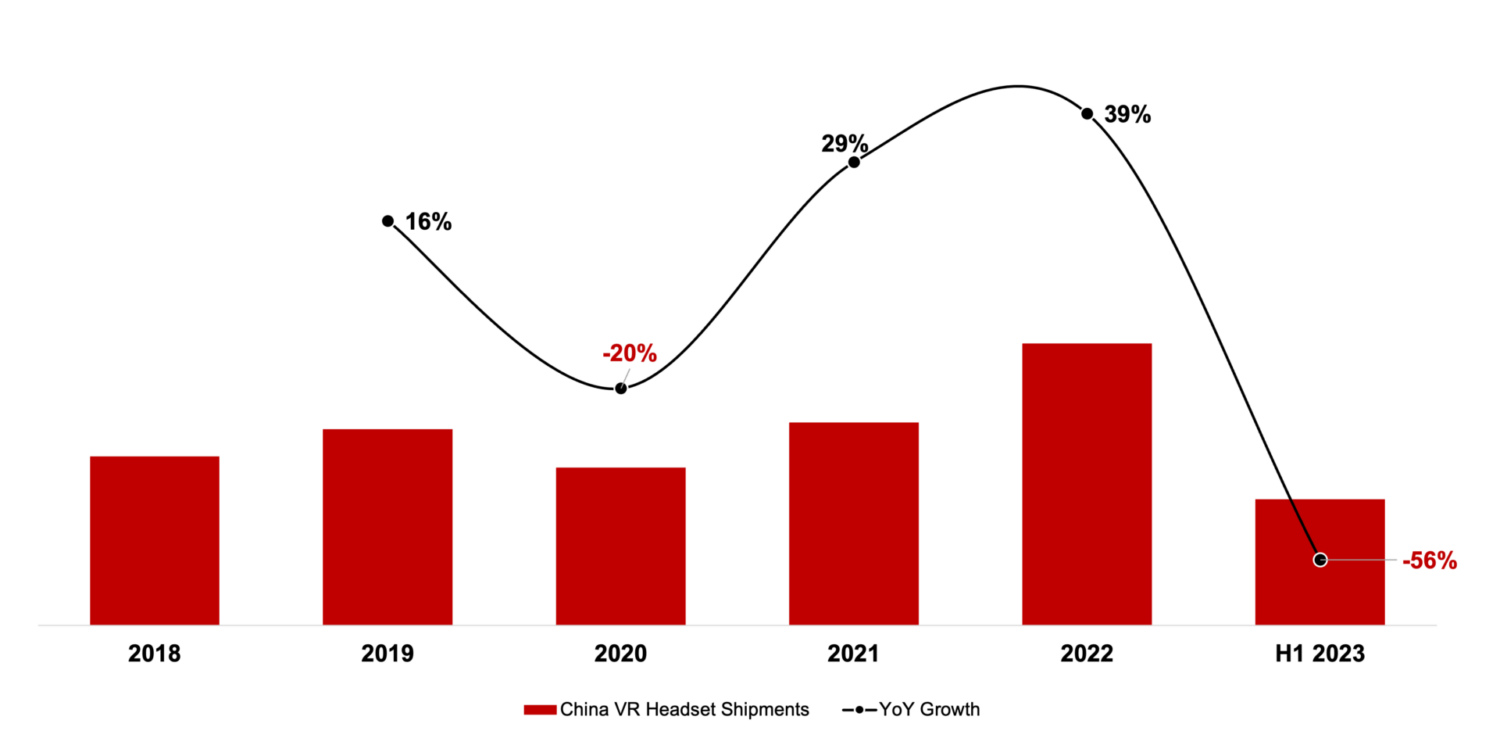

- China’s Virtual Reality (VR) market declined by 56% year-over-year (YoY) in H1 2023, marking an end to the market’s two-year growth streak spanning 2020-2022.

- Market leader Pico has chosen to strategically scale back its marketing investments since 2023 to ensure a healthier operation amid China’s tepid economic recovery, resulting in lower shipments target for its VR headsets.

- Despite the bleak sales figure of the existing market, launch of Apple’s Vision Pro has ignited a wave of inspiration to drive the industry forward.

China’s VR market shipments declined significantly by 56% YoY in H1 2023, according to the latest data from Counterpoint’s China eXtended Reality (XR) research service. This marked the end of the Chinese VR market’s two-year growth streak, spanning 2020-2022, and reverting to a state of stagnation. The decline in China appears to be more severe than that observed in the global VR market, which fell 39% YoY in H1 2023. Consequently, China’s share of the global VR shipments in Q2 2023 accounted for only 10%, which is relatively low compared to its 20%-30% share in the global smartphone market.

Exhibit 1: China VR Market Shipments and YoY Growth, CY2018-H1 2023

Note: VR headsets referred to here exclude smartphone boxes that rely on a smartphone to serve as the display panel.

The subdued market demand in China can be attributed to several factors. Firstly, the market’s growth over the past two years was largely driven by the extensive marketing efforts of China’s leading VR player, Pico. After it was acquired by internet giant ByteDance in September 2021, Pico significantly ramped up its product promotion to drive sales. However, since 2023, Pico has chosen to strategically scale back its marketing investments to ensure its operations are more stable amid China’s tepid economic recovery. Consequently, this decision has resulted in a lowered shipment target for Pico’s VR headsets. Secondly, despite Pico’s efforts to educate consumers on the enjoyable and entertaining experiences offered by VR headsets over the years, the absence of killer applications and a robust content ecosystem remains a significant challenge in China’s VR industry, hindering user adoption and retention. Additionally, during H1 2023, the absence of enticing new products in China dampened consumer demand. While the sales generated by new models such as Sony’s PSVR 2 and the Pico 4 Pro showed promise, they were insufficient to counteract the noticeable decline in the overall market.

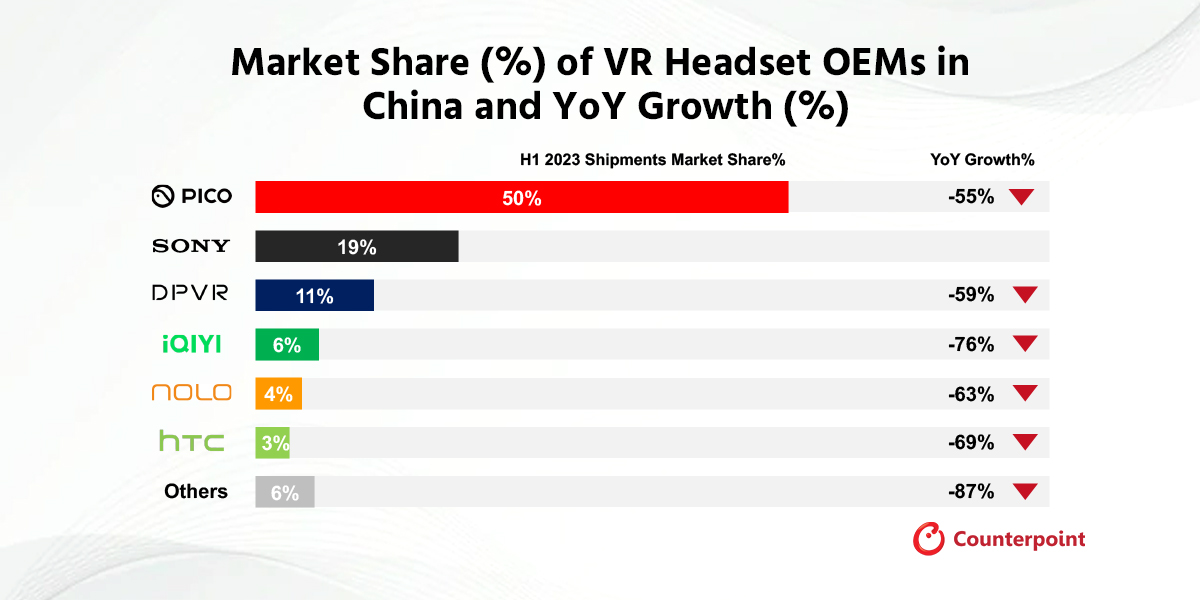

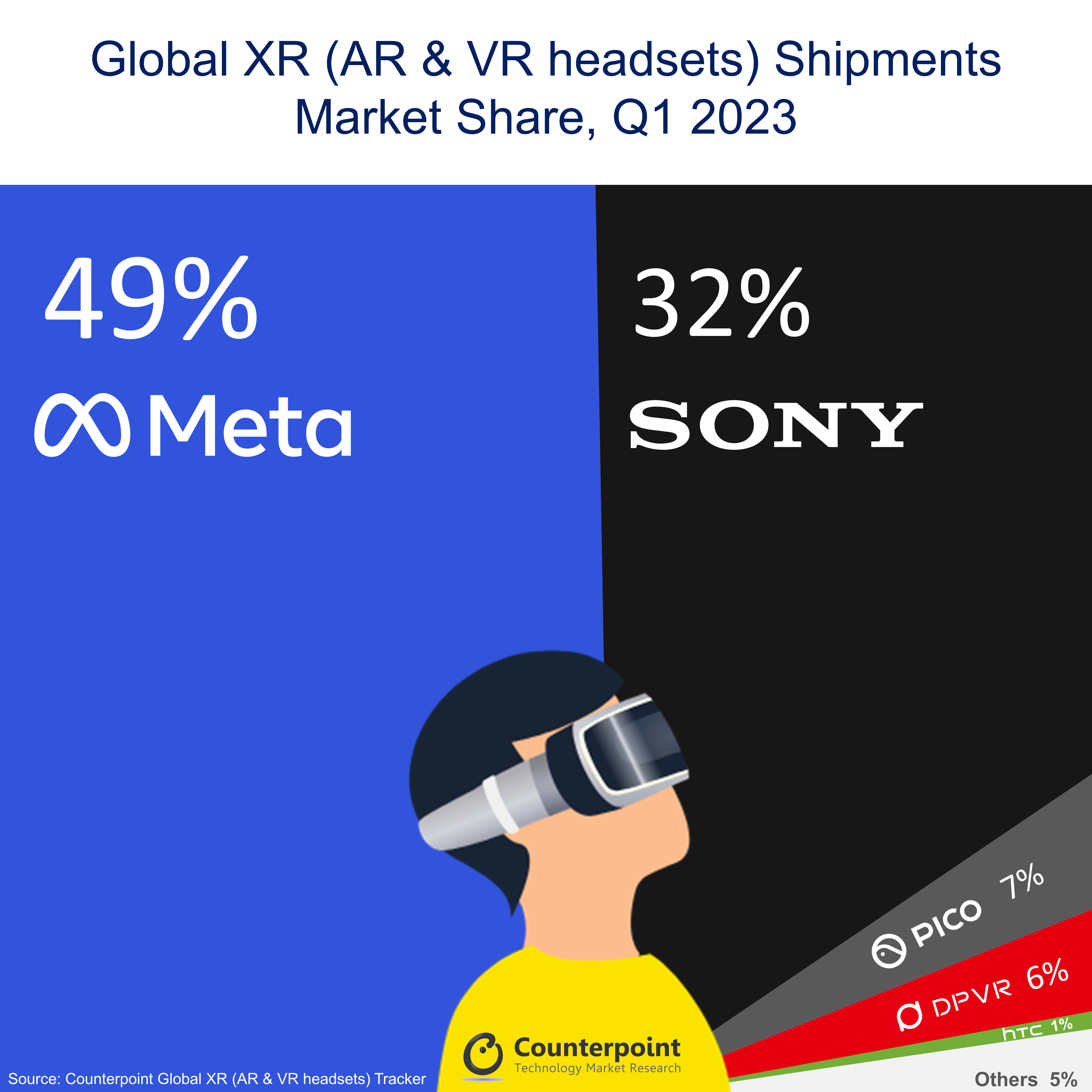

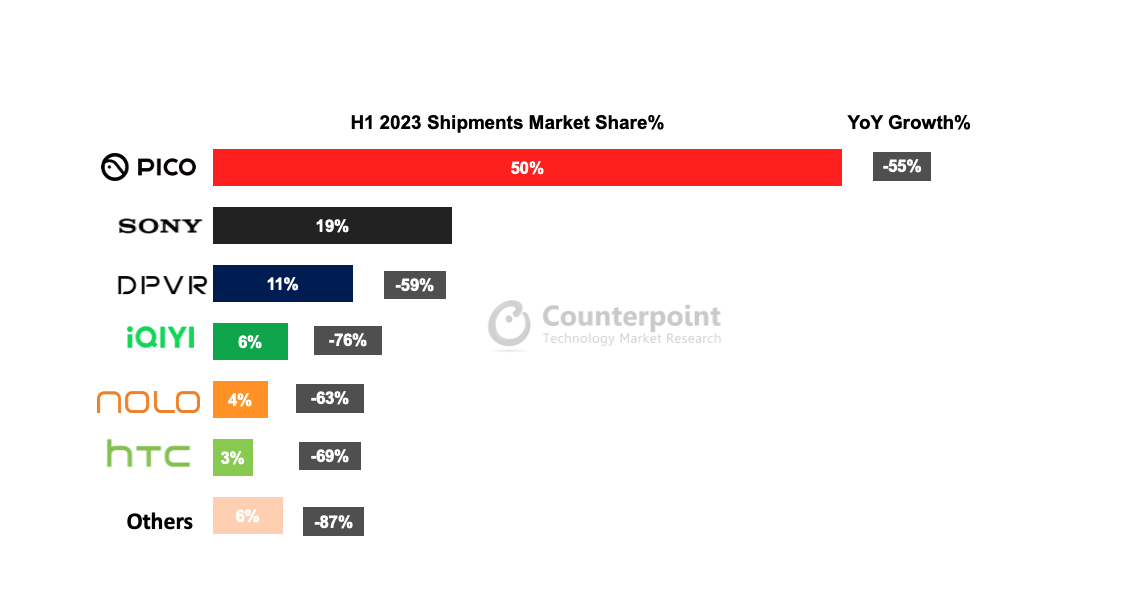

In terms of the competitive landscape, China’s VR market has seen significant consolidation, with just a handful of dominant vendors. As market leader, Pico holds a substantial market share of roughly 50%. However, even Pico experienced an over 50% YoY decline during H1 2023. Sony captured a 19% share of the market thanks to a significant sales surge following the release of PSVR 2, which attracted Chinese PlayStation enthusiasts to purchase and explore the product. Nevertheless, it is expected that the momentum of the PSVR 2 will wane during H2 2023. DPVR continues to lead in China’s enterprise segment due to its competitive pricing, but it also faces a decline due to a slowdown in spending on digital transformation by Chinese enterprise customers. Apart from the top three players, there are limited providers competing in China’s VR segment, with iQiyi withdrawing from the market due to operational difficulties.

Exhibit 2: Market Share (%) of VR Headset OEMs in China and YoY Growth (%)

Notably, Meta’s Quest VR is not yet officially available in the Chinese market, while Chinese smartphone OEMs such as OPPO, vivo and Xiaomi, despite their success in the global smartphone market, appear to be cautious when it comes to introducing a commercial VR headset.

Will Apple and Meta MR Headsets Revitalize Sales in China?

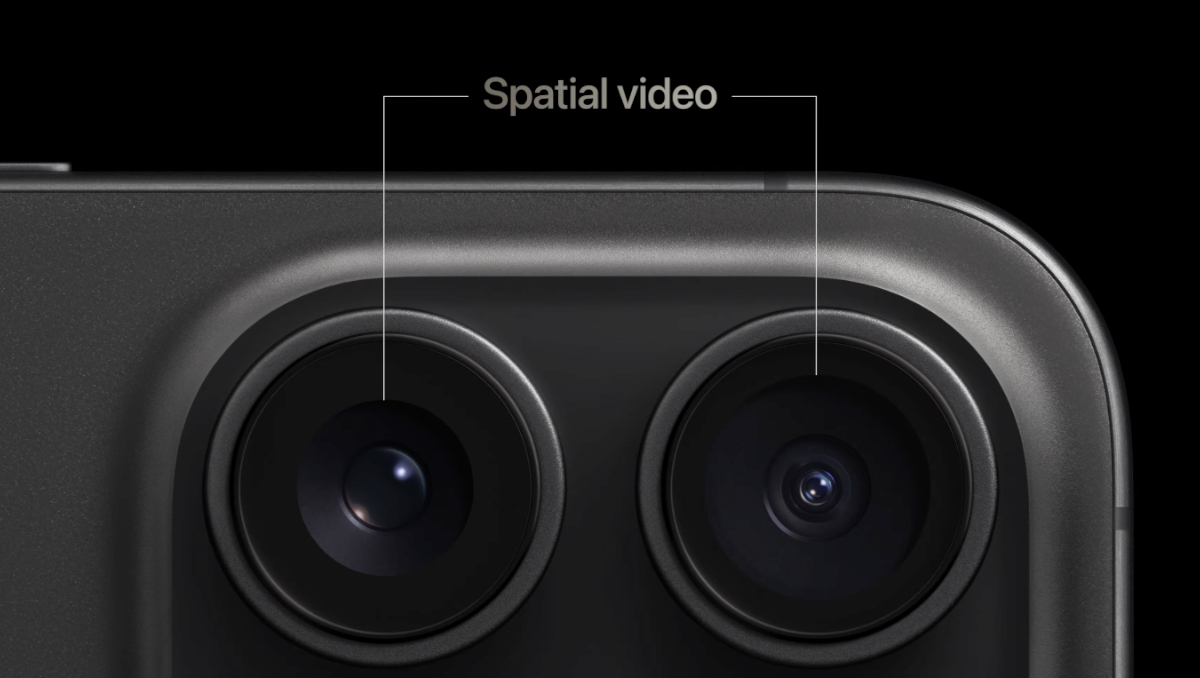

Despite the bleak sales figures of the existing market, the launch of Apple’s first MR headset, the Vision Pro, along with the accompanying “spatial computing” concept, has generated a significant buzz in the Chinese technology industry. Apple has set an industrial standard for what an ideal product can be, and we believe that the Apple Vision Pro (AVP), though not yet available in the market, has ignited a wave of inspiration to drive the industry forward.

- Since the release of the AVP, China’s dedicated VR companies have actively delved into its technology specifications and ramped up their R&D endeavors. They are particularly focused on optimizing ultra-low-latency color video see-through technologies, optical solutions, and hand tracking algorithms, aiming to bridge the technological gap with Apple.

- Chinese smartphone OEMs (Original Equipment Manufacturers), previously cautious with a “wait-and-see” approach to commercializing AR/VR headsets, are now re-evaluating their investments. Fearing the risk of lagging behind in the “spatial computing” era, strategic initiatives have been launched within these companies to reassess their projections regarding technology development trends and potential breakthroughs in the consumer XR segment. Additionally, we’ve noticed several OEMs bolstering their XR research teams to prepare for their first commercialized product, forging closer partnerships with industry players such as Qualcomm and Google.

- Meanwhile, China’s internet giants, some of whom had scaled back investments or disbanded their “Metaverse”-related departments in early 2023, are now re-entering the arena. Tencent, for instance, is reported to have recently established the XR Device & Content Business Group within its Interactive Entertainment Group (IEG) to oversee the development, sales, and promotion of its forthcoming XR products. The company is also in discussions with Meta regarding a potential partnership to localize the Quest VR and integrate Meta’s content ecosystem in China.

- Chinese Augmented Reality (AR) companies also have a more optimistic outlook for their future development, thanks to the emphasis on Mixed Reality (MR) features by the AVP. They strongly believe in the significance of the interaction between virtual objects and the real world, which may position AR as the ultimate future solution. In contrast to the challenges faced by China’s VR segment, Counterpoint’s China XR tracker indicates robust YoY growth in China’s AR glasses market during H1 2023. China is also a global leader in the development and commercialization of consumer AR glasses, despite the relatively small market base at present.

- In the software domain, Shanghai is among the cities where the Developer Lab for the AVP is located, alongside Cupertino, London, Munich, Singapore, and Tokyo. Apple has commenced hosting Chinese developers since June, supporting them to create and run their applications on the VisionOS platform. We expect this to invigorate the Chinese application ecosystem for MR headsets, creating new opportunities for applications beyond just gaming.

Despite the positive impacts that the AVP has had on China, it remains to be seen how tangible of a sales boost it will provide to the market. The product is primarily aimed at developers rather than consumers, with a price tag of $3,500. Additionally, the user experience of the AVP, which relies on the combination of Apple’s proprietary M2 System on Chip (SoC) and R1 co-processor, presents a significant challenge for Chinese hardware players to catch up in the short term.

Meta’s newly launched Quest 3 headset, the first MR product to hit the consumer market based on Qualcomm’s XR 2 Gen 2 platform, has emerged as a more attainable benchmark for Chinese companies in the near term. Based on the hardware specifications disclosed by Meta, the Quest 3 has demonstrated substantial improvements in MR features, which are poised to open up new avenues and application scenarios for developers. However, it also seems that the Quest 3 has not fully tapped into the best capabilities of the XR 2 Gen 2 platform. Consequently, there may be opportunities for improvement that Chinese latecomers can explore. We expect these opportunities to catalyze the launch of new products by Chinese hardware OEMs in 2024/2025.

Furthermore, the advancements made by Meta with both the Quest 3 and its upcoming products, coupled with the competition presented by Apple, are likely to expedite the closing of a deal between Tencent and Meta within the Chinese market. This presents a noteworthy opportunity to enhance the sales and adoption of XR products in China.

We will closely monitor the market to observe how the competitive landscape will be reshaped with the entrance of these newcomers.

Related Posts