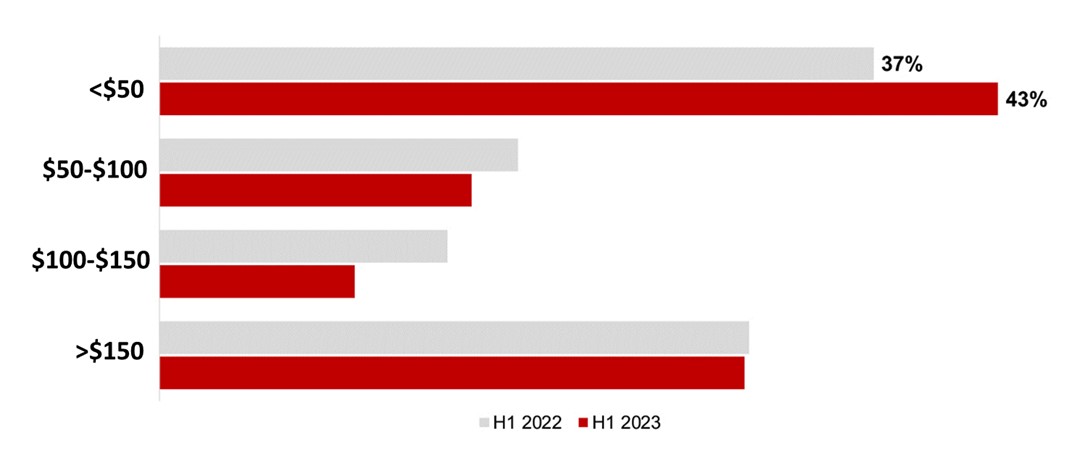

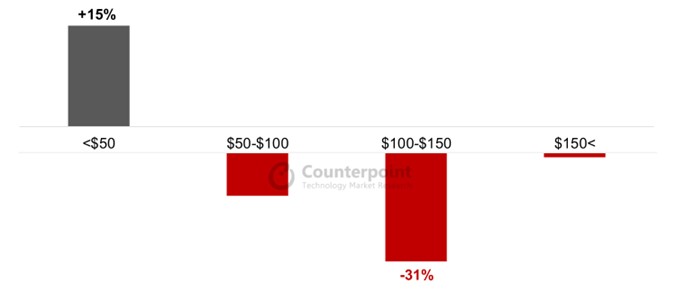

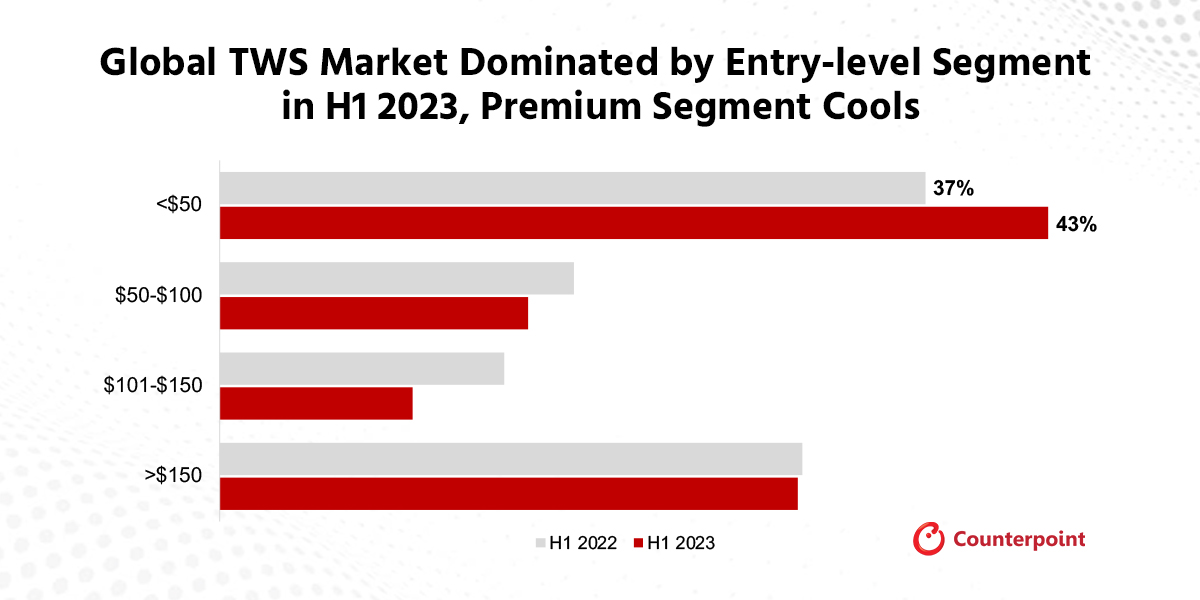

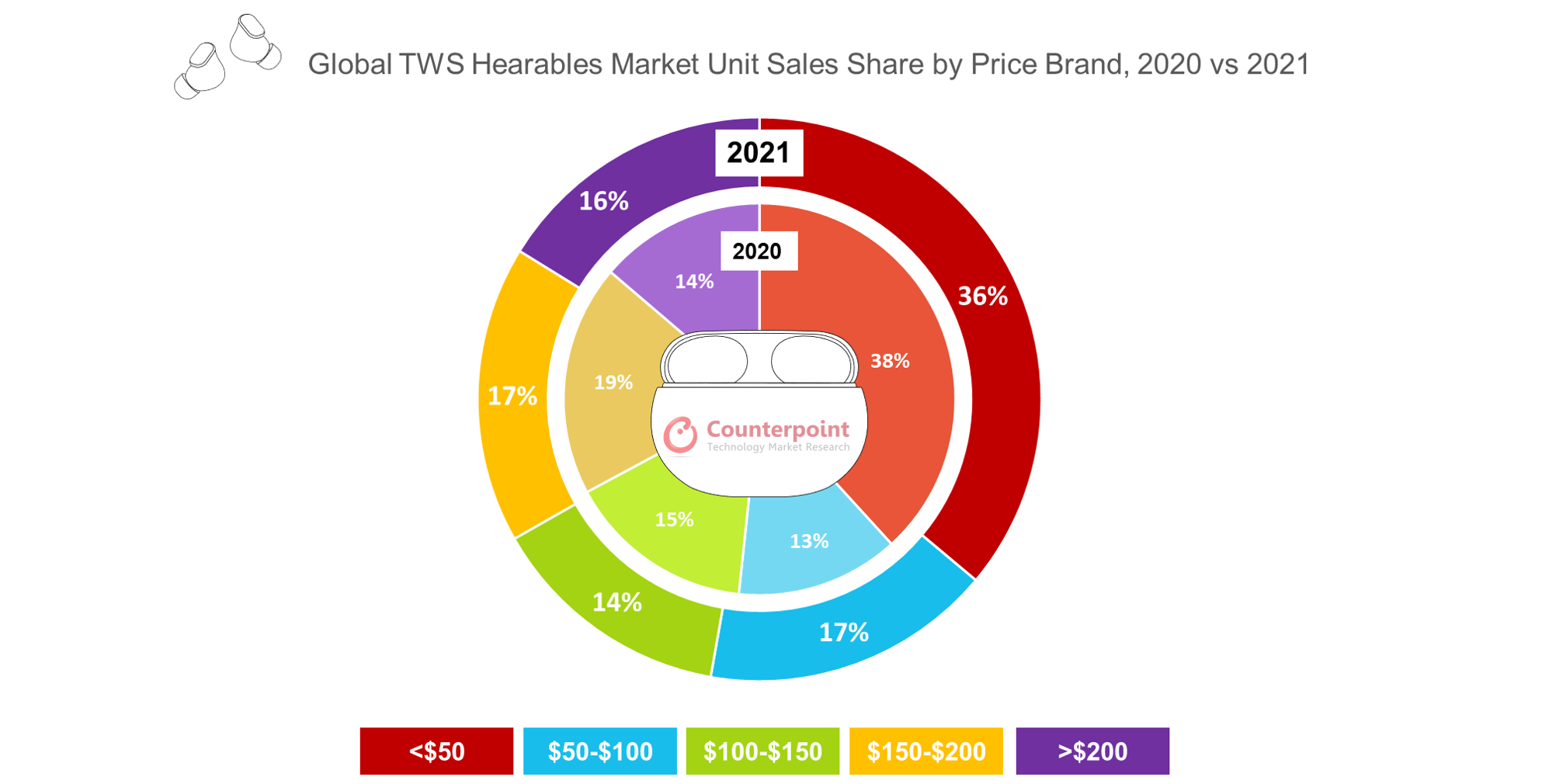

- The entry-level (<$50) segment continued to grow as TWS adoption rose across emerging markets.

- Premium brands such as Apple, Samsung and Sony marked a slowdown due to a lack of new models.

- For full year 2023, we forecast TWS sales to grow 2% in volume but decline 3% in value due to a mix shift towards low-cost TWS sales across emerging markets.

The global TWS market’s unit sales slipped only 2% YoY in H1 2023, according to the latest data from Counterpoint’s TWS Hearables Market Tracker, despite low demand for IT devices amid macroeconomic headwinds and consumer weakness. Surprisingly, the TWS market seemed somewhat immune to inflationary headwinds, especially the <$50 entry-level segment where sales increased 15% YoY in H1 2023. This mitigated the sales decline in higher-tier price segments as TWS demand polarized towards the entry and premium categories.

Some of these ups and downs within the price segments were driven by regional demand dynamics. In H1 2023, demand contracted in mature markets like North America and Europe where the TWS penetration has reached a mature level. In contrast, underpenetrated emerging markets like India, the Middle East and Africa, and Latin America registered robust growth during the period. China, one of the world’s largest TWS markets, showed signs of recovery as the COVID-19-related lockdowns eased in the latter half of 2022. The uptick in H1 2023 was also driven by the 618 e-commerce festival and promotions in China. The period also witnessed the rise of low-cost TWS brands. Chinese entry-level brand ZhengQibing saw sales unit growth of 141% YoY in H1 2023 as it focused on the sub-$20 models with attractive features and CMF designs.

Global TWS Market Share by Price Band, H1 2023 vs H1 2022 (Retail Price-based)

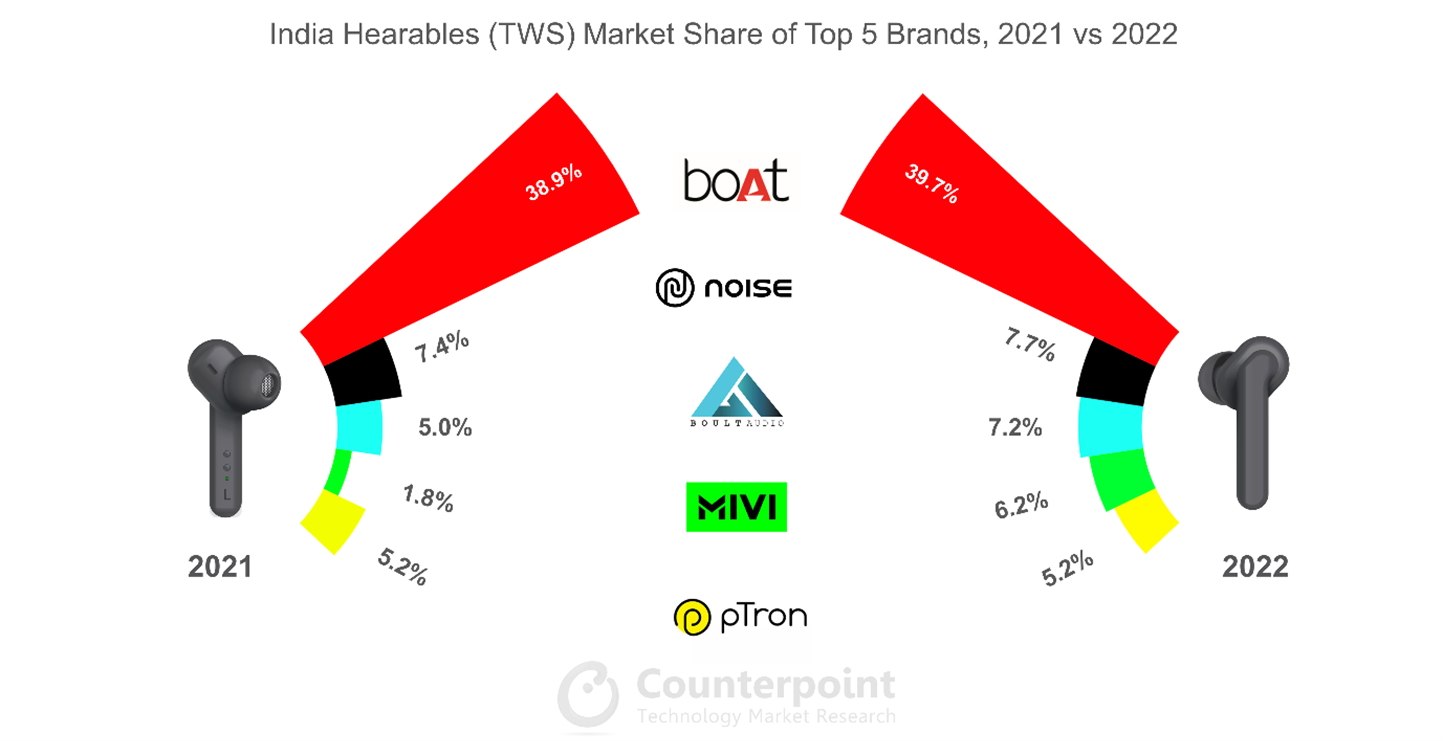

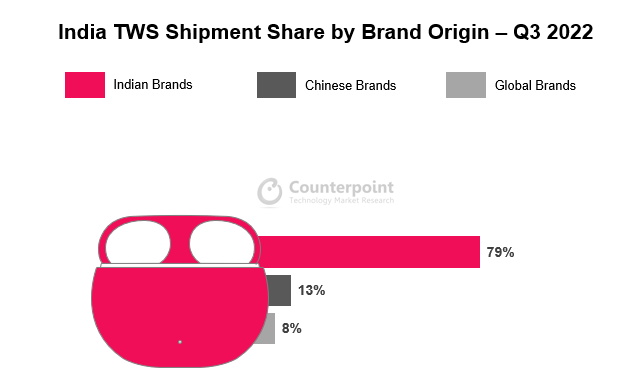

Additionally, the rising demand for TWS in big underpenetrated markets such as India, along with the Chinese market’s recovery helped the <$50 price category grow further. India’s Q2 2023 TWS shipments rose 34% YoY, capturing a 15% global share.

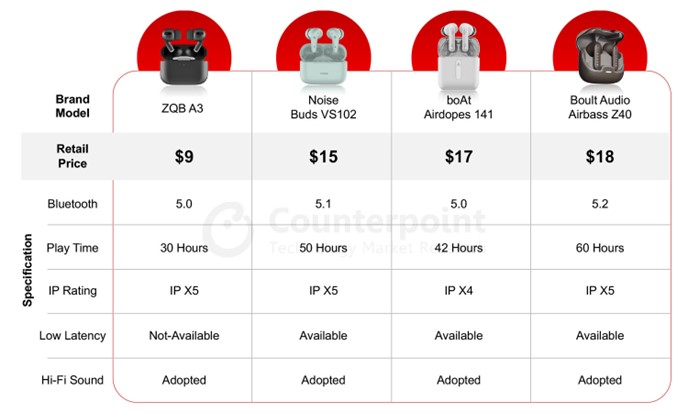

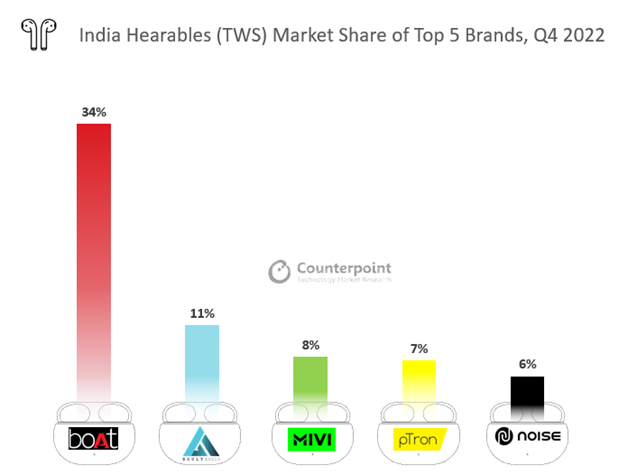

In India, local TWS brands such as boAt, Boult Audio and Noise reported strong double-digit YoY growth in Q2 2023driven by a broader portfolio of entry-level models. boAt successfully leveraged online shopping events like Amazon Prime Day, Flipkart Big Saving Days, and other online promotions to fulfill the demand for new affordable models. Boult Audio, with a keen focus on affordability, strategically launched a series of new models priced below $25, effectively drawing in customers. Noise‘s major model series, the Noise VS102 and VS404, were well received due to their affordable price, satisfactory sound quality, and long battery life. Additionally, they offered an up to 80% discount on their audio products during the Noise Anniversary Sales in 2023. The enhanced performance of models in the <$25 (retail price) segment also played a significant role in boosting sales.

Specifications of Major Entry-level TWS Models

Global TWS Market Growth by Price Band, H1 2023 vs H1 2022 (Retail Price-based)

Meanwhile, major global players such as Apple, Samsung and Sony saw market share declines and slower growth in the absence of new models. These premium-focused brands are bringing about incremental improvements in features compared to the low-cost models of challenger brands that are trying to innovate on design, audio features, latency, battery life, and more. Samsung also saw a noticeable decline in sales share on the high-tier price range with its aggressive pricing and promotions on the Galaxy Buds 2, due to a mix-shift in sales volumes centered around the $50-$100 price segment. Overall, the absence of new model releases and the lack of new features failed to drive replacement demand which resulted in a decrease in sales in the high- and premium-tier segments in H1 2023. The upcoming AirPods 2 with the new H2 chip and support for lossless audio, optimized for the upcoming Apple Vision Pro XR headset, could drive some uptick during the holiday season in Q4 2023.

Looking forward, the global TWS market’s sales volume is set to grow by 2% YoY in 2023, but revenue will decrease by 3% YoY. We expect the TWS market to keep growing till 2026 and the attach rate to new smartphone sales to reach 36% as the average lifespan of a TWS device before replacement reaches 1.5-1.8 years.

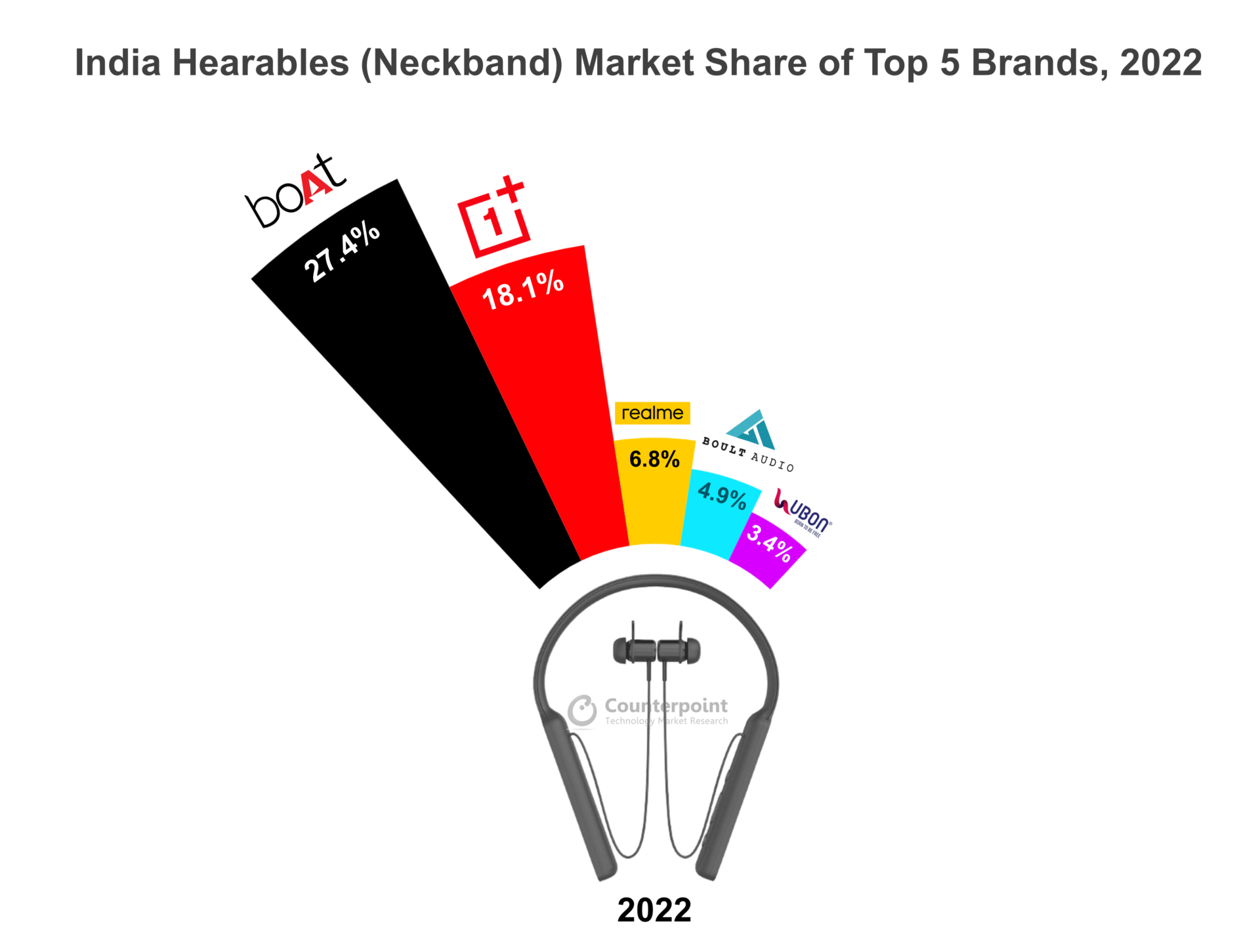

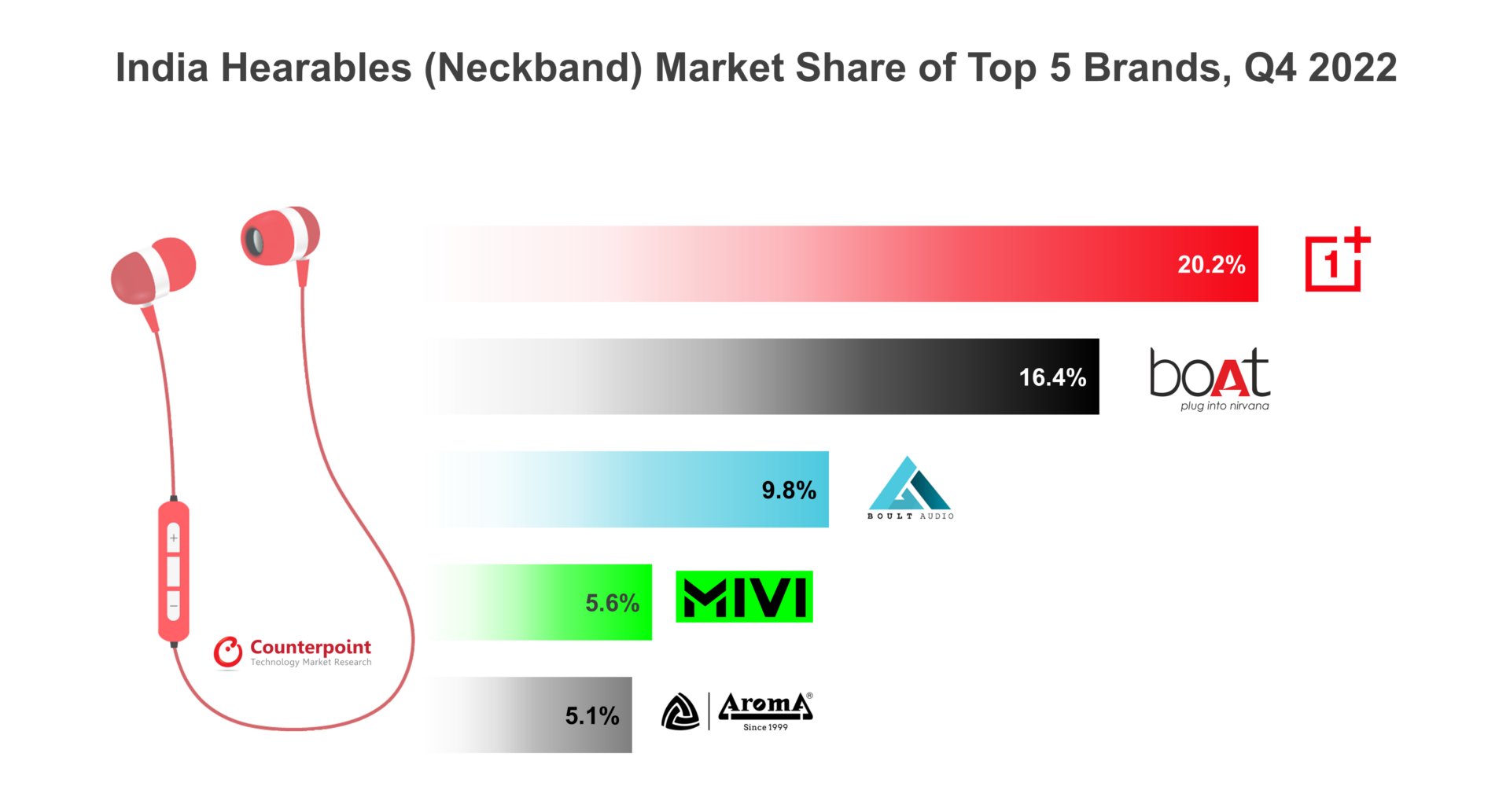

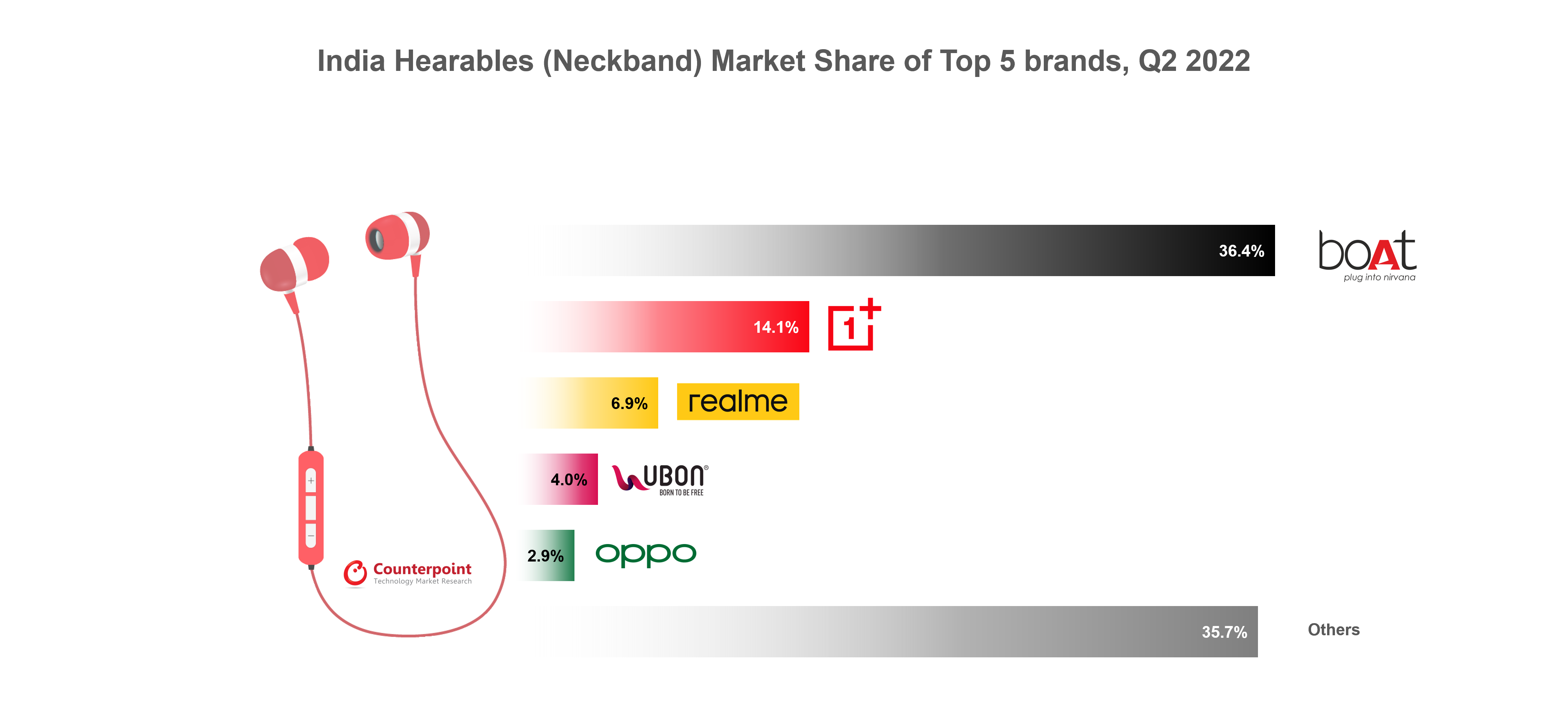

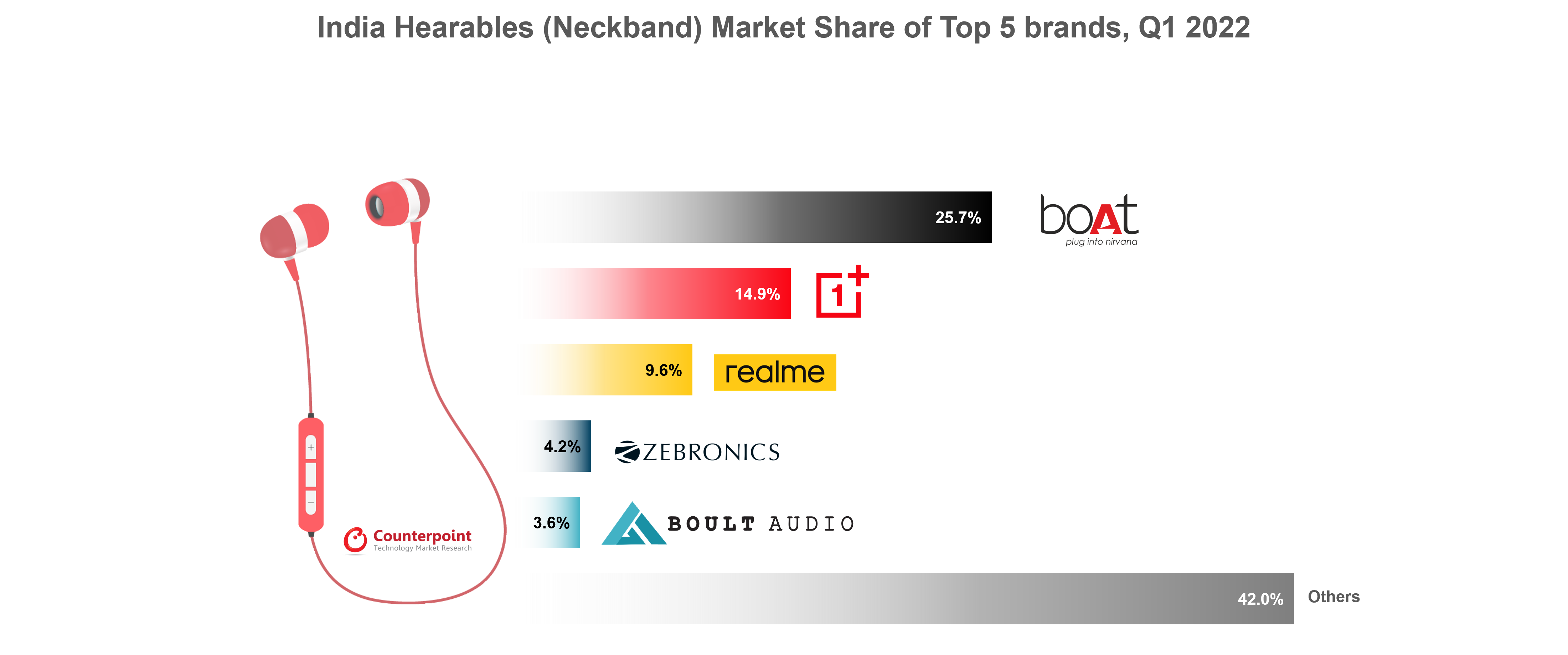

Source: India Hearables (Neckband) Shipments, Model Tracker, Q4 2022

Source: India Hearables (Neckband) Shipments, Model Tracker, Q4 2022

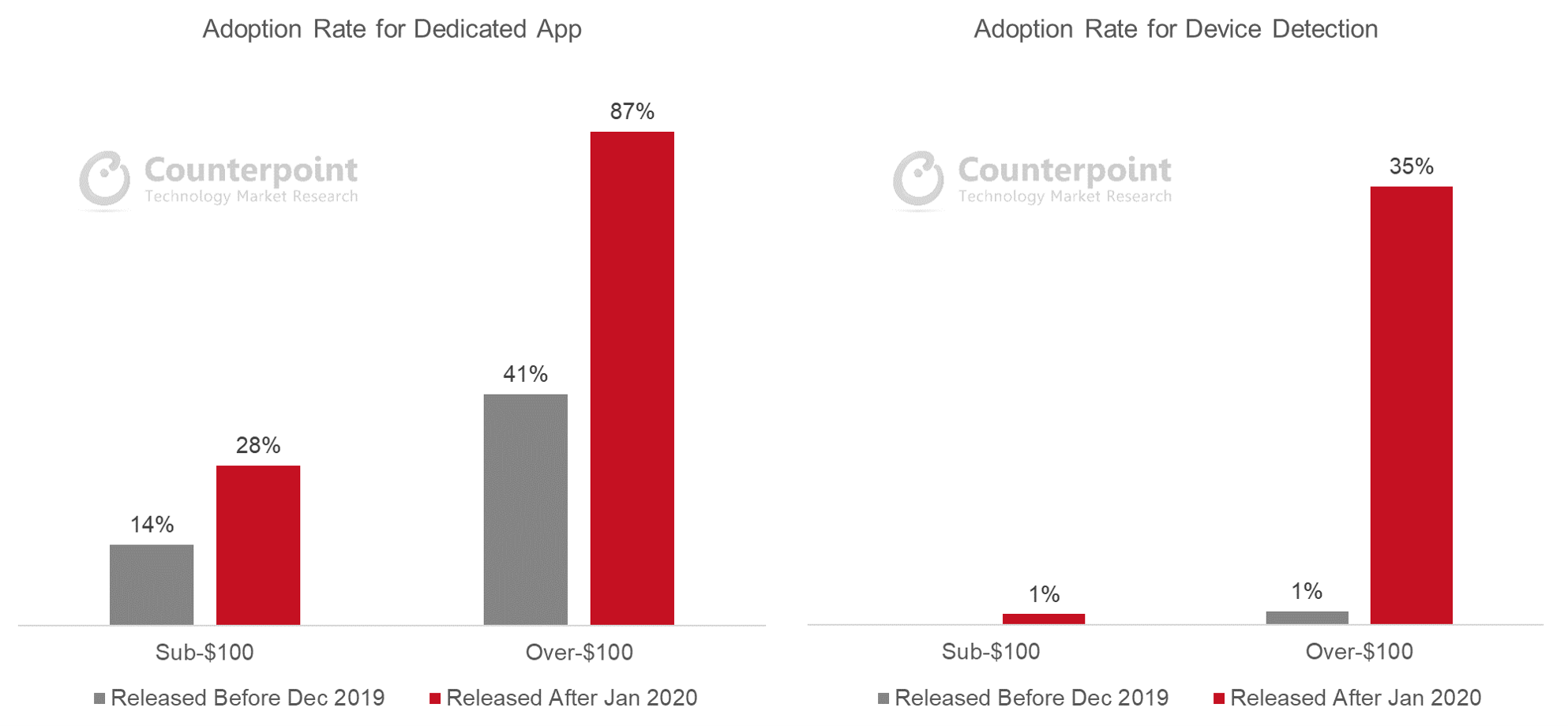

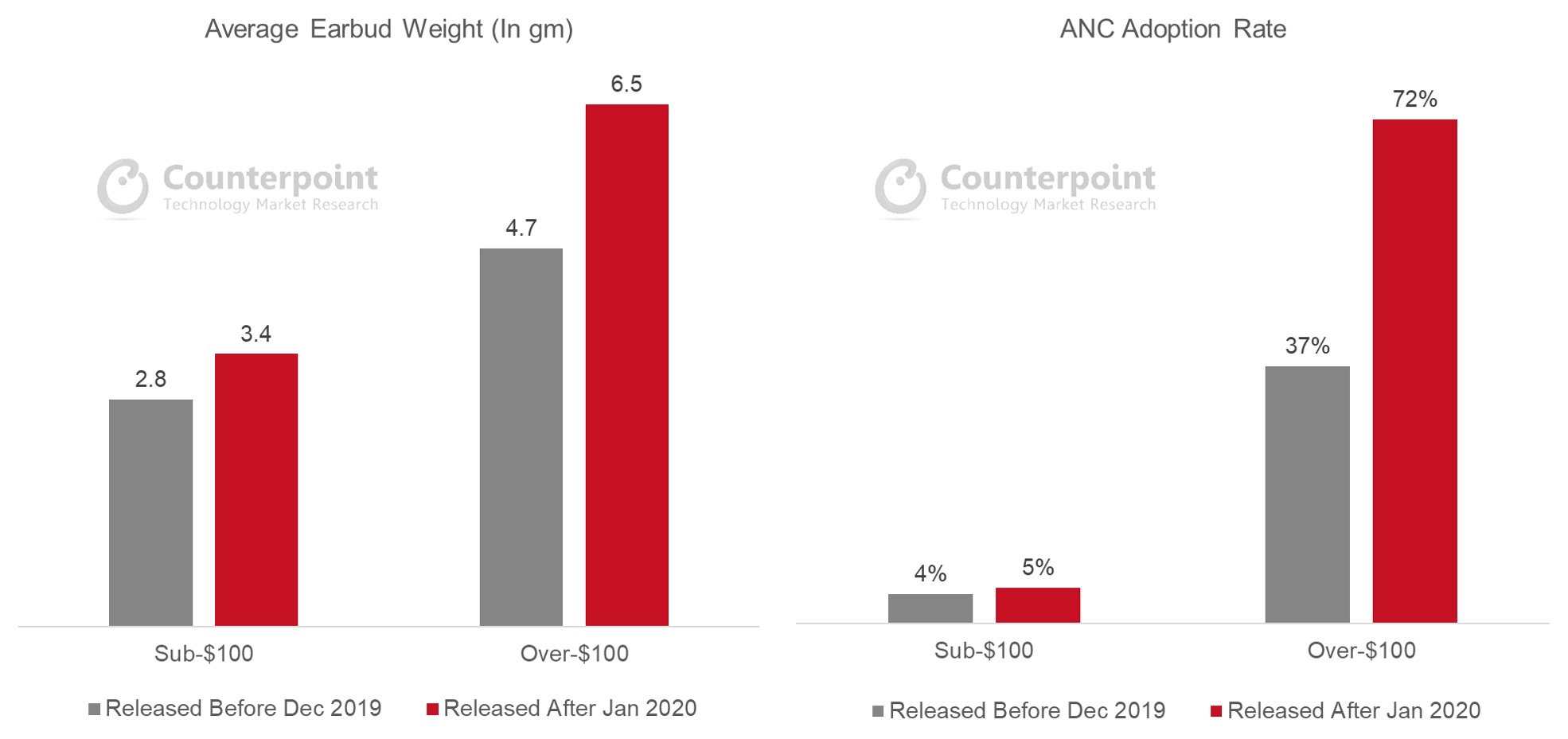

Not only ANC but other functions are also gaining importance. Dedicated apps, in particular, are seeing increased adoption as they provide an immersive entertainment experience. The adoption rate of dedicated apps has increased by almost two times both in the sub-$100 and over-$100 segments. Consumers looking to set their own music preferences and maximize sound quality through own equalizer have dedicated apps as one of their key priorities when purchasing a TWS. Device detection and finding own TWS through an app are some of the other features becoming popular. Adoption of these features was not much in the models released before December 2019, but it increased significantly in the models released after January 2020.

Not only ANC but other functions are also gaining importance. Dedicated apps, in particular, are seeing increased adoption as they provide an immersive entertainment experience. The adoption rate of dedicated apps has increased by almost two times both in the sub-$100 and over-$100 segments. Consumers looking to set their own music preferences and maximize sound quality through own equalizer have dedicated apps as one of their key priorities when purchasing a TWS. Device detection and finding own TWS through an app are some of the other features becoming popular. Adoption of these features was not much in the models released before December 2019, but it increased significantly in the models released after January 2020.