Salesforce has made its latest push into the AI space with Agentforce — a platform for deploying generative AI in areas such as customer support, service, sales, or marketing. It will be available on Oct. 25.

At a press briefing on Sep. 12, Salesforce CEO Marc Benioff emphasized that Agentforce customers won’t need to build their own AI models or even manually choose between models and that the AI will not be a “bolt-on copilot” that adds bloat to existing services.

The services previously referred to as Einstein Copilot, including Einstein Copilot in Slack, will now fall under the Agentforce brand.

Agentforce turns chatbots into generative conversationalists

Agentforce is a deployment platform for generative AI agents that can autonomously interact with current and prospective customers. It connects to Salesforce’s Data Cloud and filters both structured and unstructured data through the Atlas Reasoning Engine, a pillar of the company’s generative AI deployment.

The Data Cloud data lake can store “Zero Copy” data, pulling from external systems without duplicating the data. The Atlas Reasoning Engine is a proprietary tool that Salesforce has not fully detailed. However, they explained that Atlas serves as the mechanism for:

- Filtering AI agents’ decisions.

- “Reasoning” which data is most relevant.

- Cross-referencing proposed answers with real-world information.

Agentforce agents can have autonomous conversations with customers to answer service questions, call sales leads, or work on marketing campaigns. They can interact with customers through voice, phone, or text. During the Sep. 12 event, Salesforce demonstrated how an AI “personality” — complete with its own name, access to company information, and settings — can be used multimodally across various mediums.

SEE: What are the different stages of CRM?

Benioff recommended using Agentforce as a replacement for level 1 customer staff, the front-line responders. The AI agents would still be able to escalate more difficult questions to level 2 workers, the staff members with more expertise.

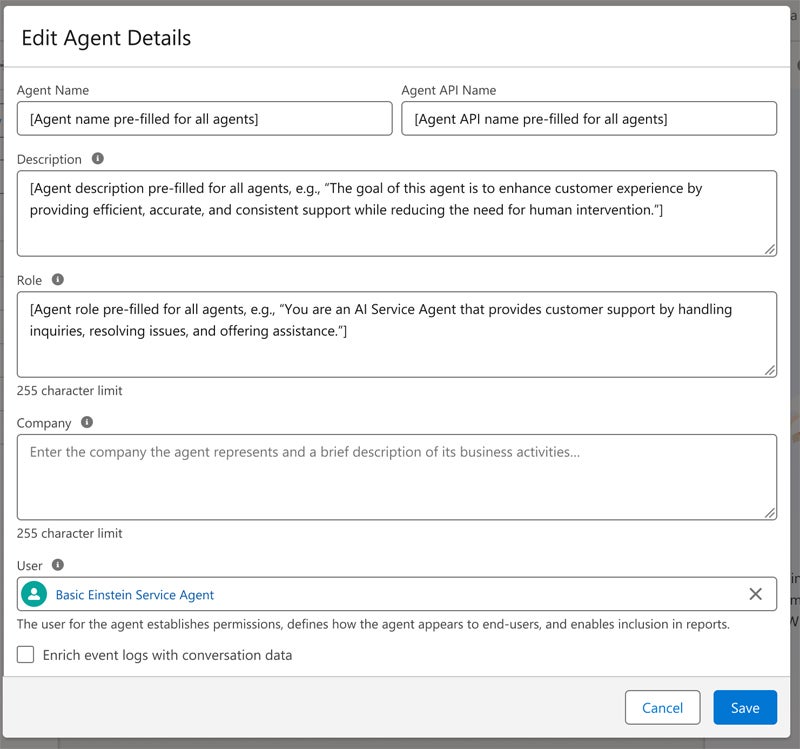

Agentforce can be deployed as a low-code solution, where a library of actions for the agent can be integrated into a menu, with some agent customization done using natural language.

Prompt Builder, a service for building prompts from Data Cloud, helps users customize the autonomous agents. A low-code model builder is available for organizations that wish to use their preferred LLMs and APIs in Prompt Builder.

Agents will be subject to some of the same call monitoring and safety standards as human agents. The existing Salesforce Omni Supervisor feature will be able to monitor agents and flag problems. Salesforce AI CEO Clara Shih said this can allow human supervisors to intervene in the case of inappropriate or inaccurate information coming from Agentforce.

“Omni Supervisor is now a place where service managers can also manage their AgentForce agents. They can filter by topic, they can spot hotspots … ” said Shih. “Just like with a new hire with a human, they can jack in and intervene and make sure nothing goes awry.”

Salesforce tries to solve the problem of phone trees and wait times

The current era of AI has left organizations wondering where the tangible customer values are, according to Benioff.

Customers “want to get their time back,” Benioff said, positioning Agentforce as a potential alternative to waiting on hold with a customer service representative.

Agentforce will be priced per conversation

Agentforce costs $2 per conversation. Salesforce did not detail how the $2 per conversation compares to human workers.

Agentforce for Service and Sales will become available on Oct. 25, but certain elements of the Atlas Reasoning Engine won’t be ready until February 2025.

Salesforce product releases coming in October

Additional updates to Salesforce coming in the October update include a Quota Attainment Planning tool and a ServiceCloud Employee Service, which is an AI solution for employee support.