Global Smartwatch Shipments Market Share Q2 2023

August 31, 2023

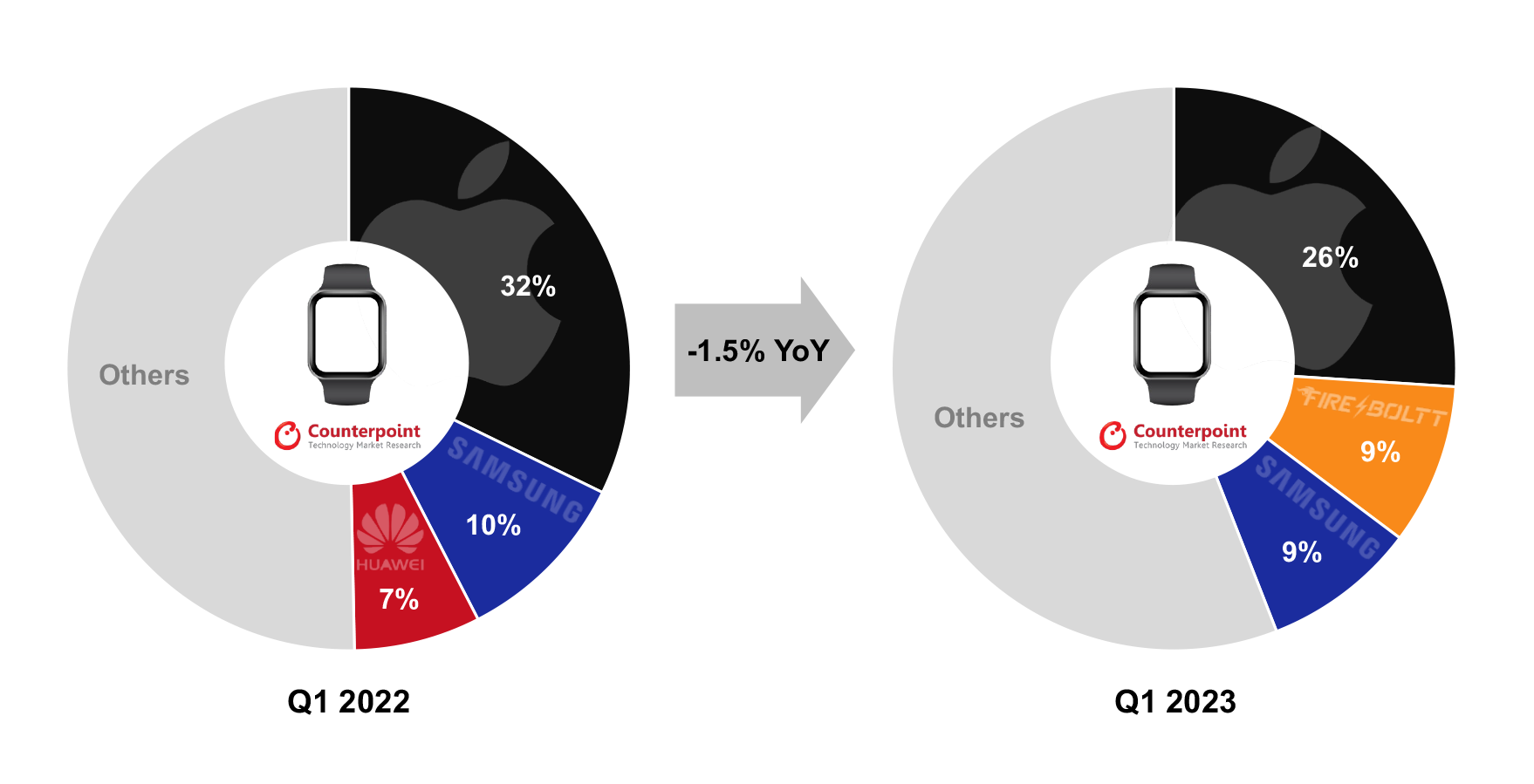

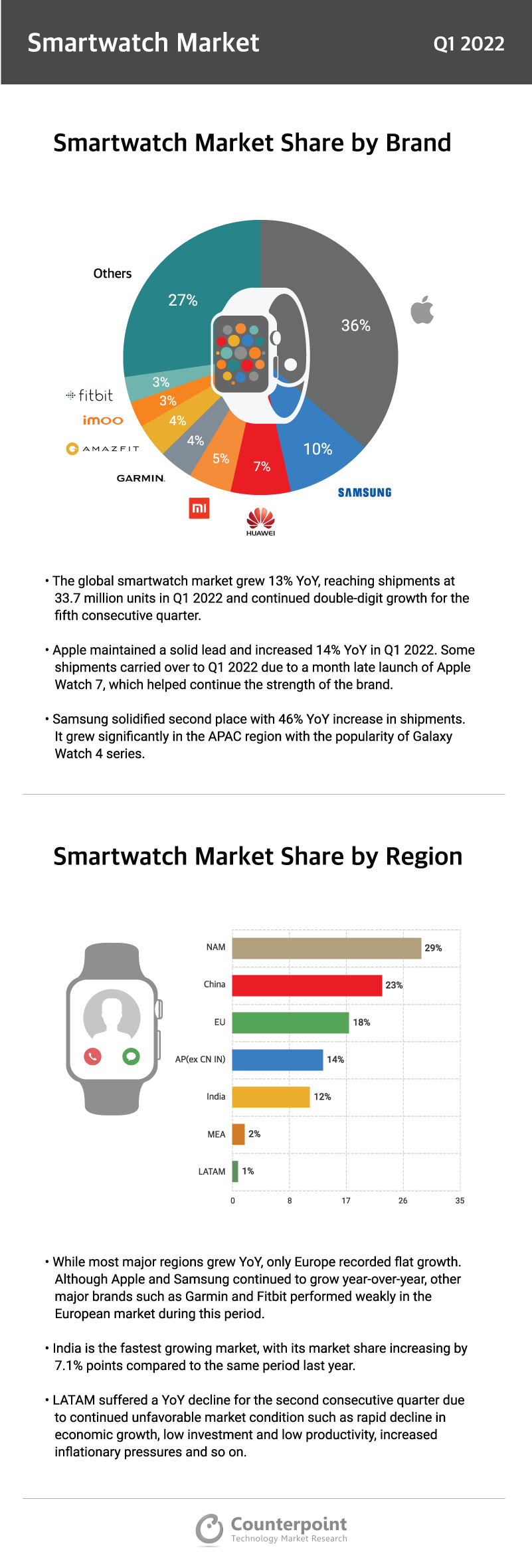

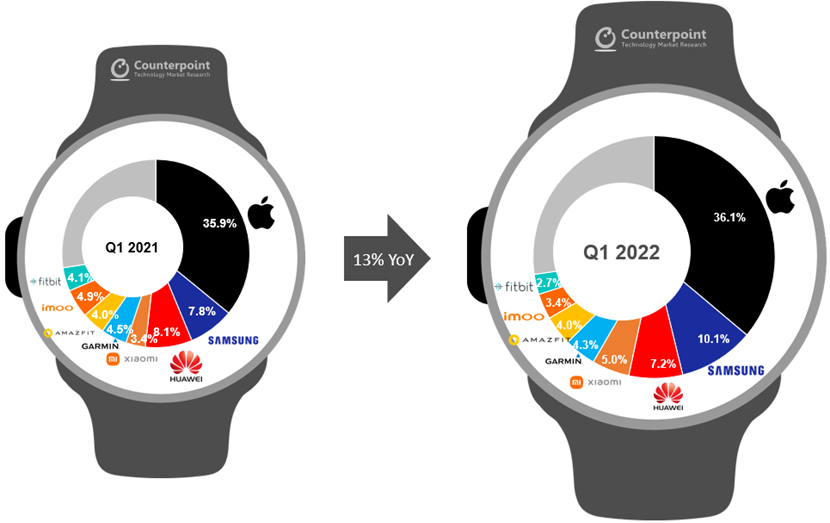

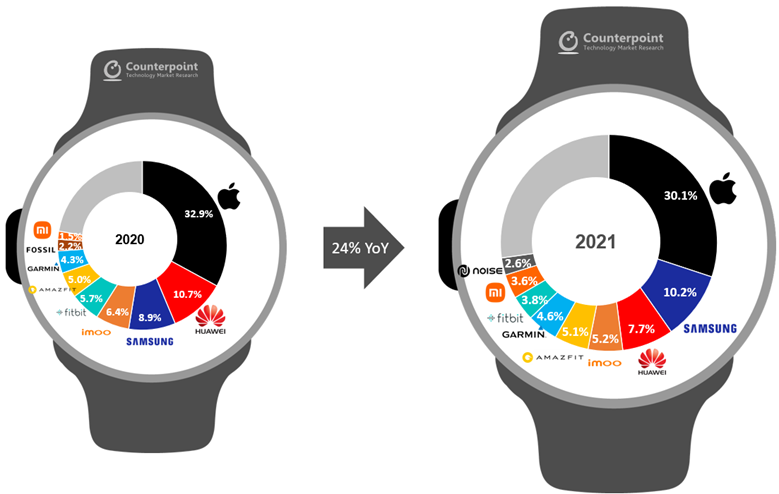

This page represents the global smartwatch market share based on shipments by quarter (from 2022-2023) by top brands.

The chart includes the top three brands and “others” for each quarter.

Source: Global Smartwatch Shipments by Model Quarterly Tracker

DOWNLOAD:

(Use the buttons below to download the complete chart)

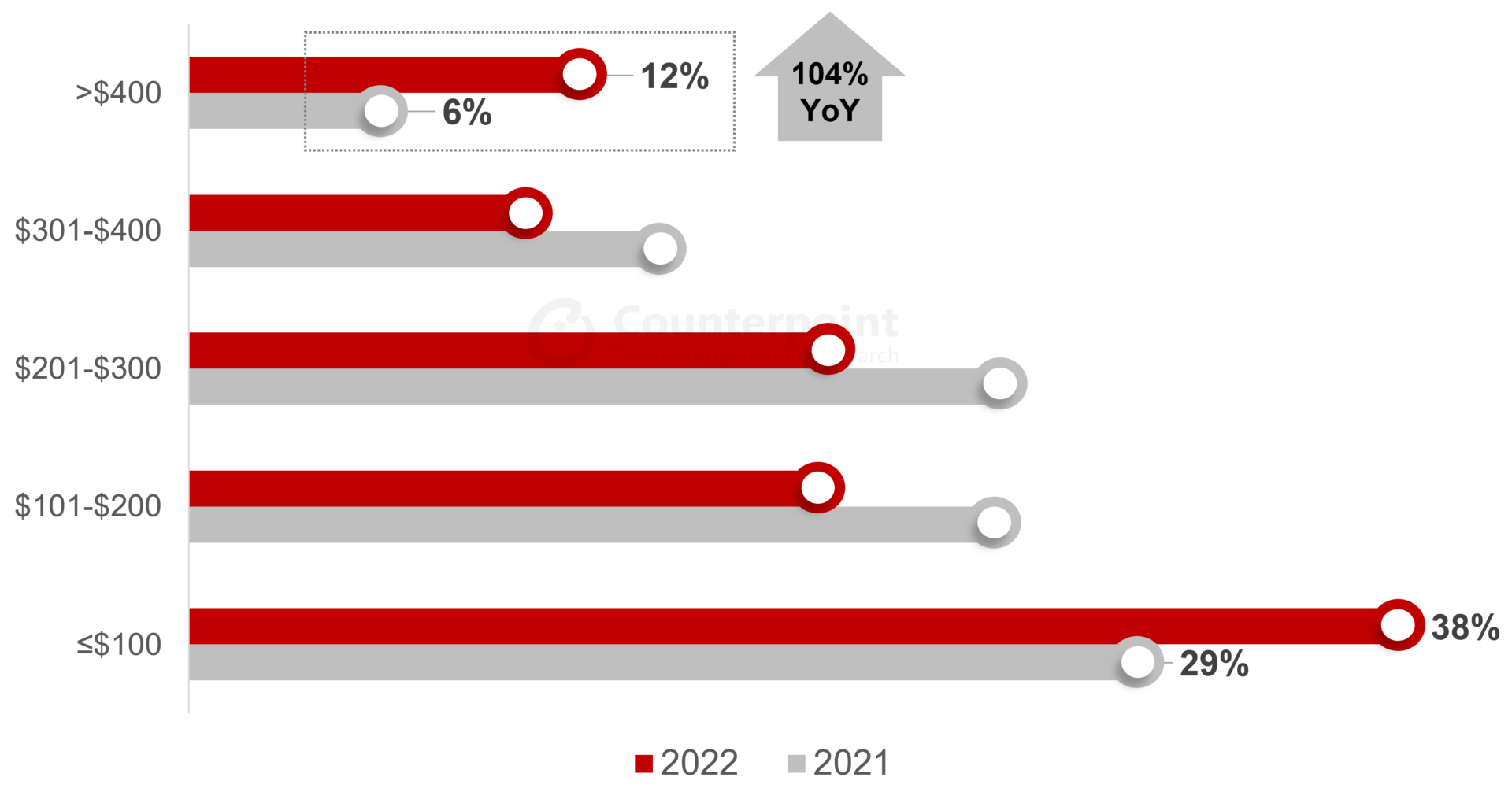

| Global Smartwatch Shipments Market Share (Q1 2022 – Q2 2023) | ||||||

| Brands | Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

Q1 2023 |

Q2 2023 |

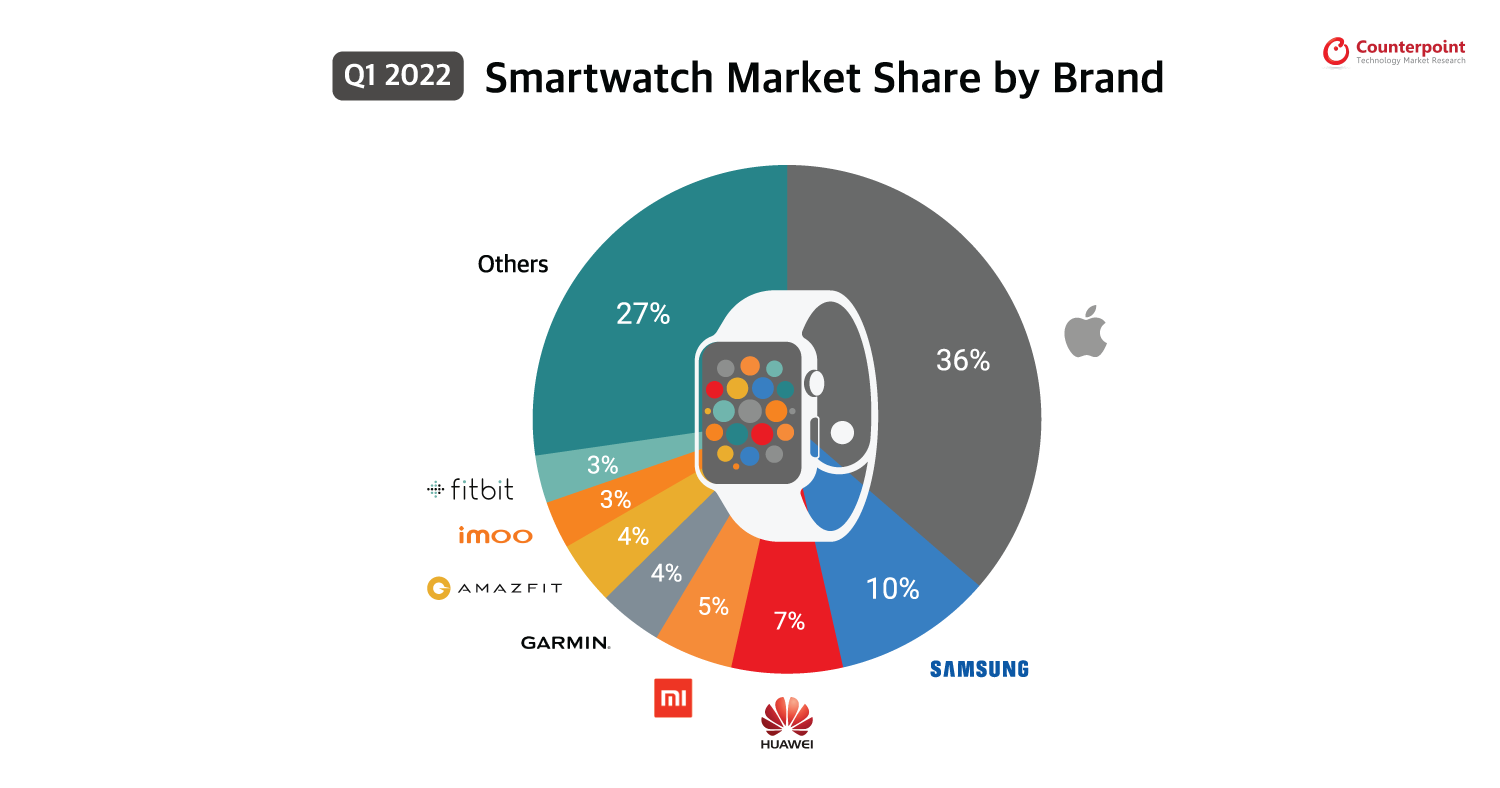

| Apple | 32% | 27% | 22% | 37% | 26% | 22% |

| Samsung | 10% | 9% | 12% | 9% | 9% | – |

| Huawei | 7% | 7% | 7% | 10% | ||

| Fire Boltt | – | – | – | – | 9% | – |

| Noise | – | – | 9% | – | – | 10% |

| Others | 50% | 57% | 56% | 47% | 56% | 58% |

Highlights:

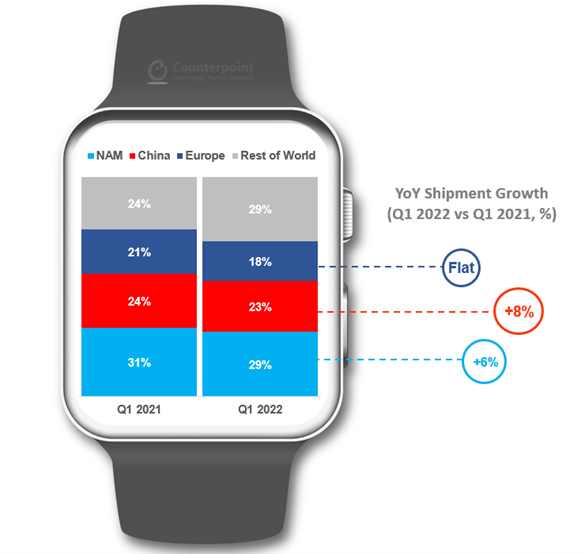

- The global smartwatch market’s shipments bounced back to increase by 11.1% YoY in Q2 2023 to reach 35 million. The previous two quarters had experienced a YoY decline.

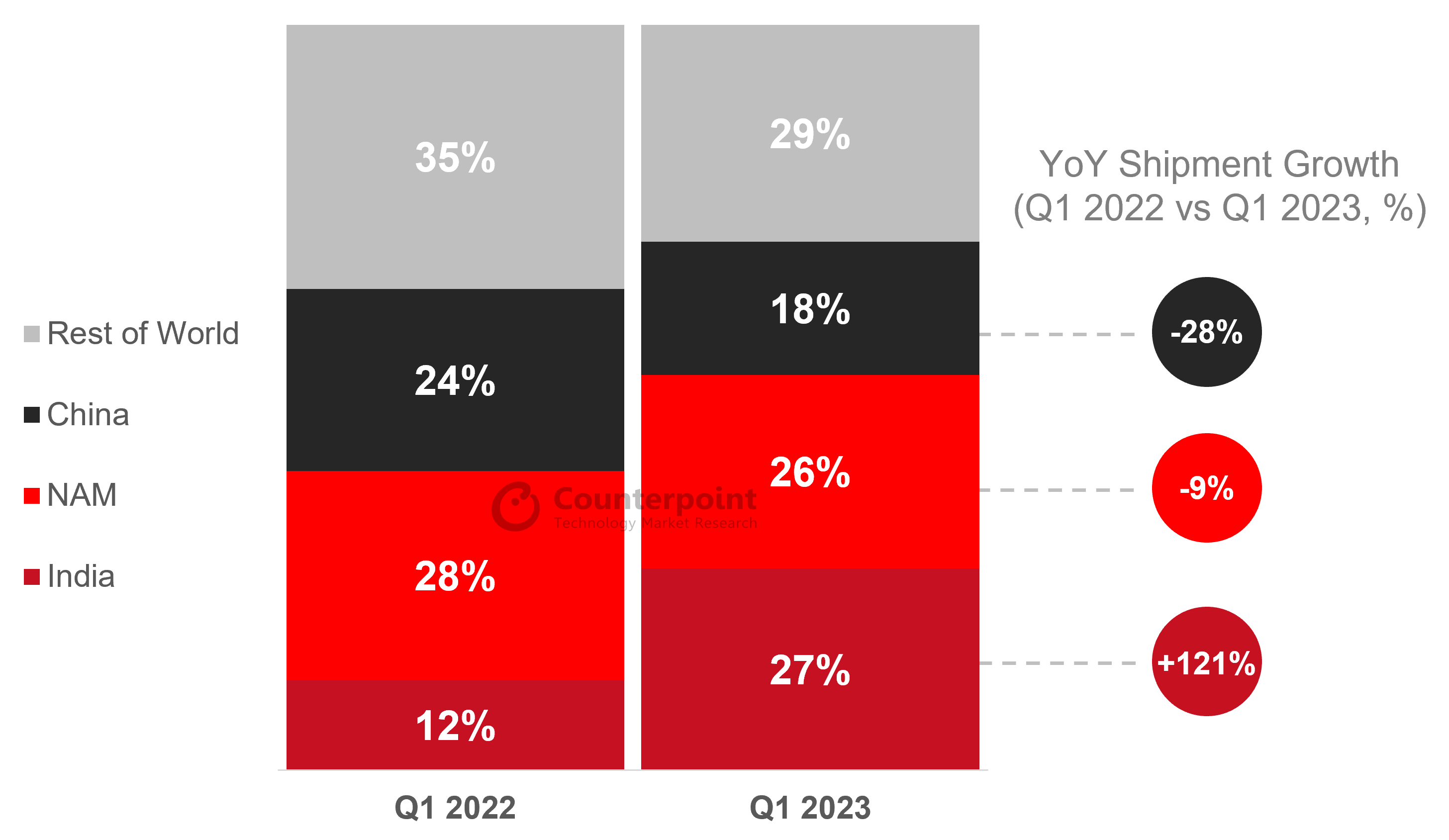

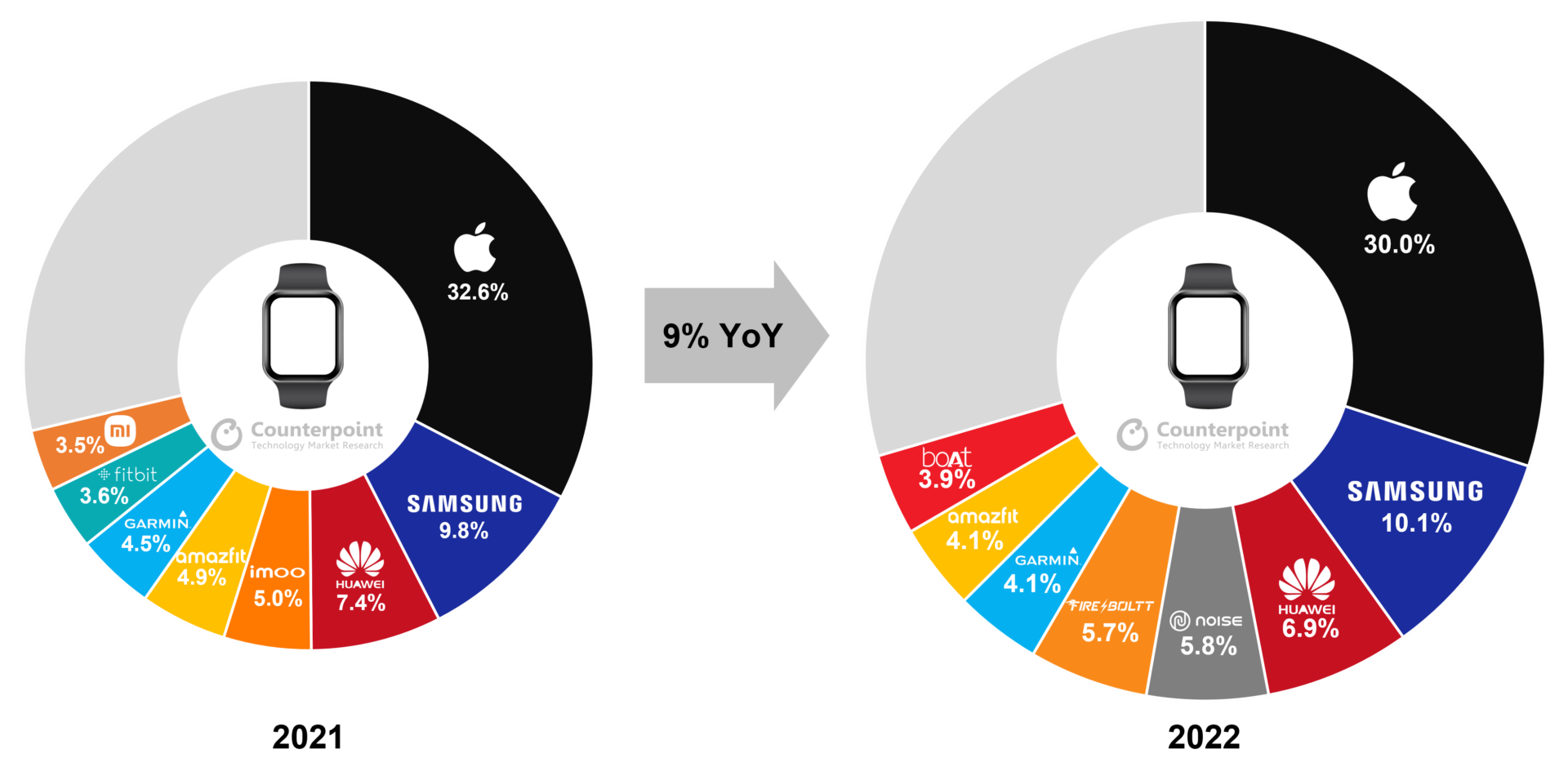

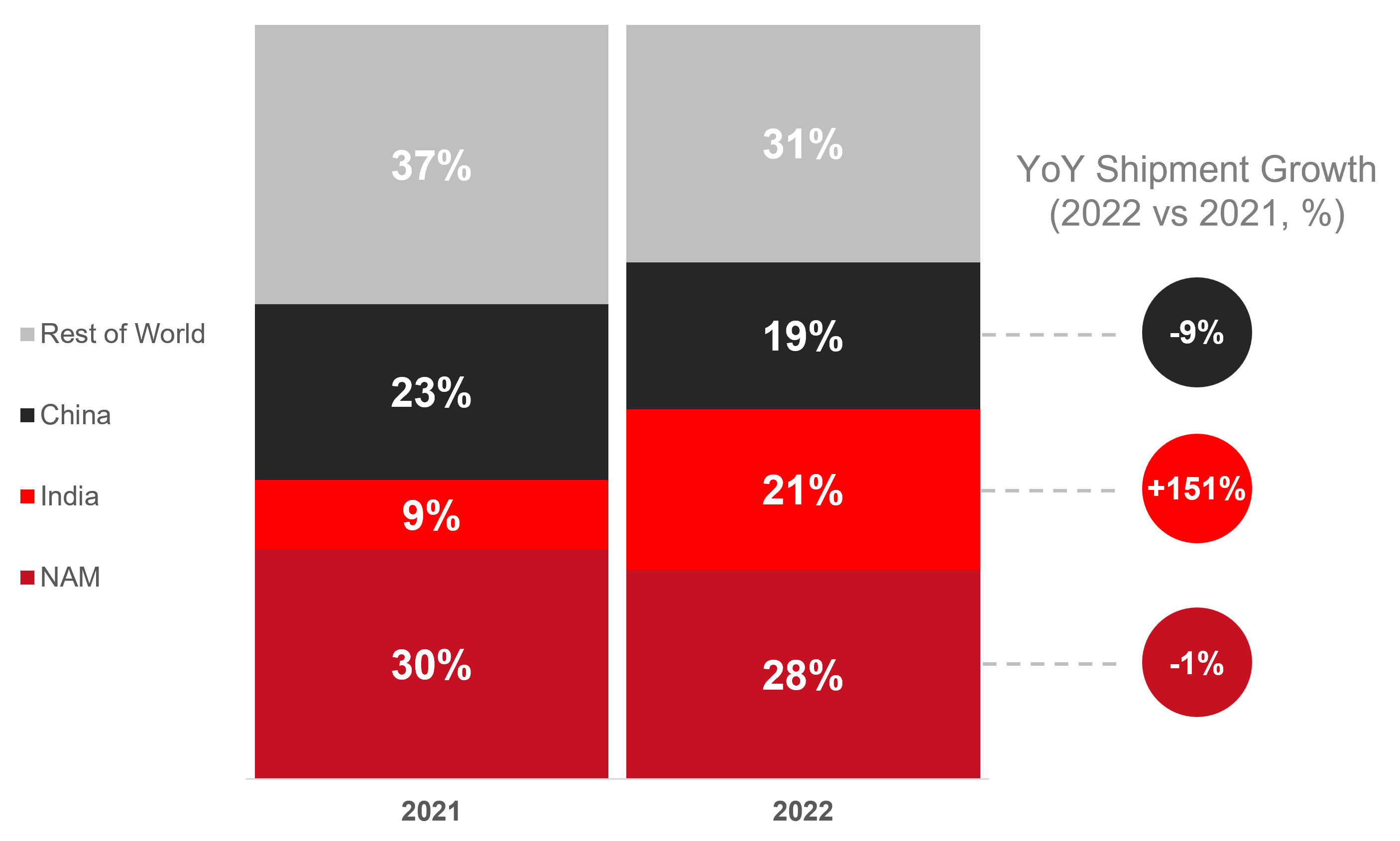

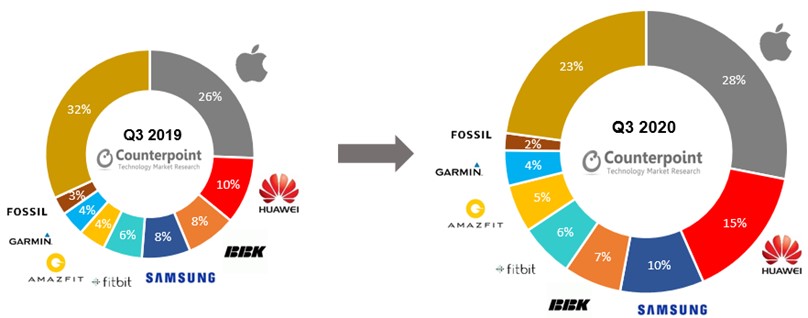

- While Apple and Samsung saw YoY declines of 10% and 19% respectively, Huawei and India’s top two brands – Noise and Fire-Boltt – recorded significant growth.

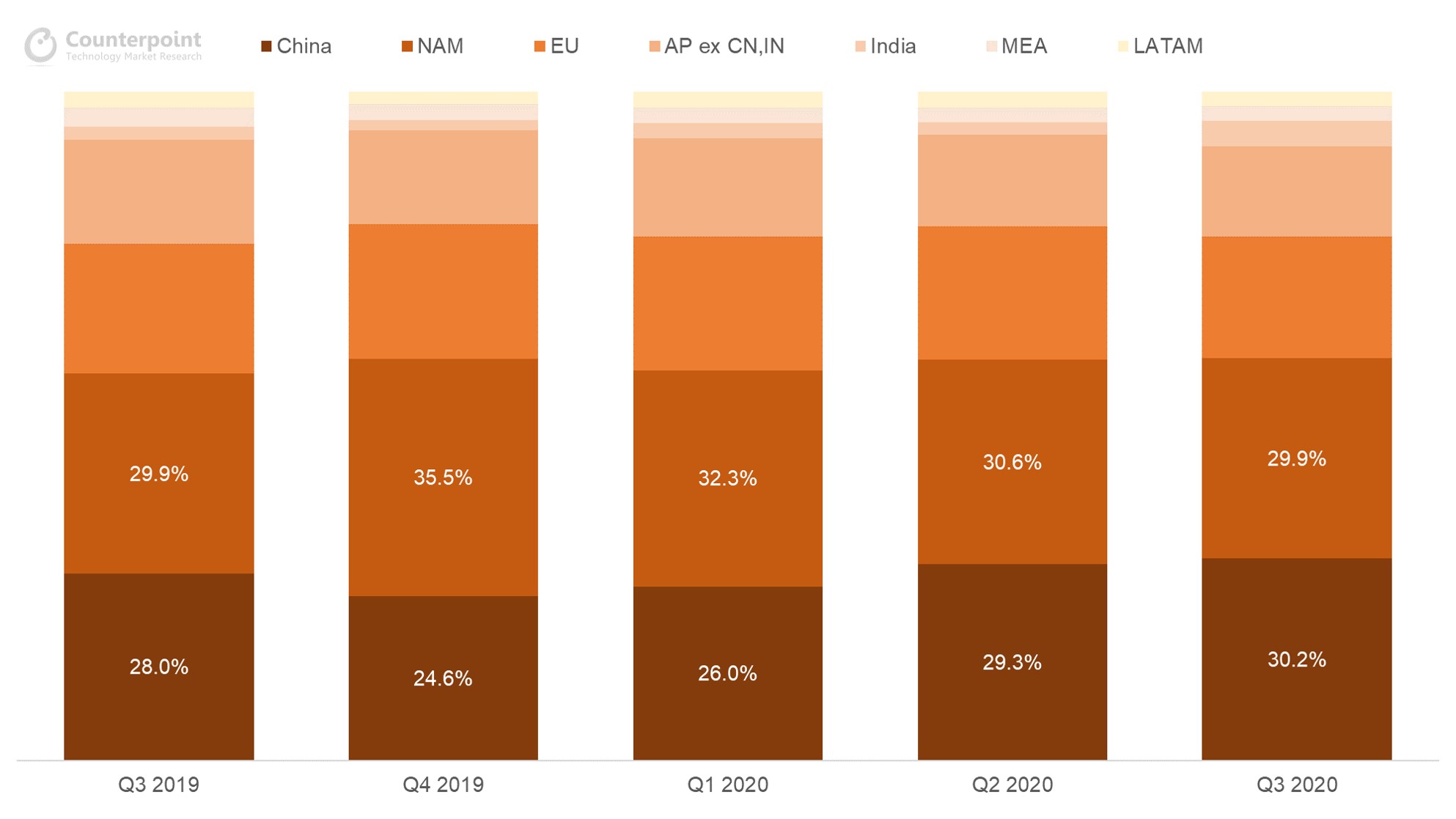

- In terms of regional markets, India led the overall global gains as it more than offset declines in North America, Europe and the rest of Asia.

We also have a detailed smartwatch shipments model tracker available for subscribing clients:

Global Smartwatch Shipments by Model Quarterly Tracker, Q2 2023

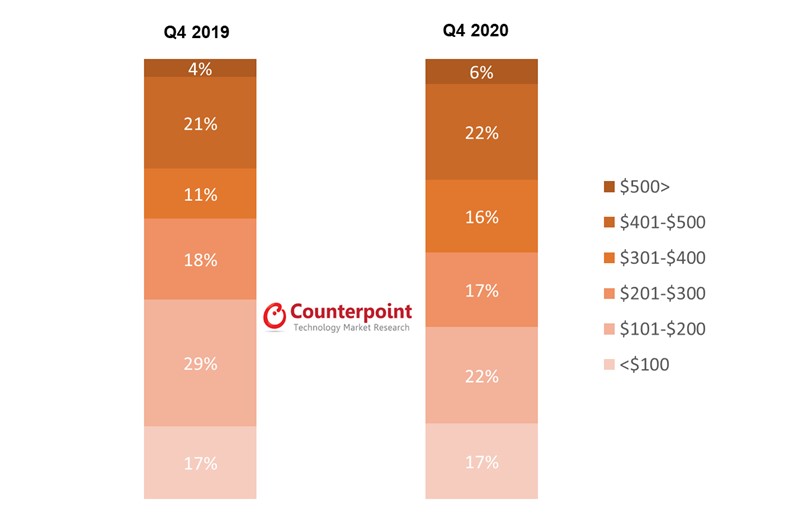

This report analyses the shipments of smartwatches splitting them in ASPs, price bands and revenues. It also includes model and specs level analysis with a region split.

This is a robust quarterly report with fact-based deep analysis that covers multiple dimensions and will help players across the smartwatch value chain to holistically analyze the current state of the global smartwatch market and plan ahead of competition.

The global smartwatch market increased by 11.1% YoY reaching 35million of quarterly shipments. This is a turnaround in three quarters after experiencing a YoY decline in the previous two quarters.

While Apple and Samsung saw YoY declines of 10% and 19% respectively, Huawei and India’s top two brands – Noise and Fire Boltt – recorded significant growth. By region, India led the overall global gains as it more than offset declines in North America, Europe and the rest of Asia.

*Data on this page is updated every quarter

This data represents the global smartwatch market share by quarter (from 2020-2023) by top brands. For detailed insights on the data/tracker, please reach out to us at contact(at)counterpointresearch.com. If you are a member of the press, please contact us at press(at)counterpointresearch.com for any media enquiries.

Disclaimer: The data, charts and other visuals on this page are the exclusive property of Counterpoint Research. While we encourage free use and sharing of all the data on this page, we do request that you always attribute Counterpoint Research

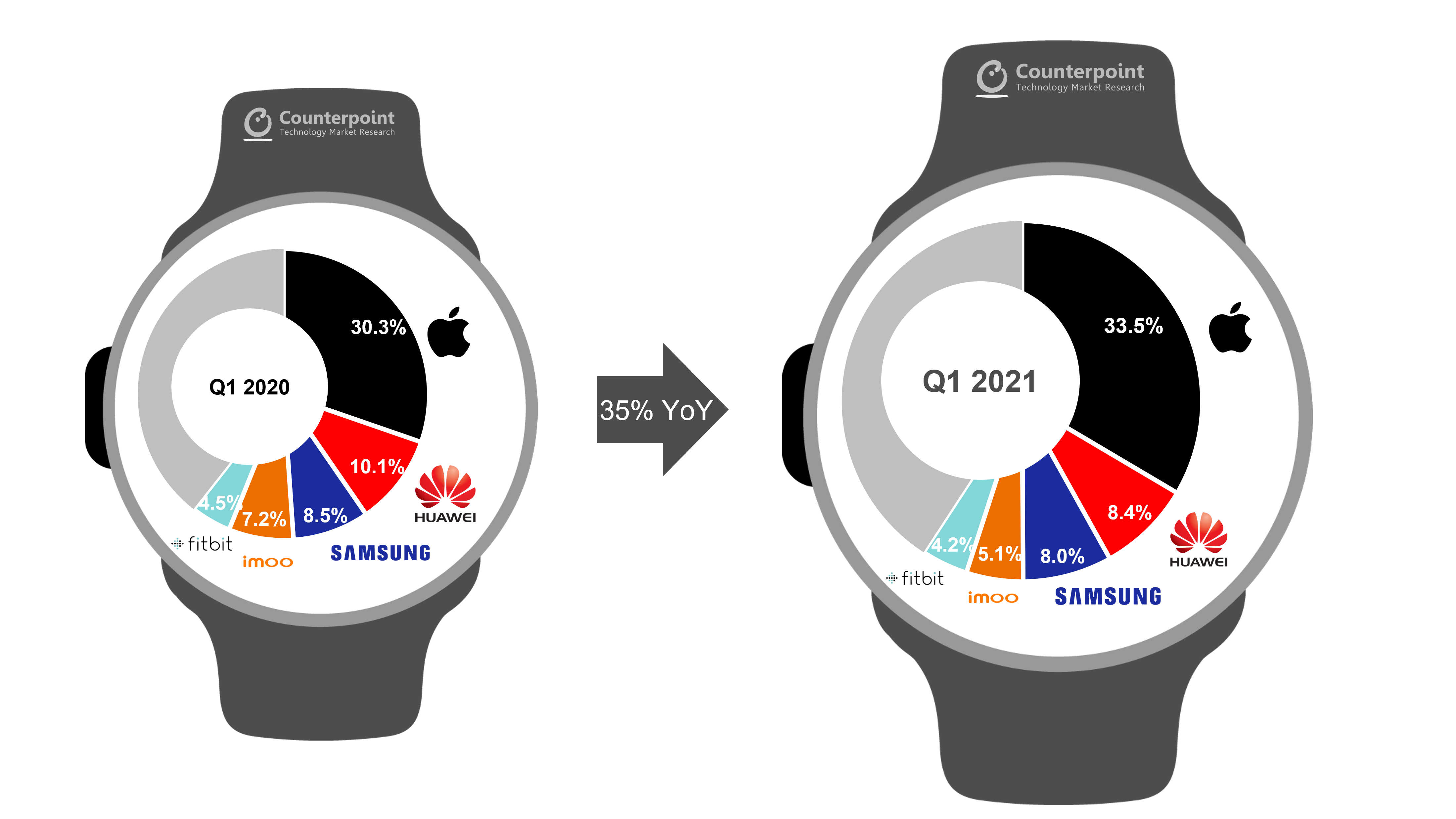

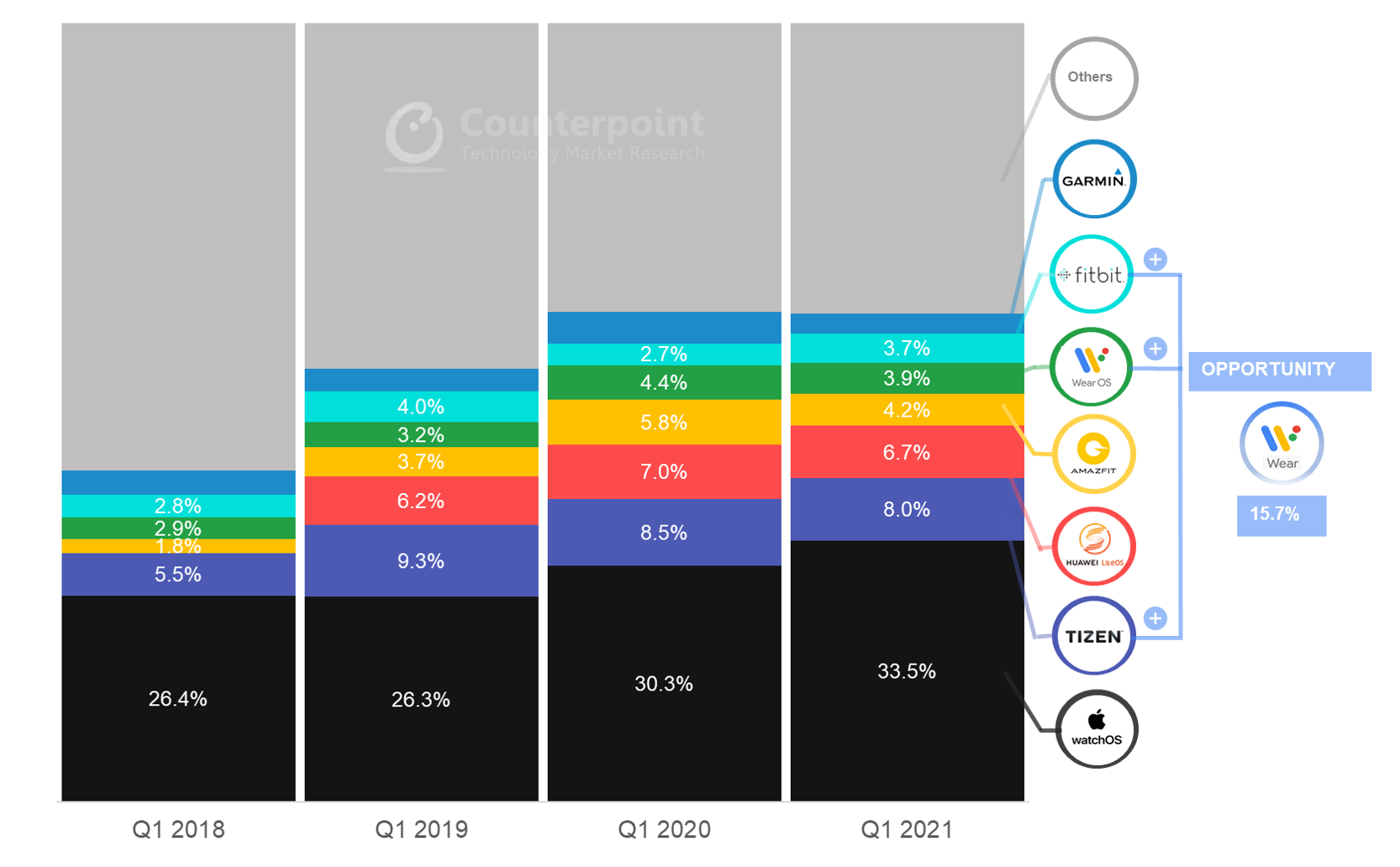

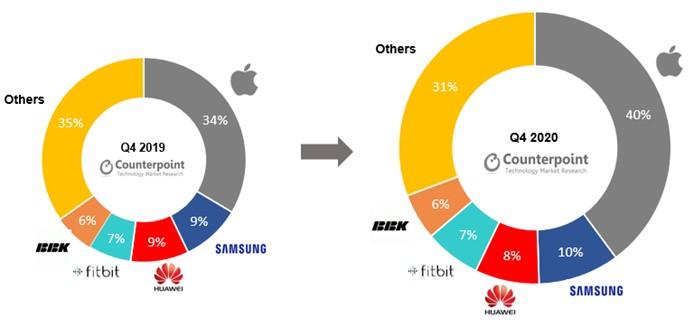

Source: Counterpoint Global Smartwatch Model Shipment & Revenue Tracker, Q1 2023

Source: Counterpoint Global Smartwatch Model Shipment & Revenue Tracker, Q1 2023

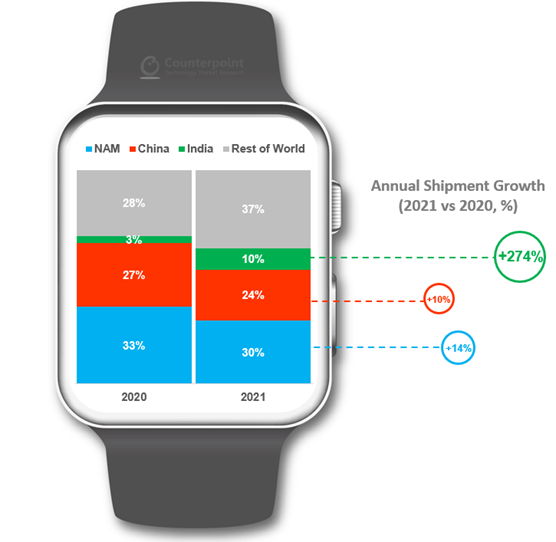

India, which occupies only about 4% share, has emerged as a bigger market than the MEA (Middle East and Africa) and Latam (Latin America), with shipments growing 95% YoY. Lim added, “In India, local brand Noise is growing rapidly while realme, a Chinese brand familiar to Indian consumers, launched the Watch in the third quarter. The country’s smartwatch market seems to have reached its first period of growth, thanks to the active expansion of brands. The market is expected to grow in earnest from the end of next year after recovering from COVID-19.”

India, which occupies only about 4% share, has emerged as a bigger market than the MEA (Middle East and Africa) and Latam (Latin America), with shipments growing 95% YoY. Lim added, “In India, local brand Noise is growing rapidly while realme, a Chinese brand familiar to Indian consumers, launched the Watch in the third quarter. The country’s smartwatch market seems to have reached its first period of growth, thanks to the active expansion of brands. The market is expected to grow in earnest from the end of next year after recovering from COVID-19.”