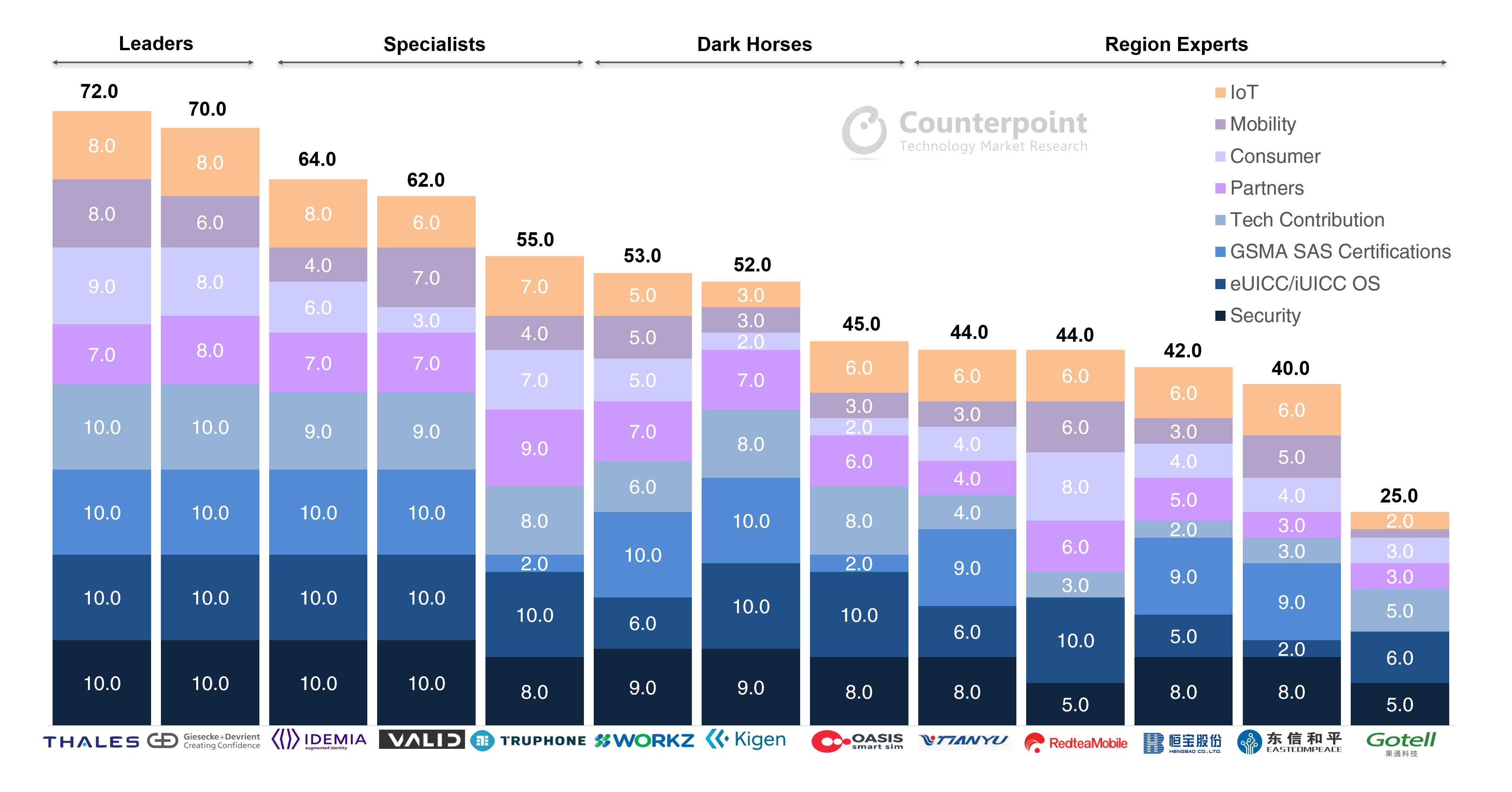

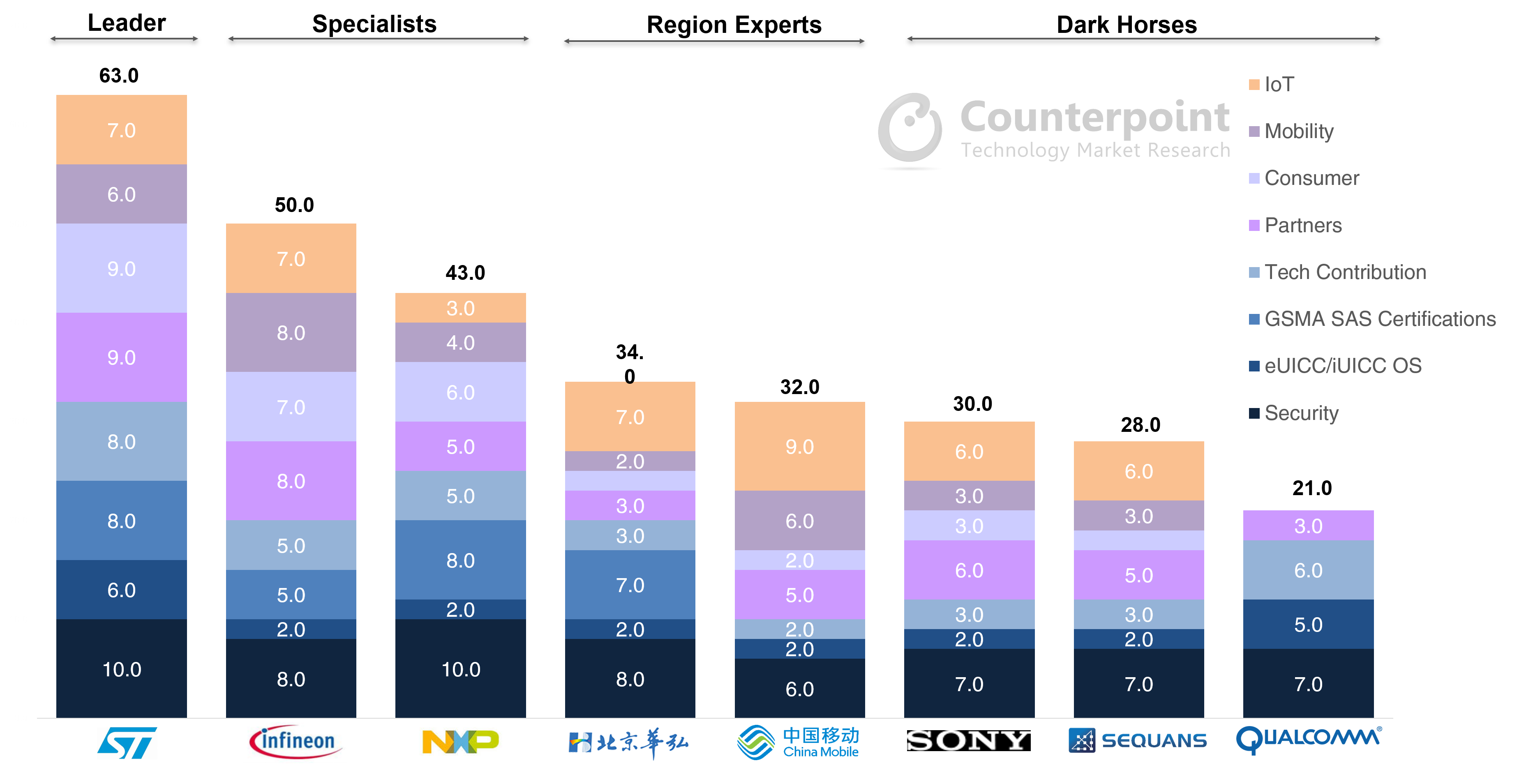

Source: eSIM Ecosystem – Opportunities, Trends, Evaluation, Analysis and Outlook, December 2020

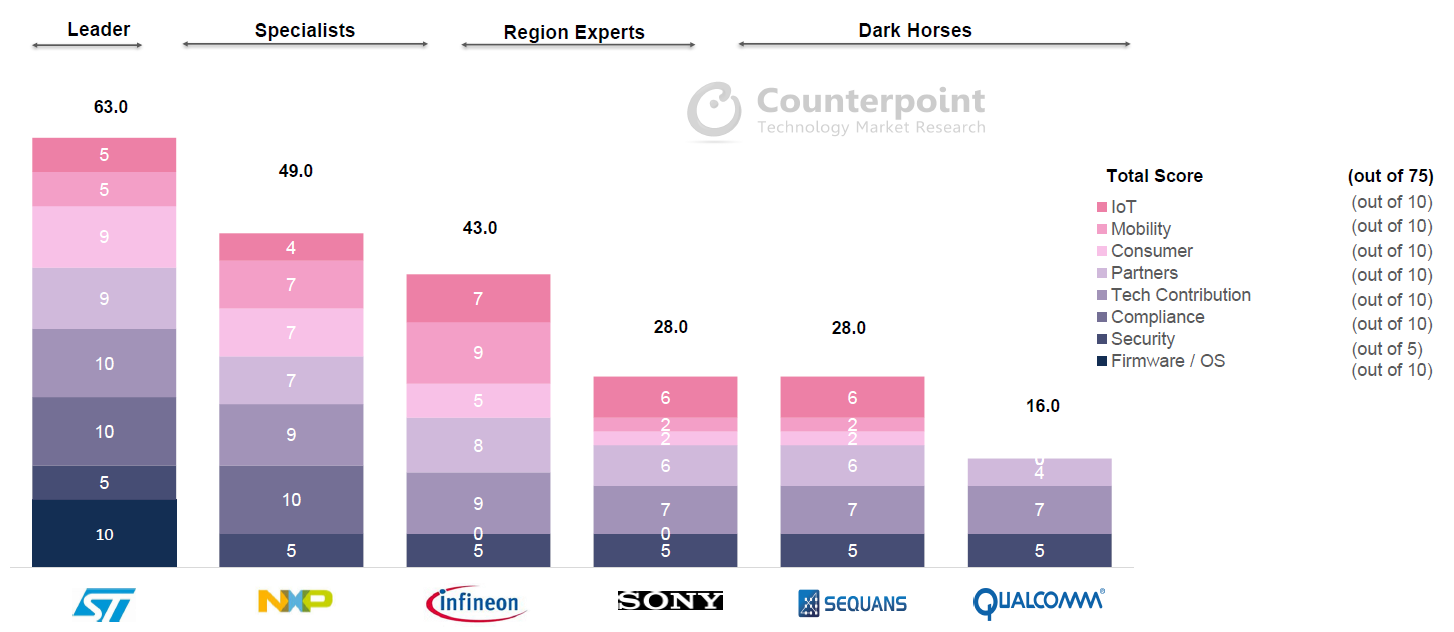

Source: eSIM Ecosystem – Opportunities, Trends, Evaluation, Analysis and Outlook, December 2020 Source: eSIM Ecosystem – Opportunities, Trends, Evaluation, Analysis and Outlook, December 2020

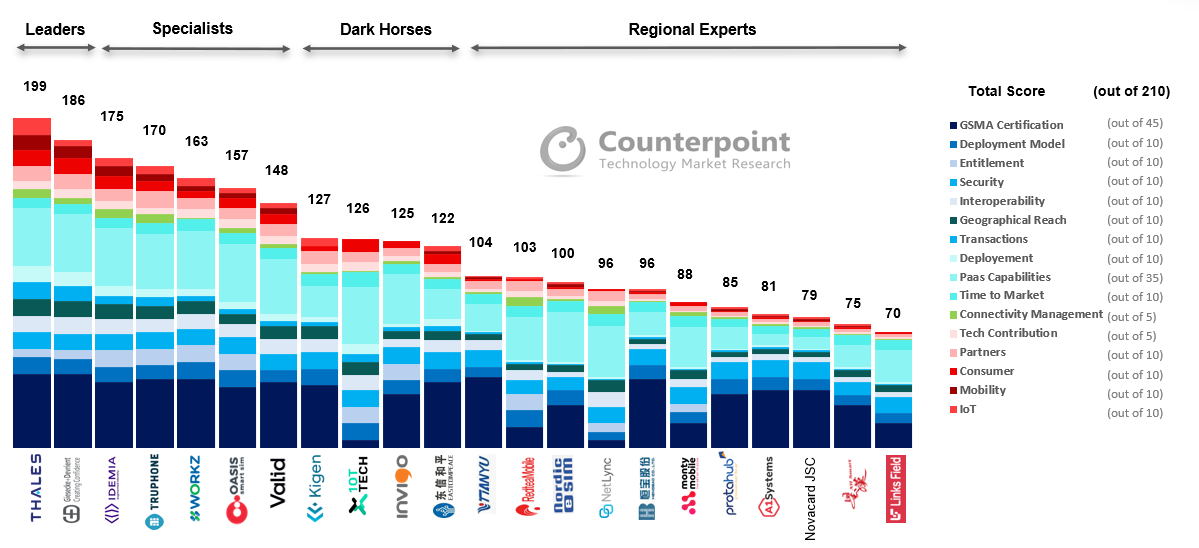

Source: eSIM Ecosystem – Opportunities, Trends, Evaluation, Analysis and Outlook, December 2020