- In Q1 2023, China’s smartwatch shipments declined both YoY and QoQ.

- HLOS* smartwatches’ share increased when compared to that in 2022.

- Despite its shipments falling 15% YoY, Huawei ranked first in Q1 with more than a quarter of the market share.

- Apple’s Watch Series 8 was the best-selling model in Q1 even as the brand’s shipments fell 27% YoY.

Beijing, New Delhi, Seoul, Hong Kong, London, Buenos Aires, San Diego – May 30, 2023

China’s smartwatch market did not fully recover in the first full quarter after the country’s reopening. According to Counterpoint Research’s latest Global Smartwatch Model Tracker, China’s smartwatch shipments declined 28% YoY and 16% QoQ in Q1 2023 to reach their lowest level in 12 quarters.

Senior Analyst Shenghao Bai said, “Although the Spring Festival can boost consumption generally, the demand for smartwatches was still weak in Q1 2023. This was similar to what we saw in China’s smartphone shipments. The market needs more time to recover.”

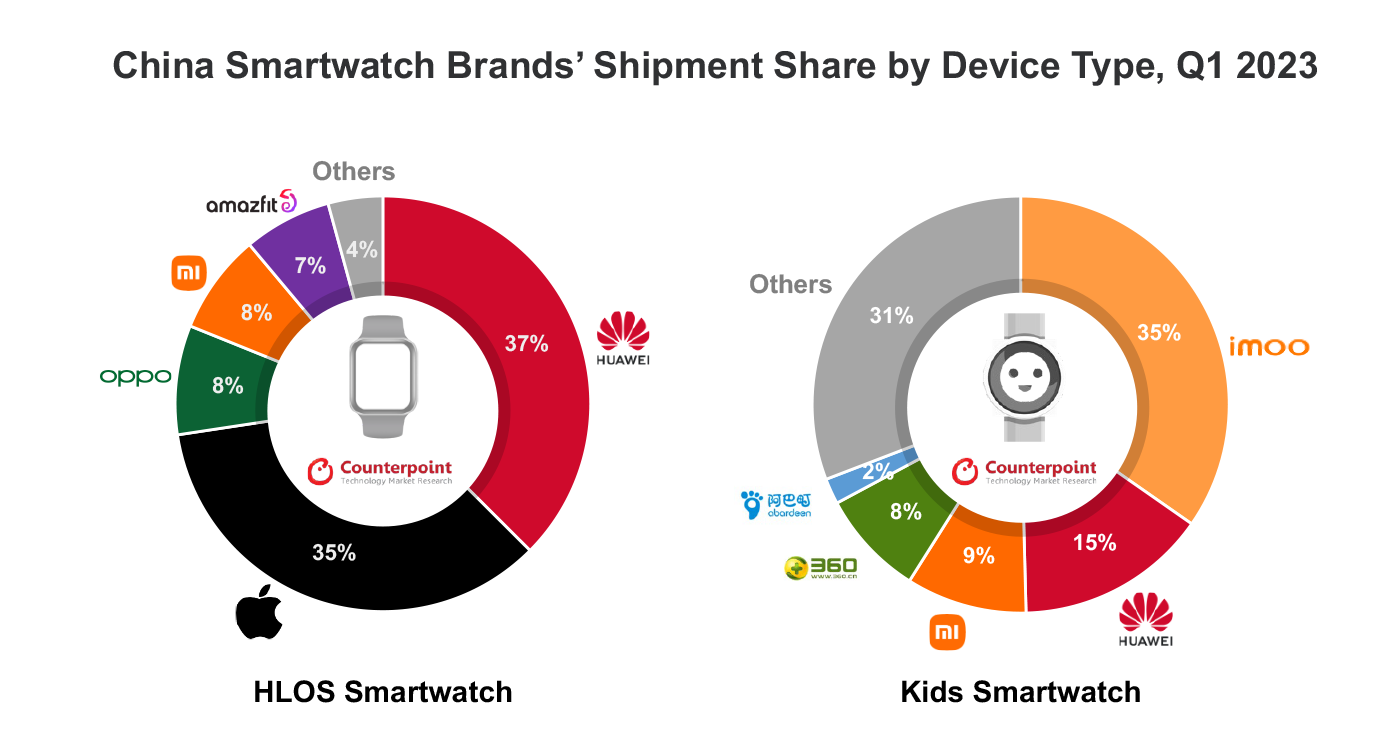

The top three brands were Huawei, Apple and BBK (imoo). They accounted for nearly 60% of China’s smartwatch market in Q1 2023. Among the types of smartwatches, the HLOS* smartwatch’s shipments saw the smallest YoY drop even as its share increased to 45% from 39% in Q1 2022. Meanwhile, China’s ‘kids smartwatch’ shipments decreased 31% YoY. The country is the world’s biggest kids smartwatch market.

Source: Counterpoint’s Global Smartwatch Model Tracker

Note: Figures may not add up to 100% due to rounding

Commenting on the market trends, Research Associate Alicia Gong said, “Despite the overall demand for smartwatches dropping in Q1, the demand share for HLOS smartwatches rose. These are advanced watches offering users more customization and independence. Though BBK (imoo) still dominated the kids smartwatch market with a 35% share, its shipments of the watch remained flat YoY amid a shrinking kids segment.”

Market summary

Huawei was the biggest winner in China’s smartwatch market with a 27% share, thanks to its strategy of having multiple portfolios. Though the brand’s overall shipments dropped 15% YoY, it ranked first in all price bands from $101 to $400. The Huawei Watch GT 3 was the second best-selling model in Q1 2023.

Apple took the second largest share, mainly driven by its Apple Watch Series 8 and Apple Watch SE 2022. The two models were the first and third best-selling models in Q1 2023. However, Apple’s shipments decreased 27% YoY due to shrinking demand. Focusing on HLOS smartwatches helped the brand take an 87% share in the above-$400 segments.

BBK (imoo)’s Q1 shipments were generally flat YoY thanks to the back-to-school season. The brand benefited from its multiple-models strategy. Its Z6A series contributed the most to its shipments.

Xiaomi’s shipments saw a 42% YoY drop but a 31% QoQ increase in Q1 2023. The brand ranked first in the <$50 segment.

OPPO was the only one among the main brands to see its shipments increase both YoY and QoQ. The performance was driven by the OPPO Watch 3 and OPPO Watch 3 Pro. OPPO’s market share increased to 4% in Q1.

Qihoo 360 recorded a 35% YoY drop. It had fewer models on sale compared to Q1 2022.

Amazfit has a variety of models in China but lags behind in having popular models. The brand’s shipments declined 34% YoY in Q1 2023.

*HLOS smartwatch: Electronic watch running a high-level OS, such as Watch OS (Apple) or Wear OS (Samsung), with the ability to install third-party apps.

*All the prices mentioned in the article are wholesale prices.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Counterpoint Research

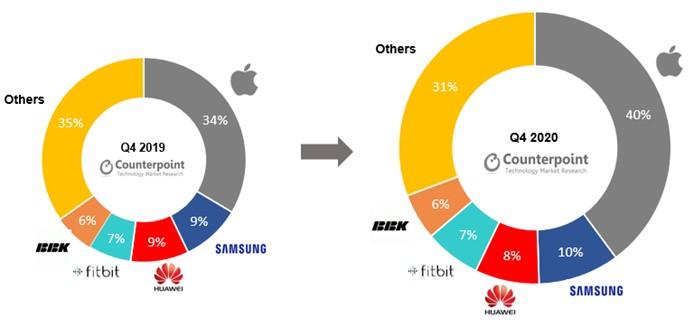

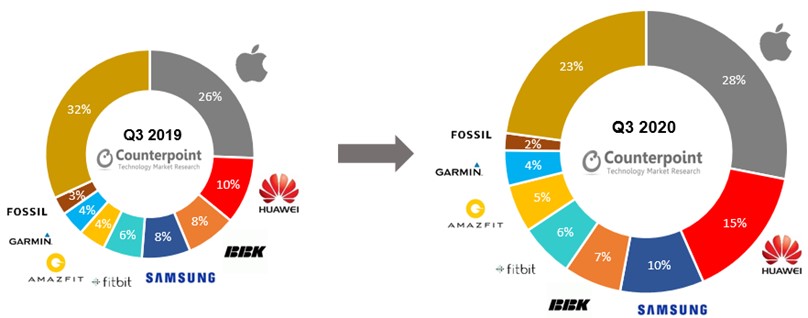

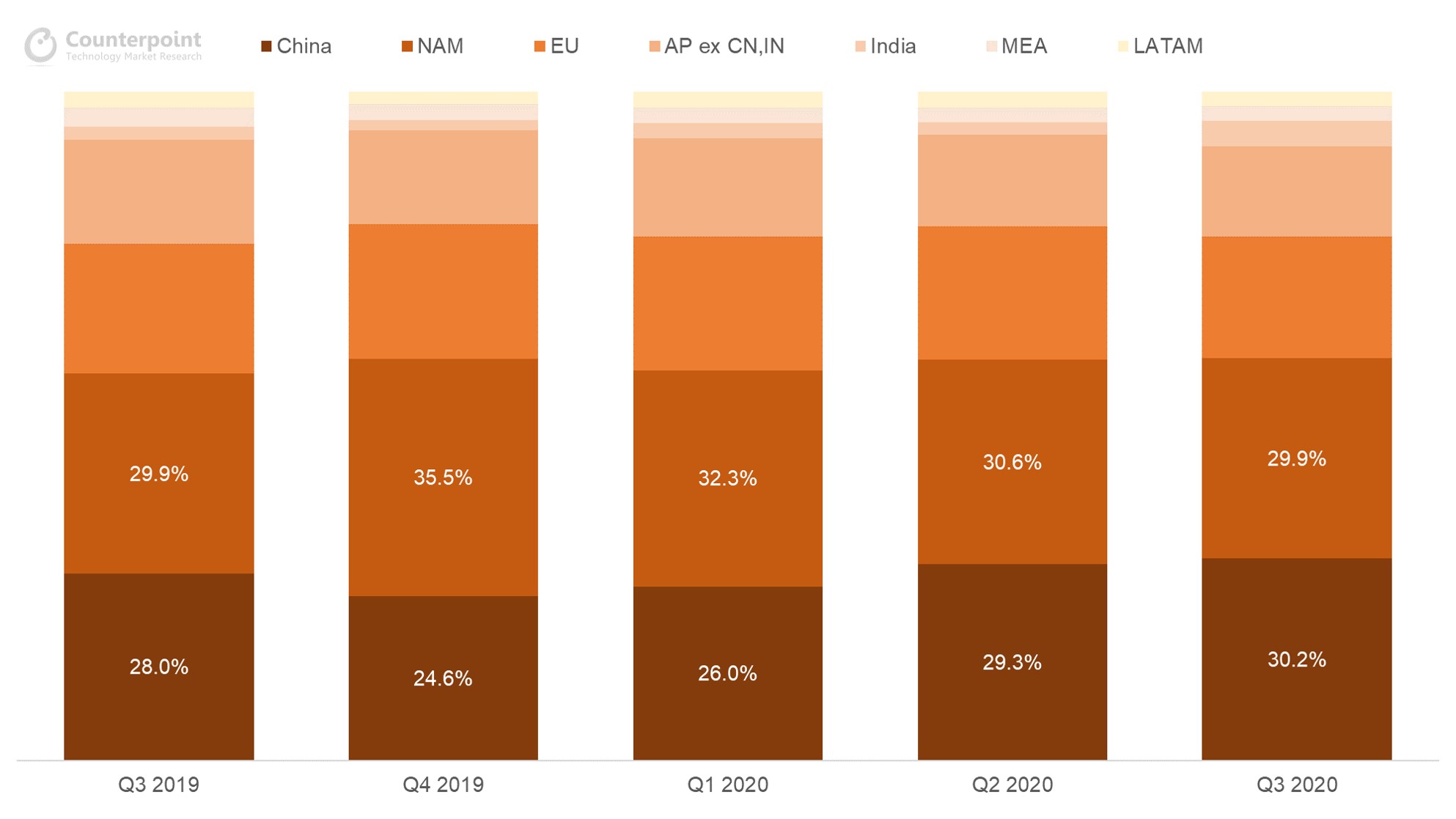

India, which occupies only about 4% share, has emerged as a bigger market than the MEA (Middle East and Africa) and Latam (Latin America), with shipments growing 95% YoY. Lim added, “In India, local brand Noise is growing rapidly while realme, a Chinese brand familiar to Indian consumers, launched the Watch in the third quarter. The country’s smartwatch market seems to have reached its first period of growth, thanks to the active expansion of brands. The market is expected to grow in earnest from the end of next year after recovering from COVID-19.”

India, which occupies only about 4% share, has emerged as a bigger market than the MEA (Middle East and Africa) and Latam (Latin America), with shipments growing 95% YoY. Lim added, “In India, local brand Noise is growing rapidly while realme, a Chinese brand familiar to Indian consumers, launched the Watch in the third quarter. The country’s smartwatch market seems to have reached its first period of growth, thanks to the active expansion of brands. The market is expected to grow in earnest from the end of next year after recovering from COVID-19.”